Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 8.33 points eBook Print References Check my work The partnership of Wingler, Norris, Rodgers, and Guthrie was formed several years ago as a

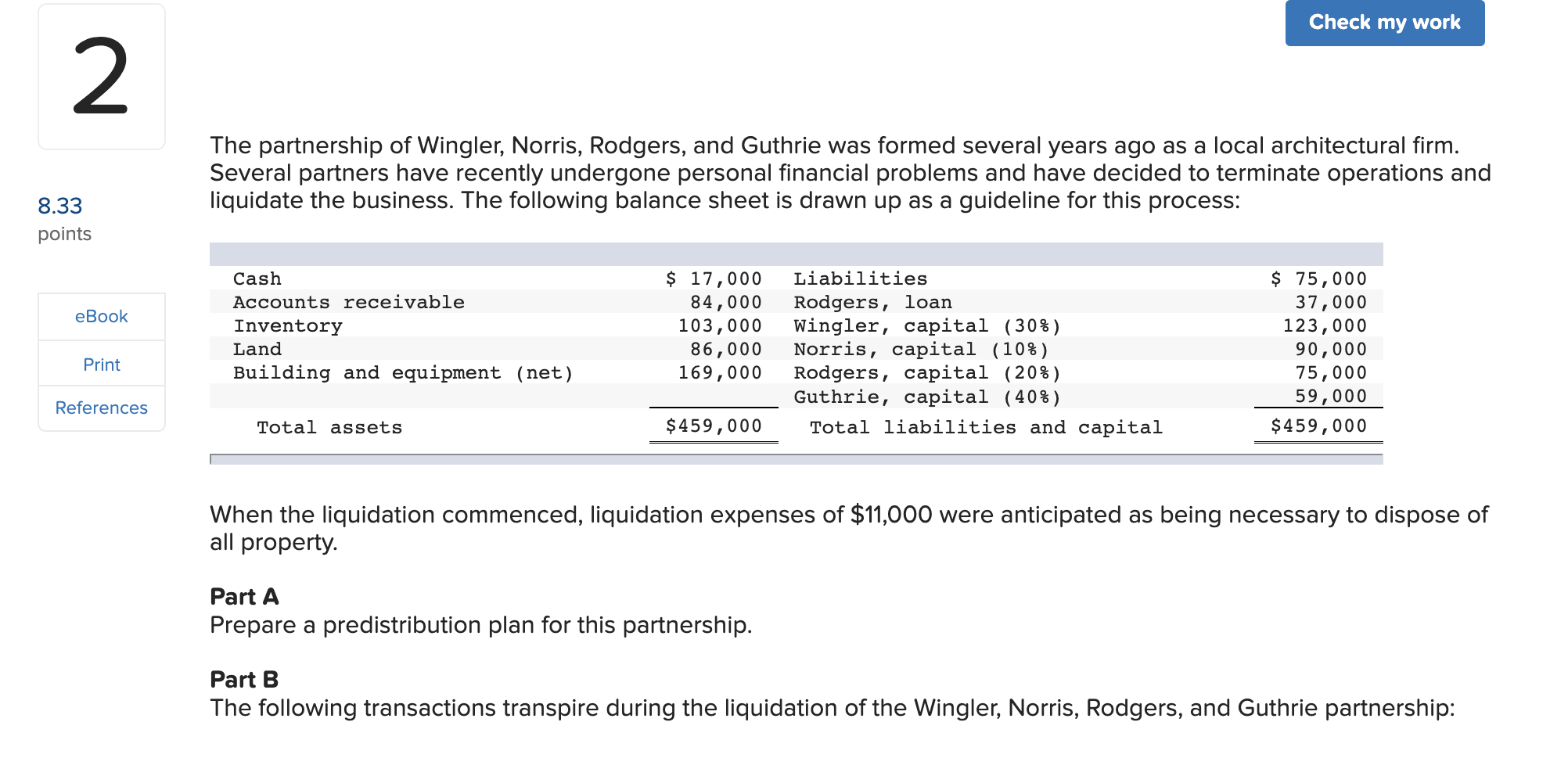

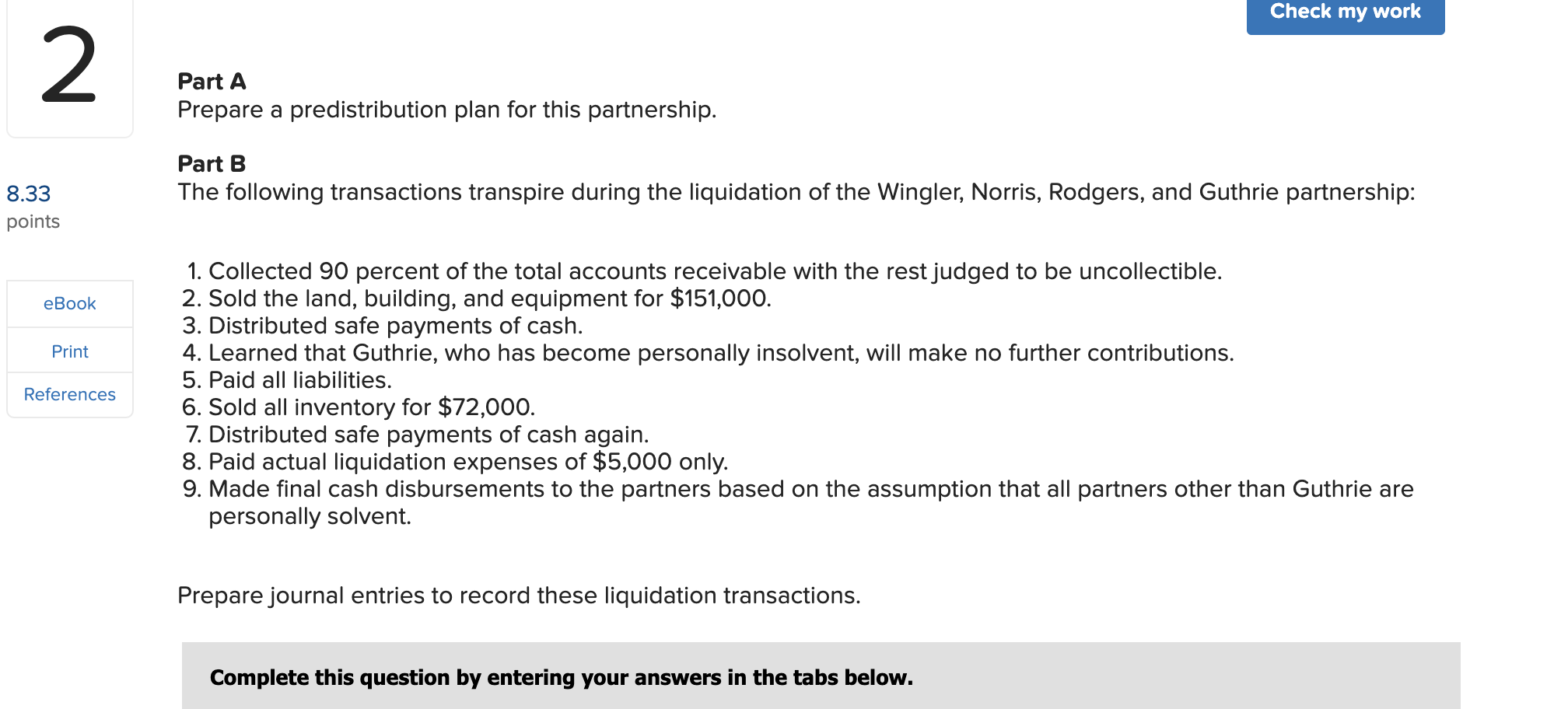

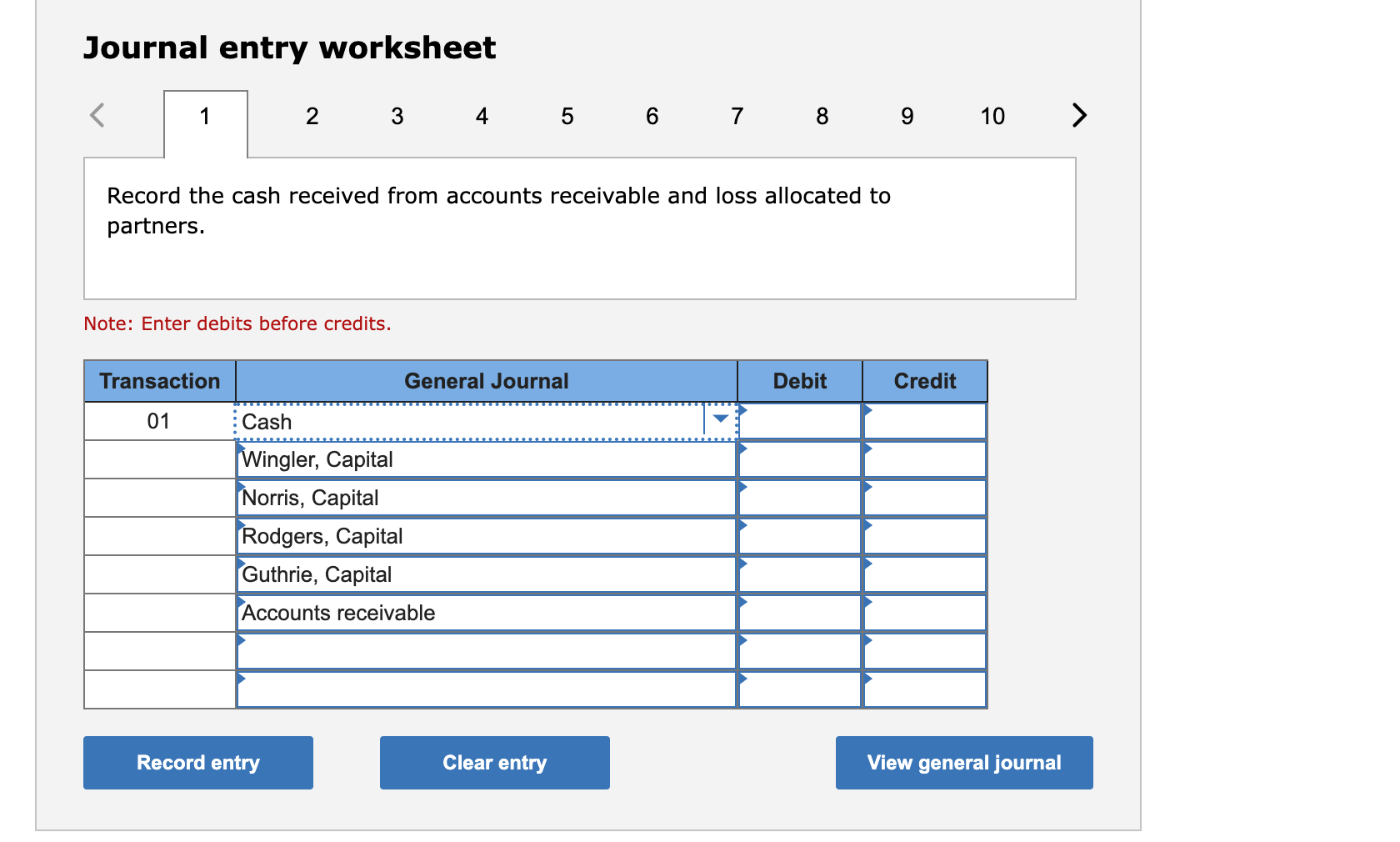

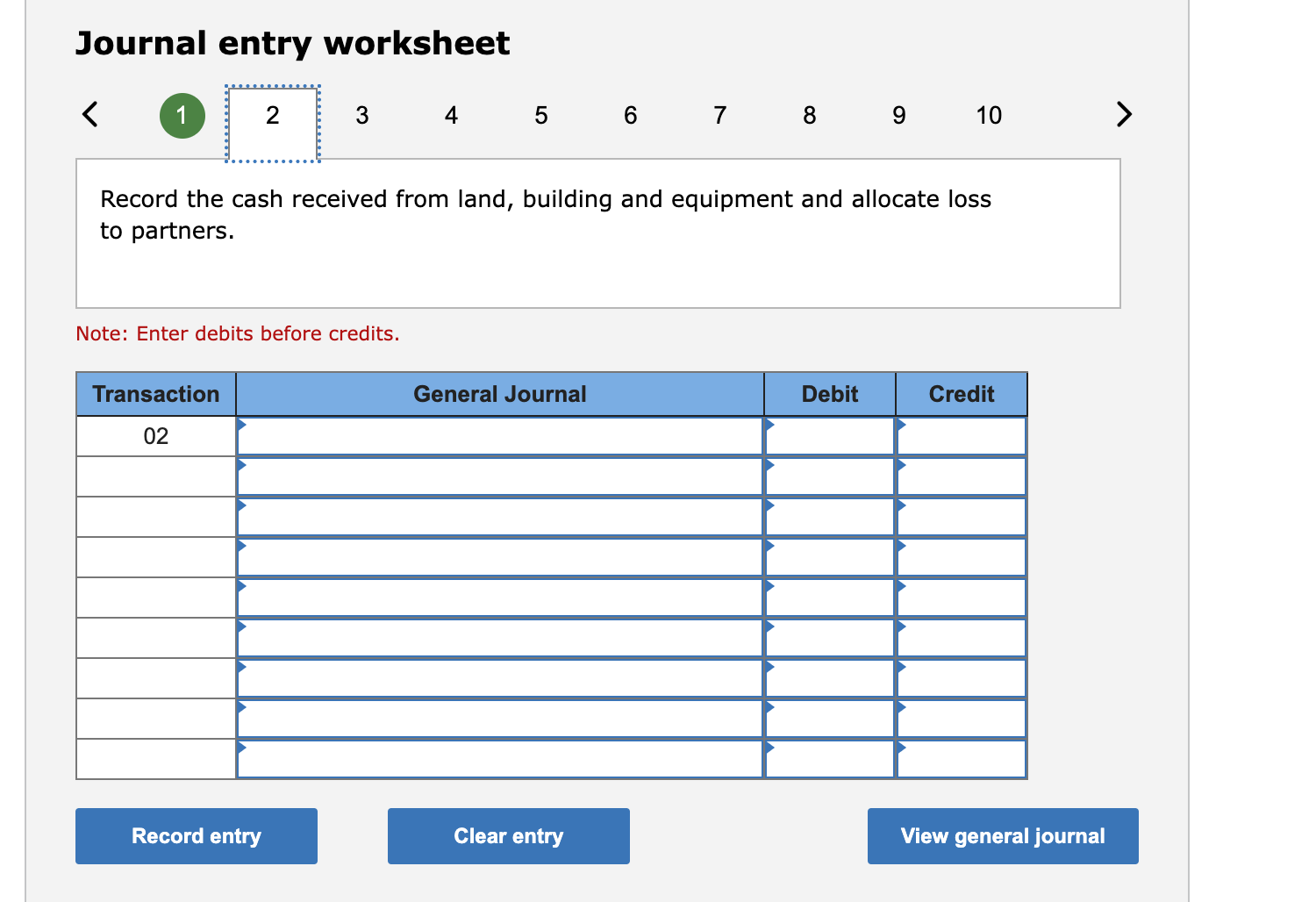

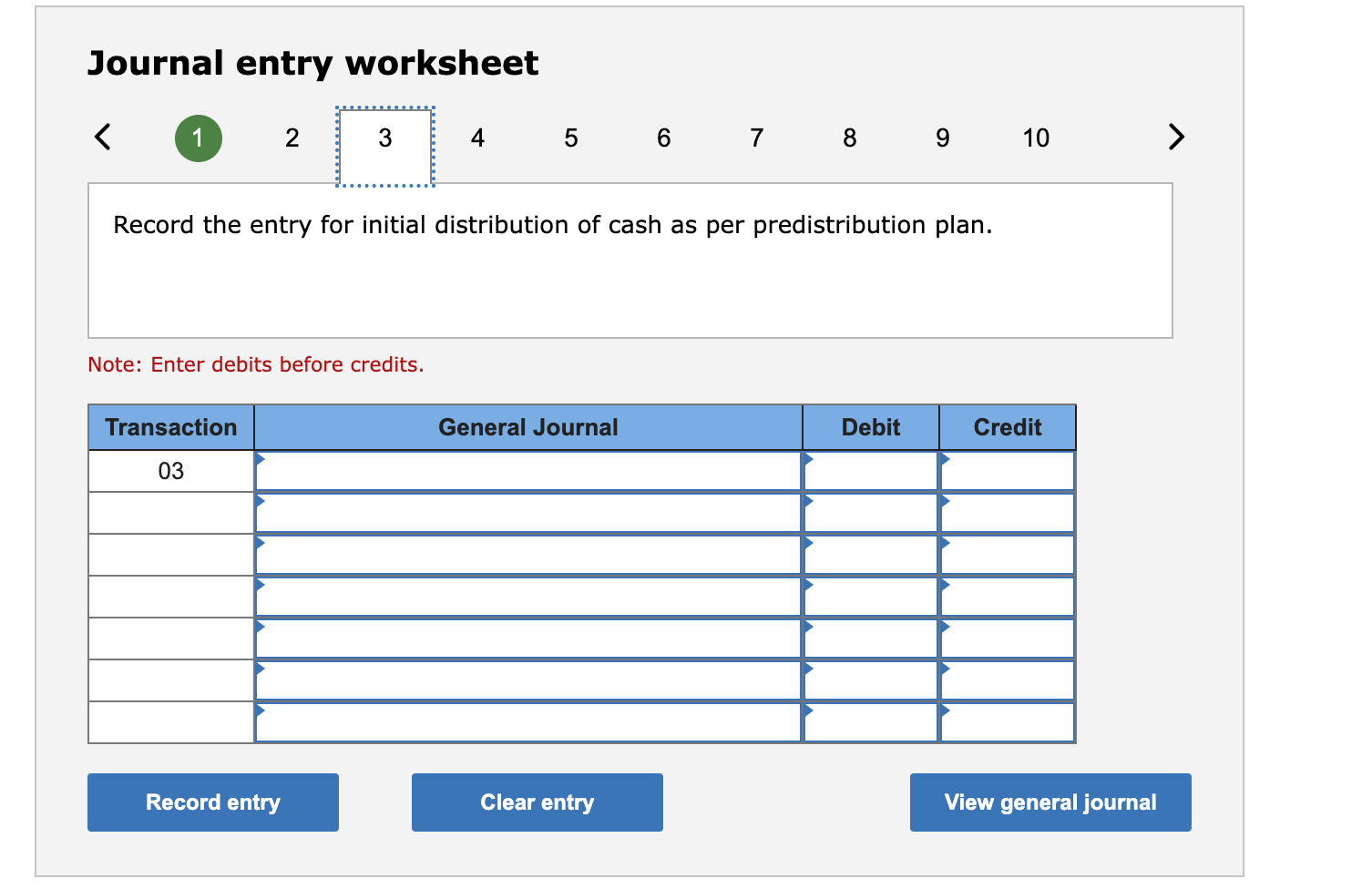

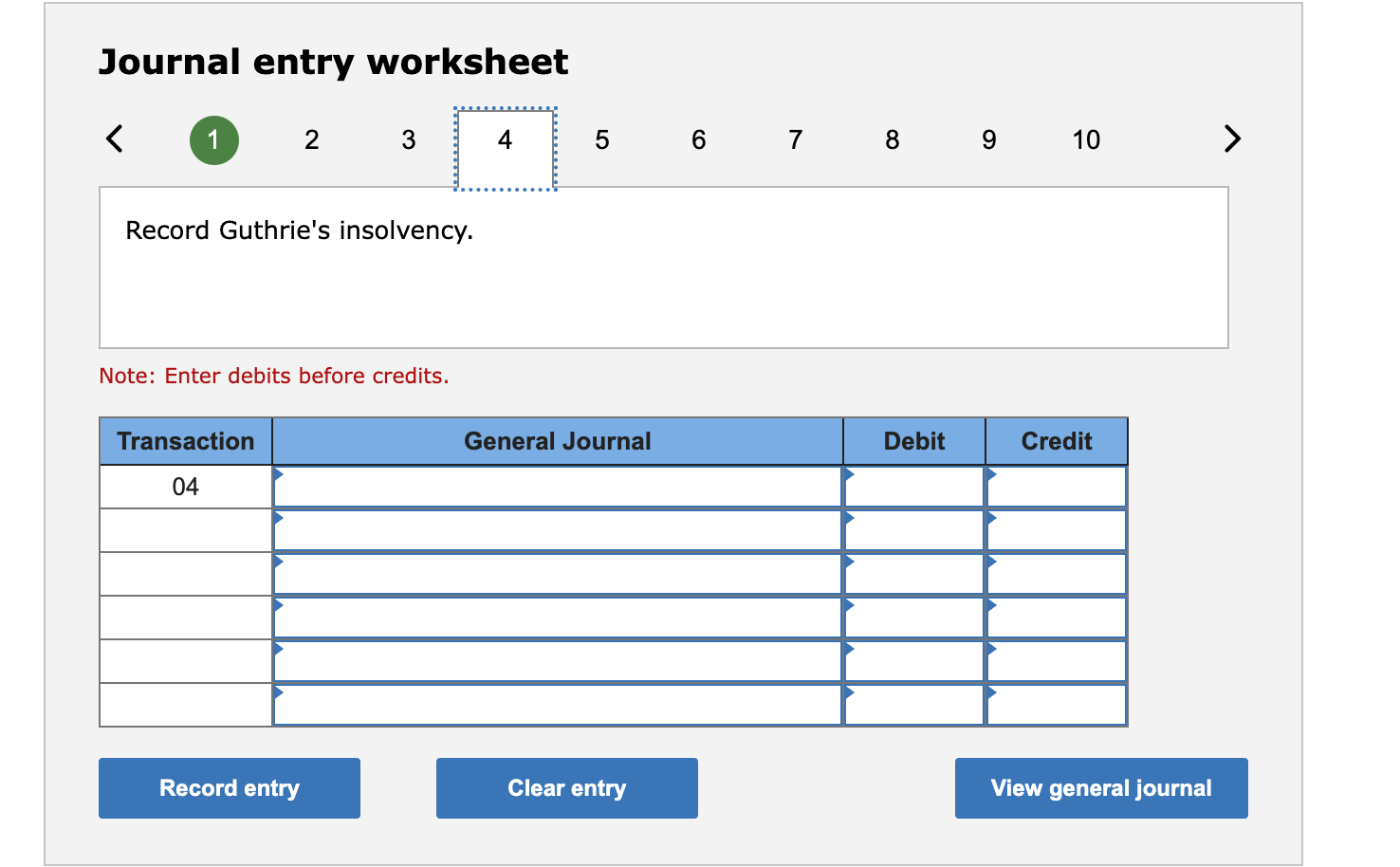

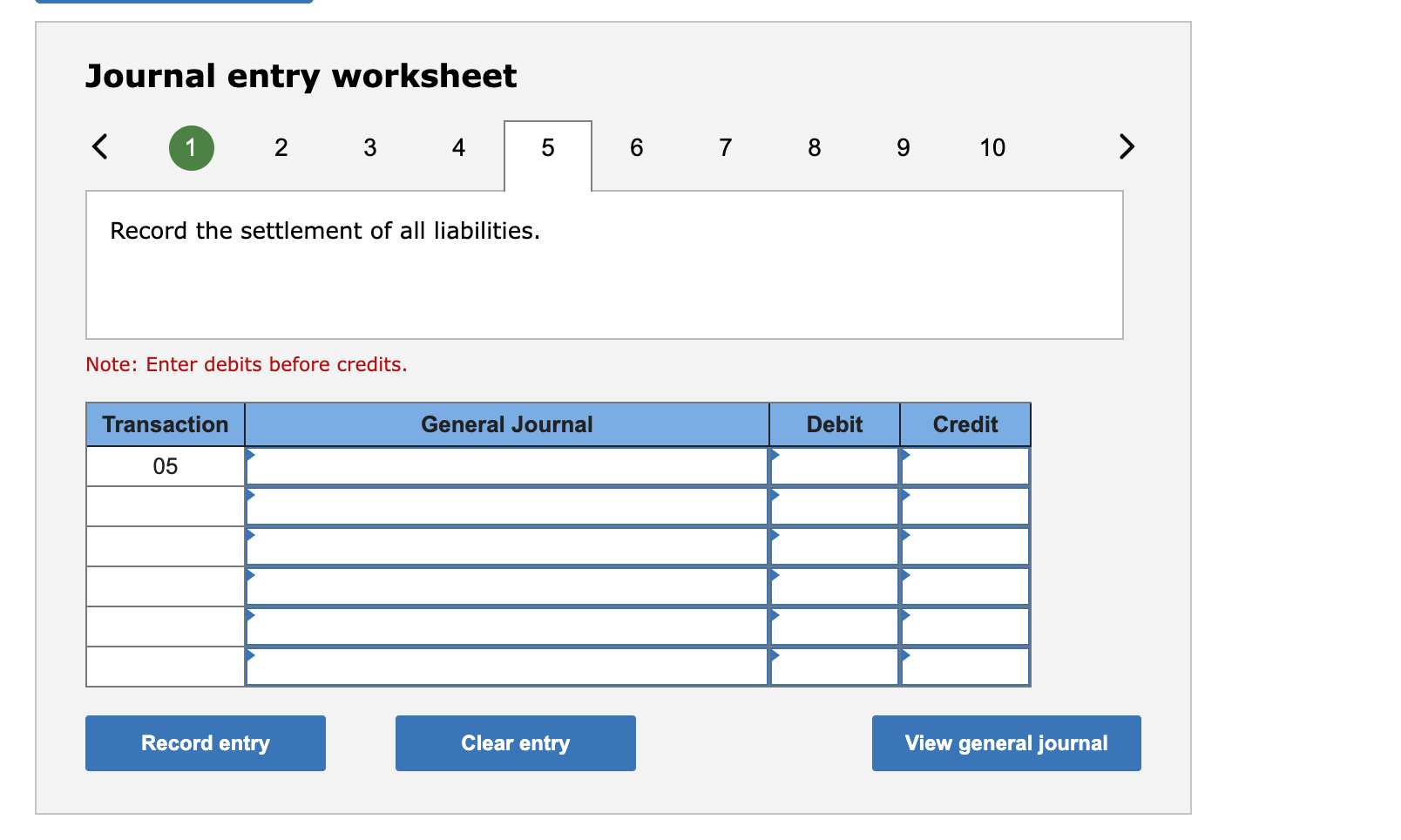

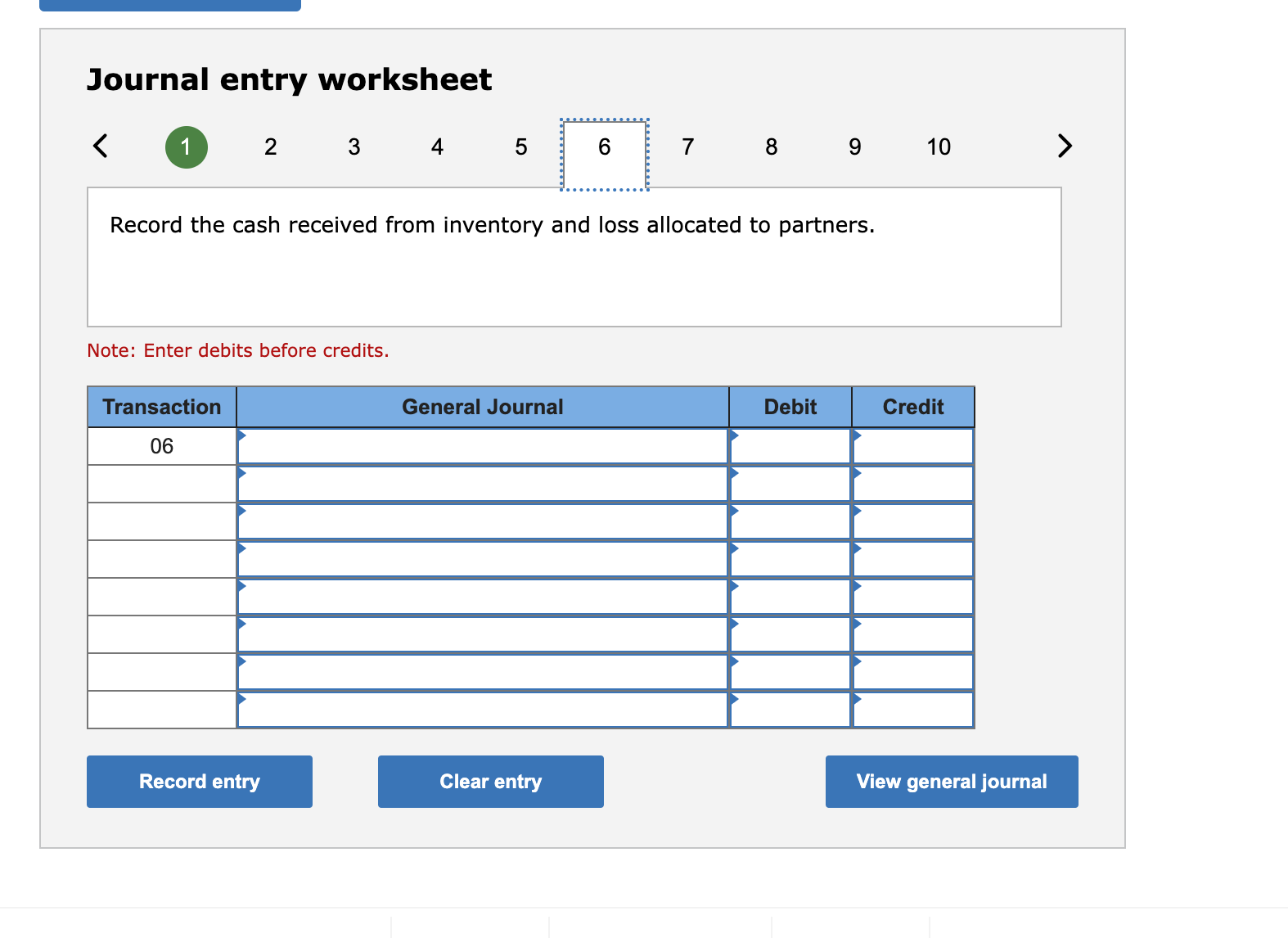

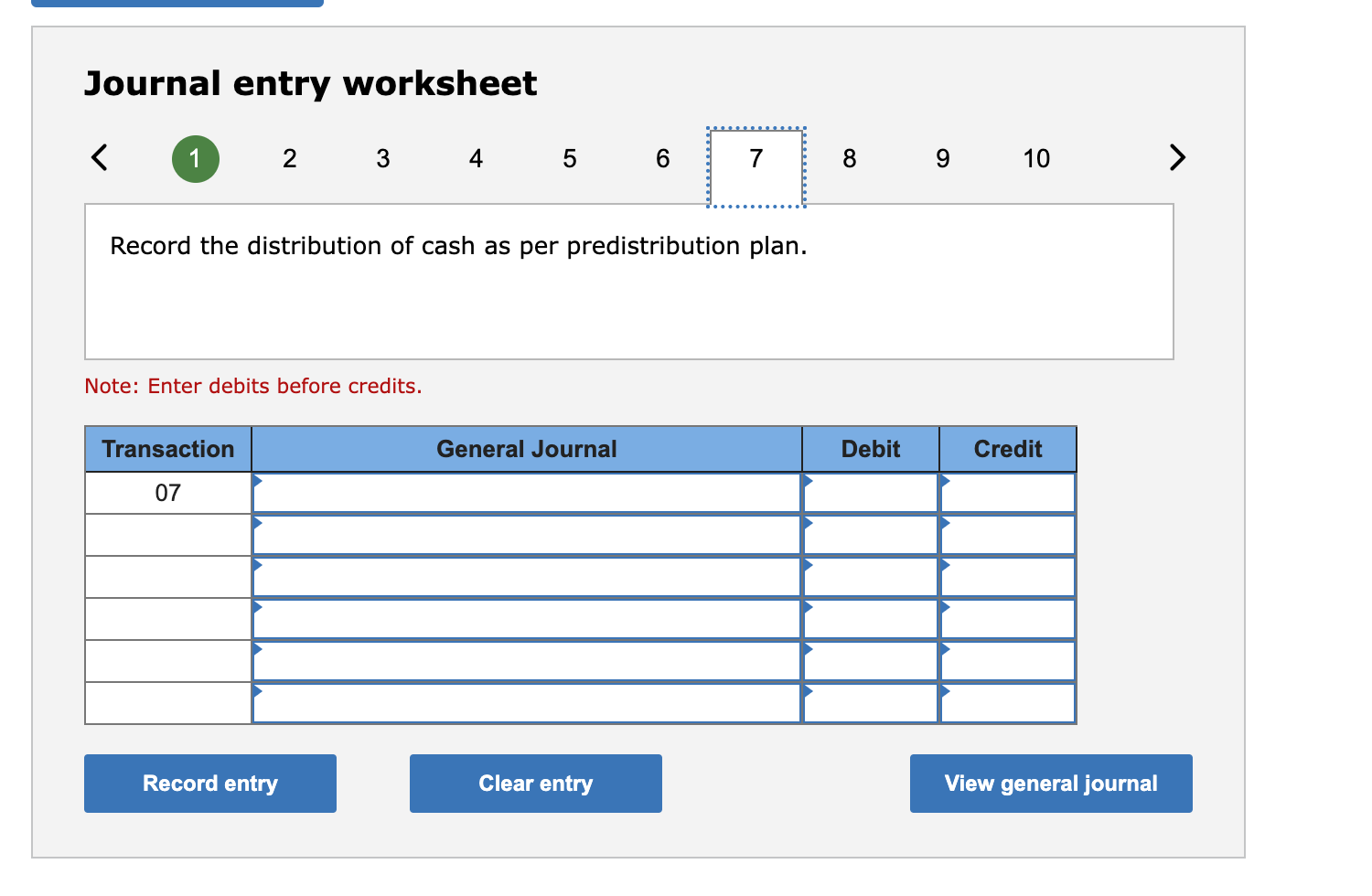

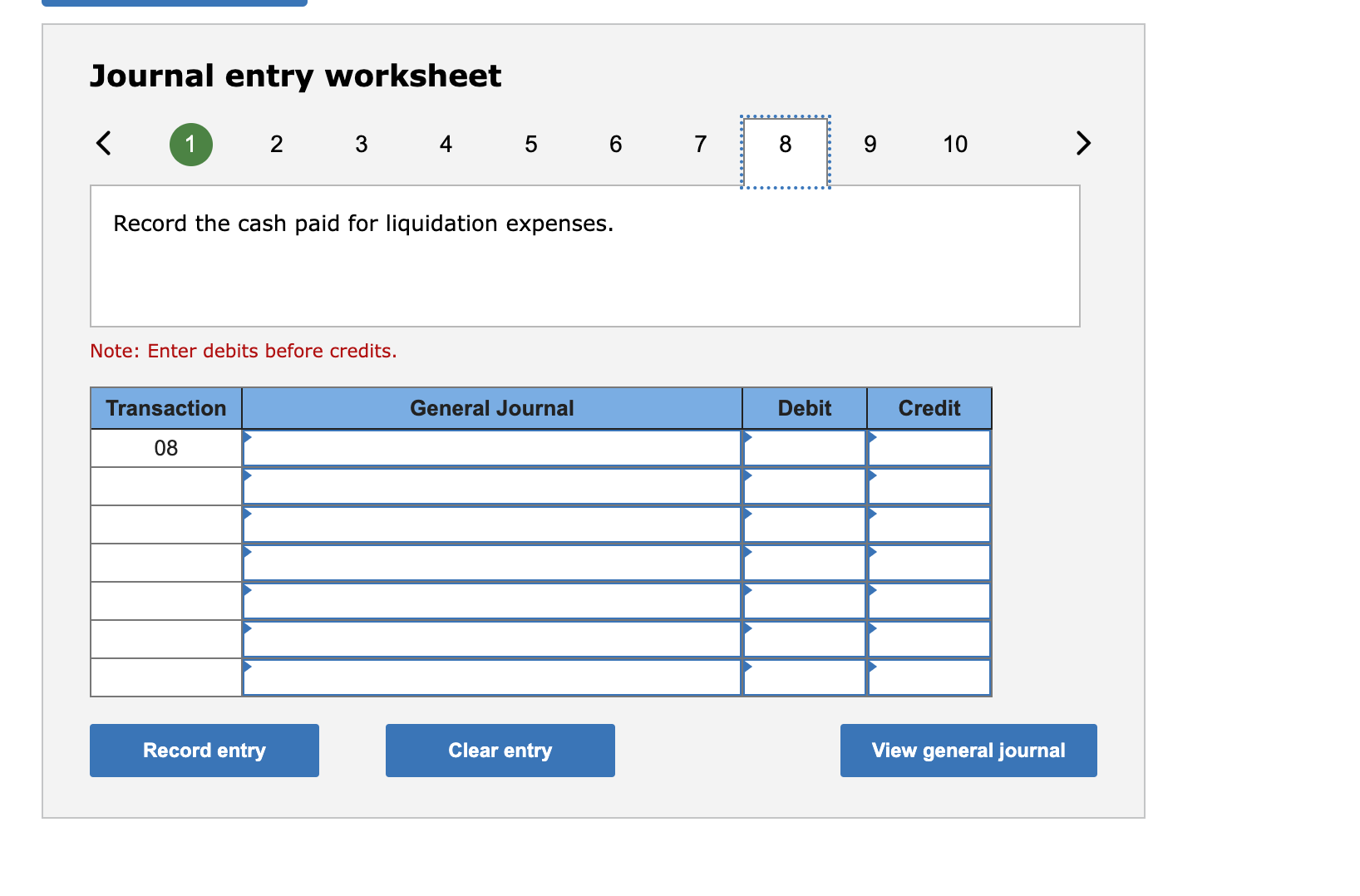

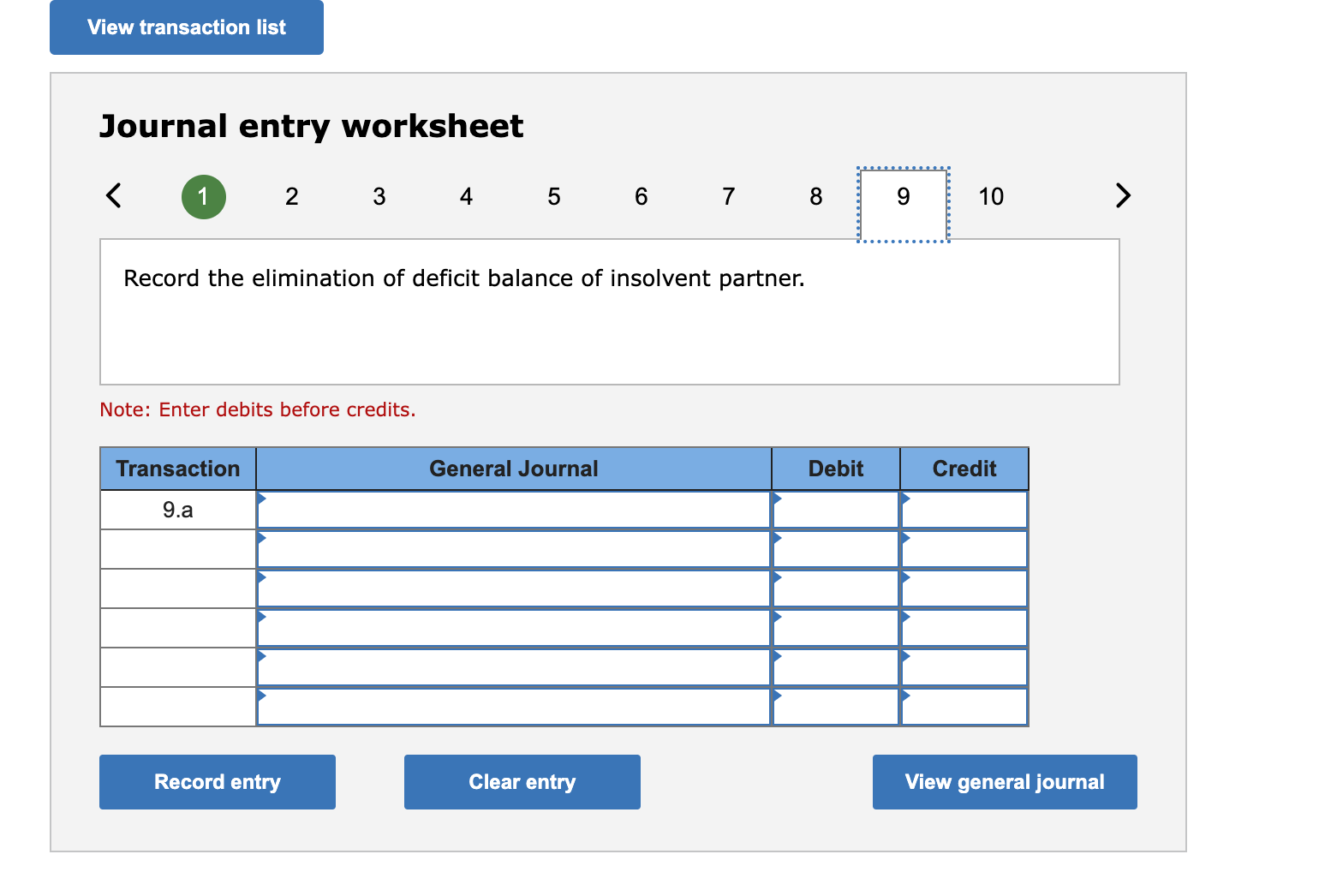

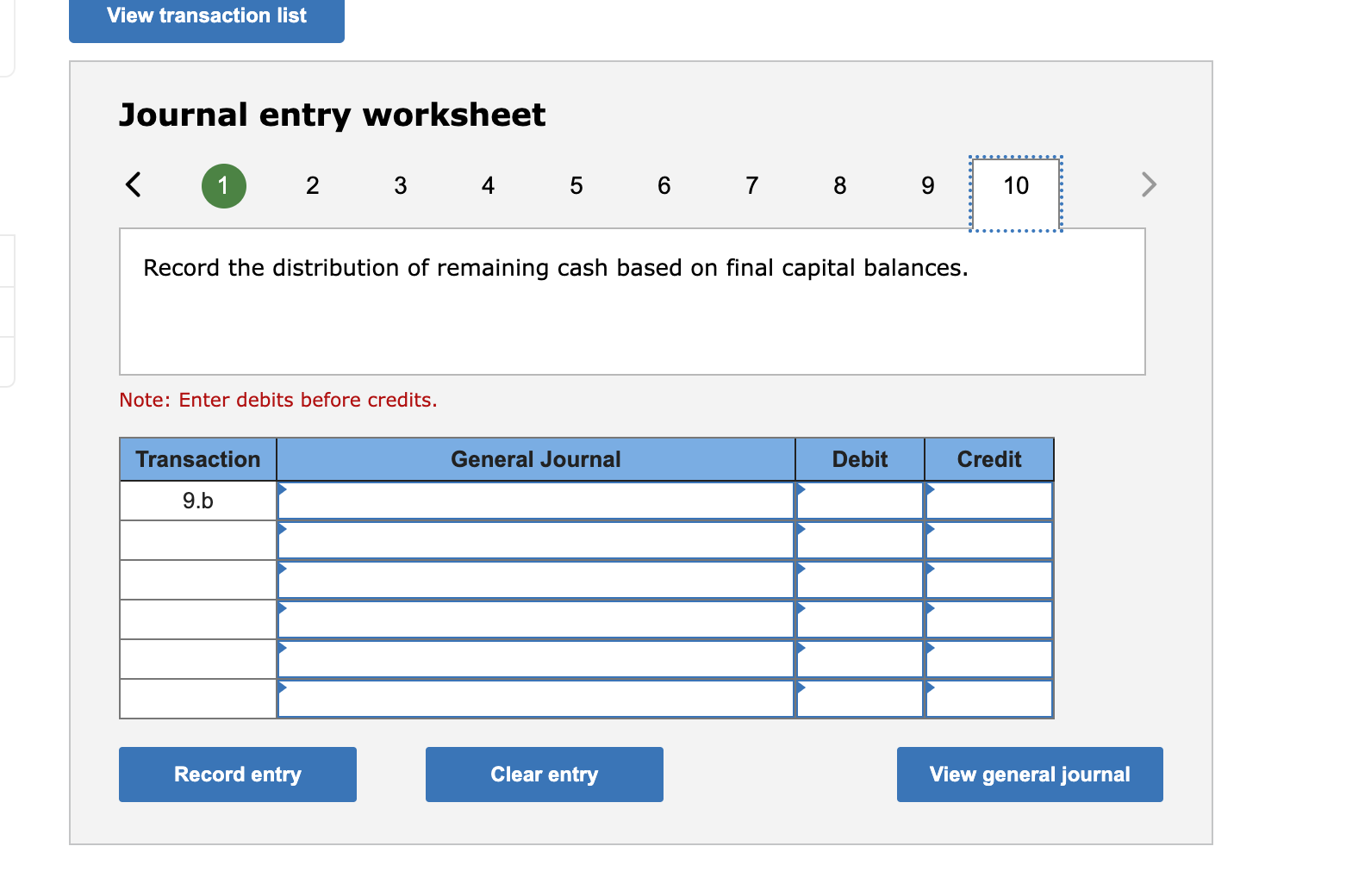

2 8.33 points eBook Print References Check my work The partnership of Wingler, Norris, Rodgers, and Guthrie was formed several years ago as a local architectural firm. Several partners have recently undergone personal financial problems and have decided to terminate operations and liquidate the business. The following balance sheet is drawn up as a guideline for this process: Cash Accounts receivable $ 17,000 84,000 Inventory 103,000 Liabilities Rodgers, loan Wingler, capital (30%) Land Building and equipment (net) 86,000 169,000 Norris, capital (10%) Total assets $459,000 Rodgers, capital (20%) Guthrie, capital (40%) Total liabilities and capital $ 75,000 37,000 123,000 90,000 75,000 59,000 $459,000 When the liquidation commenced, liquidation expenses of $11,000 were anticipated as being necessary to dispose of all property. Part A Prepare a predistribution plan for this partnership. Part B The following transactions transpire during the liquidation of the Wingler, Norris, Rodgers, and Guthrie partnership: Check my work 2 8.33 points eBook Print References Part A Prepare a predistribution plan for this partnership. Part B The following transactions transpire during the liquidation of the Wingler, Norris, Rodgers, and Guthrie partnership: 1. Collected 90 percent of the total accounts receivable with the rest judged to be uncollectible. 2. Sold the land, building, and equipment for $151,000. 3. Distributed safe payments of cash. 4. Learned that Guthrie, who has become personally insolvent, will make no further contributions. 5. Paid all liabilities. 6. Sold all inventory for $72,000. 7. Distributed safe payments of cash again. 8. Paid actual liquidation expenses of $5,000 only. 9. Made final cash disbursements to the partners based on the assumption that all partners other than Guthrie are personally solvent. Prepare journal entries to record these liquidation transactions. Complete this question by entering your answers in the tabs below. Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 > Record the cash received from accounts receivable and loss allocated to partners. Note: Enter debits before credits. Transaction 01 Cash Wingler, Capital General Journal Debit Credit Norris, Capital Rodgers, Capital Guthrie, Capital Accounts receivable View general journal Record entry Clear entry Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Record the cash received from land, building and equipment and allocate loss to partners. Note: Enter debits before credits. Transaction 02 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet < 1 3 4 5 6 7 8 9 10 > Record the entry for initial distribution of cash as per predistribution plan. Note: Enter debits before credits. Transaction 03 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet < 1 2 3 4 5 6 7 8 9 10 Record Guthrie's insolvency. Note: Enter debits before credits. Transaction General Journal Debit Credit 04 View general journal Record entry Clear entry Journal entry worksheet > 1 2 3 4 50 Record the settlement of all liabilities. Note: Enter debits before credits. Transaction 05 6789 10 General Journal Debit Credit View general journal Record entry Clear entry Journal entry worksheet < 1 2 3 4 5 00 6 7 8 9 10 > Record the cash received from inventory and loss allocated to partners. Note: Enter debits before credits. Transaction 06 General Journal Debit Credit View general journal Record entry Clear entry Journal entry worksheet 1 2 3 4 5 6 7 9 10 Record the distribution of cash as per predistribution plan. Note: Enter debits before credits. Transaction 07 General Journal Debit Credit View general journal Record entry Clear entry Journal entry worksheet 1 2 3 4 5 6 7 Record the cash paid for liquidation expenses. Note: Enter debits before credits. Transaction 08 00 9 10 General Journal Debit Credit Record entry Clear entry View general journal View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 8 9 Record the elimination of deficit balance of insolvent partner. Note: Enter debits before credits. Transaction 9.a 10 10 General Journal Debit Credit Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Record the distribution of remaining cash based on final capital balances. Note: Enter debits before credits. Transaction 9.b General Journal Debit Credit View general journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started