Answered step by step

Verified Expert Solution

Question

1 Approved Answer

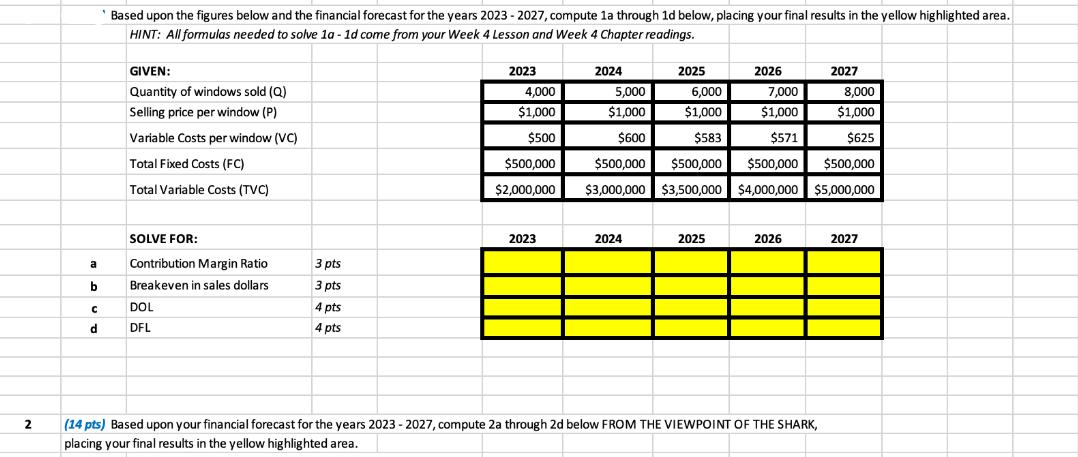

2 a b d Based upon the figures below and the financial forecast for the years 2023 2027, compute 1a through 1d below, placing

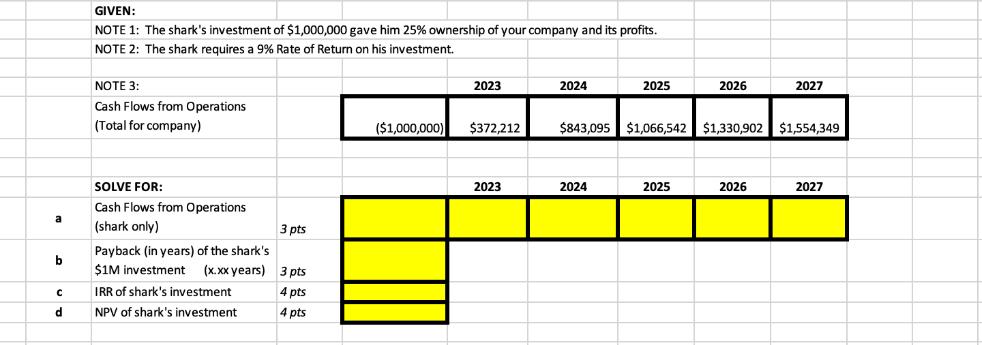

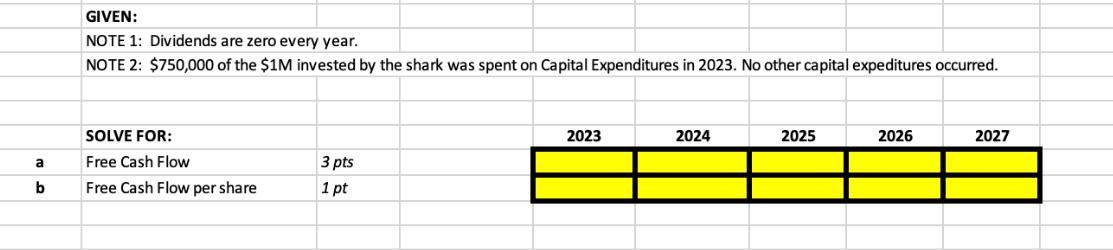

2 a b d Based upon the figures below and the financial forecast for the years 2023 2027, compute 1a through 1d below, placing your final results in the yellow highlighted area. HINT: All formulas needed to solve 1a-1d come from your Week 4 Lesson and Week 4 Chapter readings. GIVEN: Quantity of windows sold (Q) Selling price per window (P) Variable Costs per window (VC) Total Fixed Costs (FC) Total Variable Costs (TVC) SOLVE FOR: Contribution Margin Ratio Breakeven in sales dollars. DOL DFL 3 pts 3 pts 4 pts 4 pts 2023 4,000 $1,000 $500 $500,000 $2,000,000 2023 2024 5,000 $1,000 $600 2025 2024 6,000 $1,000 $583 2026 2025 7,000 $1,000 $571 $500,000 $500,000 $500,000 $500,000 $3,000,000 $3,500,000 $4,000,000 $5,000,000 2026 2027 (14 pts) Based upon your financial forecast for the years 2023 - 2027, compute 2a through 2d below FROM THE VIEWPOINT OF THE SHARK, placing your final results in the yellow highlighted area. 8,000 $1,000 $625 2027 a b d GIVEN: NOTE 1: The shark's investment of $1,000,000 gave him 25% ownership of your company and its profits. NOTE 2: The shark requires a 9% Rate of Return on his investment. NOTE 3: Cash Flows from Operations (Total for company) SOLVE FOR: Cash Flows from Operations (shark only) Payback (in years) of the shark's $1M investment (x.xx years) IRR of shark's investment NPV of shark's investment 3 pts 3 pts 4 pts 4 pts ($1,000,000) 2023 $372,212 2023 2024 2025 $843,095 $1,066,542 2024 2025 2026 2027 $1,330,902 $1,554,349 2026 2027 3 4 (3 pts) What is the growth rate of Net Income for each of the forecasted years? (4 pts) Compute the following for the forecasted years. (Total company) 2023 2024 2025 2026 2027 GIVEN: NOTE 1: Dividends are zero every year. NOTE 2: $750,000 of the $1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred. a b GIVEN: NOTE 1: Dividends are zero every year. NOTE 2: $750,000 of the $1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred. SOLVE FOR: Free Cash Flow Free Cash Flow per share 3 pts 1 pt 2023 2024 2025 2026 2027

Step by Step Solution

★★★★★

3.23 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1a Contribution Margin Ratio 2023 Sales Variable Costs Sales 4000 1000 2000000 4000 1000 05 2024 Sales Variable Costs Sales 5000 1000 3000000 5000 100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started