Answered step by step

Verified Expert Solution

Question

1 Approved Answer

# 2 7 A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for

#

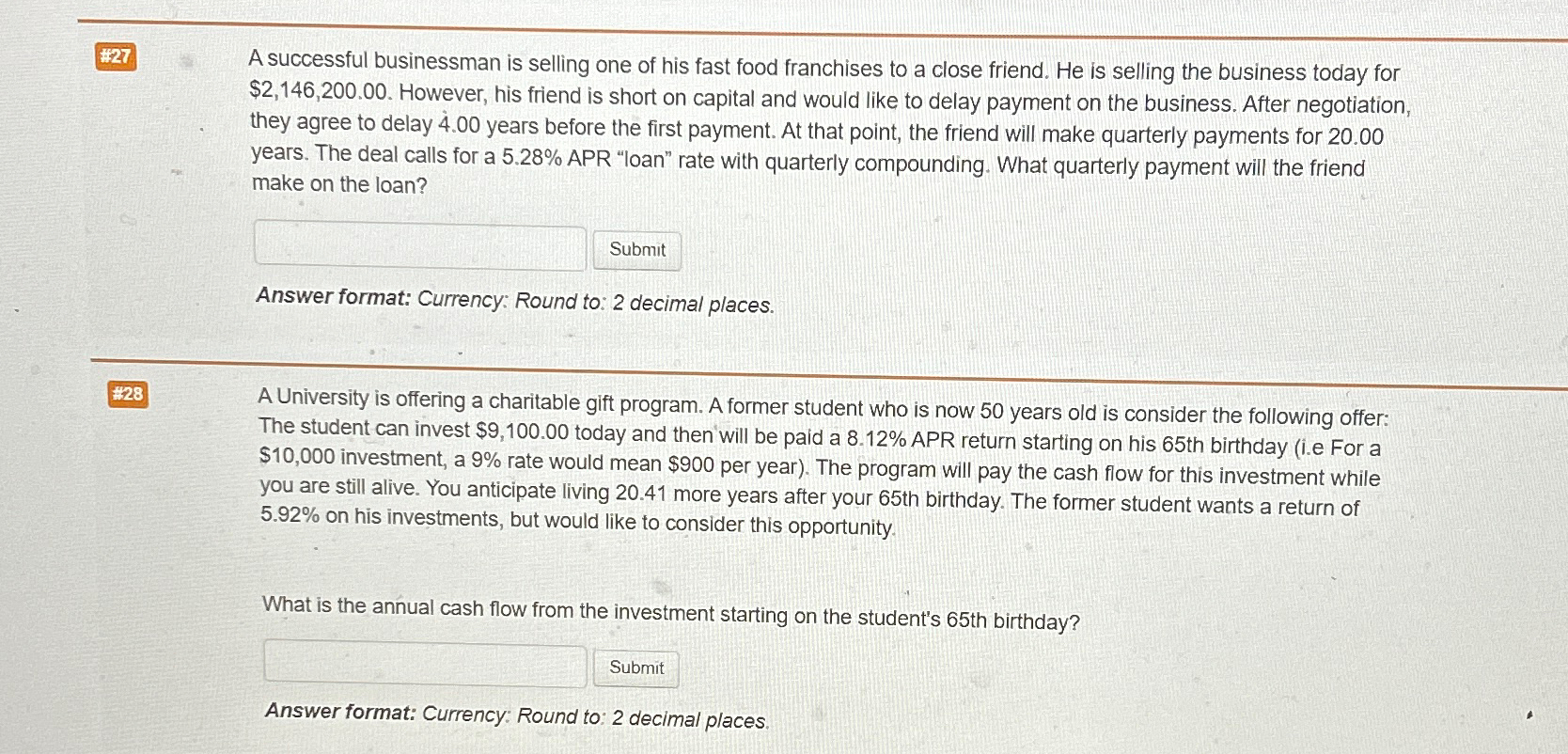

A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for $ However, his friend is short on capital and would like to delay payment on the business. After negotiation, they agree to delay years before the first payment. At that point, the friend will make quarterly payments for years. The deal calls for a APR "loan" rate with quarterly compounding. What quarterly payment will the friend make on the loan?

Answer format: Currency: Round to: decimal places.

#

A University is offering a charitable gift program. A former student who is now years old is consider the following offer: The student can invest $ today and then will be paid a APR return starting on his th birthday ie For a $ investment, a rate would mean $ per year The program will pay the cash flow for this investment while you are still alive. You anticipate living more years after your th birthday. The former student wants a return of on his investments, but would like to consider this opportunity.

What is the annual cash flow from the investment starting on the student's th birthday?

Answer format: Currency: Round to: decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started