Answered step by step

Verified Expert Solution

Question

1 Approved Answer

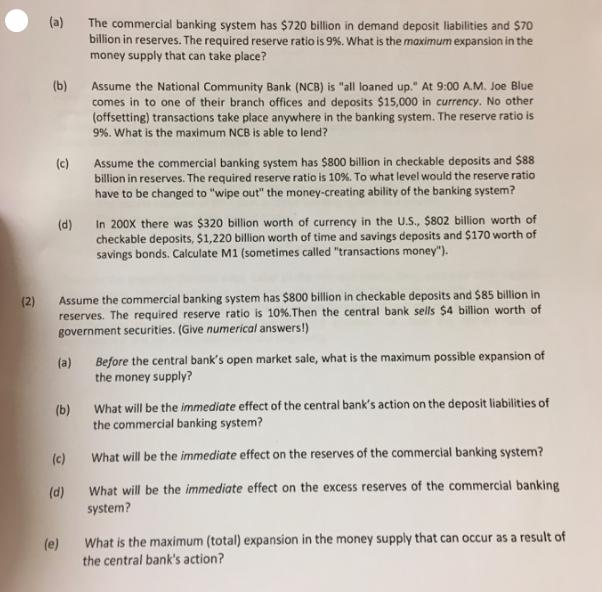

(2) (a) (b) (c) (d) (a) (b) (c) (d) The commercial banking system has $720 billion in demand deposit liabilities and $70 billion in

(2) (a) (b) (c) (d) (a) (b) (c) (d) The commercial banking system has $720 billion in demand deposit liabilities and $70 billion in reserves. The required reserve ratio is 99%. What is the maximum expansion in the money supply that can take place? Assume the commercial banking system has $800 billion in checkable deposits and $85 billion in reserves. The required reserve ratio is 10%. Then the central bank sells $4 billion worth of government securities. (Give numerical answers!) (e) Assume the National Community Bank (NCB) is "all loaned up." At 9:00 A.M. Joe Blue comes in to one of their branch offices and deposits $15,000 in currency. No other (offsetting) transactions take place anywhere in the banking system. The reserve ratio is 9%. What is the maximum NCB is able to lend? Assume the commercial banking system has $800 billion in checkable deposits and $88 billion in reserves. The required reserve ratio is 10%. To what level would the reserve ratio have to be changed to "wipe out" the money-creating ability of the banking system? In 200X there was $320 billion worth of currency in the U.S., $802 billion worth of checkable deposits, $1,220 billion worth of time and savings deposits and $170 worth of savings bonds. Calculate M1 (sometimes called "transactions money"). Before the central bank's open market sale, what is the maximum possible expansion of the money supply? What will be the immediate effect of the central bank's action on the deposit liabilities of the commercial banking system? What will be the immediate effect on the reserves of the commercial banking system? What will be the immediate effect on the excess reserves of the commercial banking system? What is the maximum (total) expansion in the money supply that can occur as a result of the central bank's action?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the maximum expansion in the money supply you can use the money multiplier formula Money Multiplier Required Reserve Ratio In this case ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started