Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) A bakery enters into 74 short wheat futures contracts on the CBoT at a futures price of 589.7 cents per bushel. It closes out

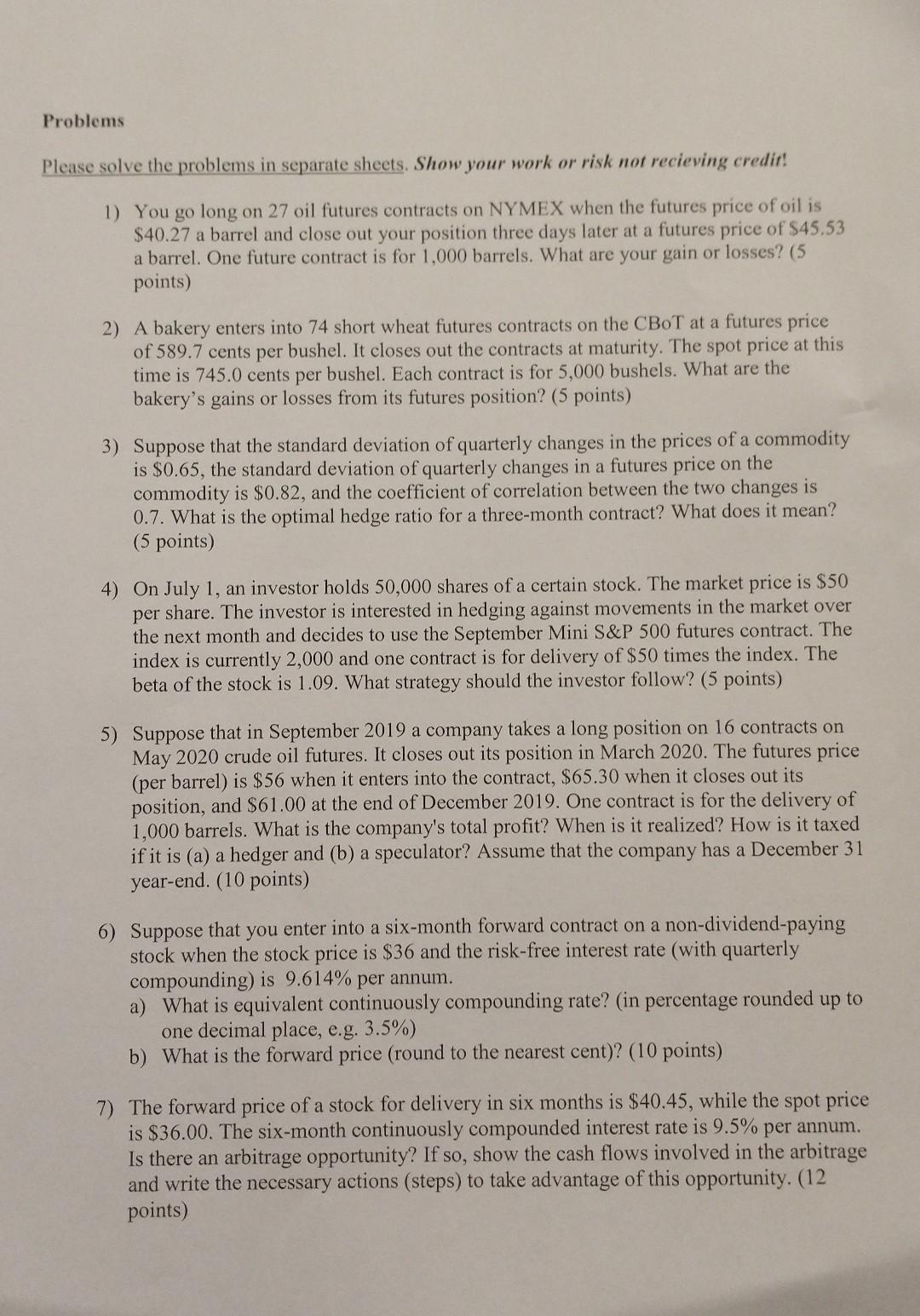

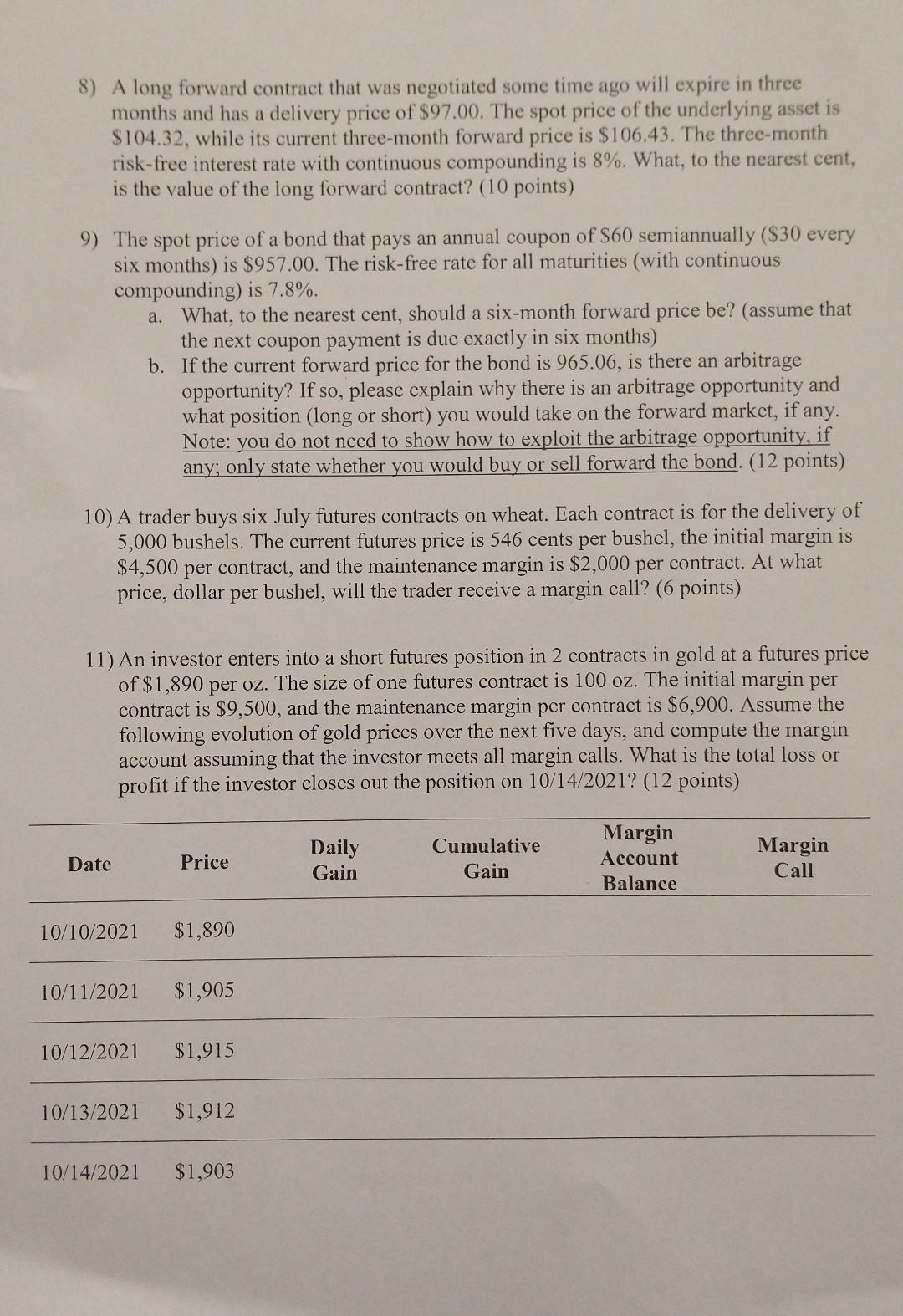

2) A bakery enters into 74 short wheat futures contracts on the CBoT at a futures price of 589.7 cents per bushel. It closes out the contracts at maturity. The spot price at this time is 745.0 cents per bushel. Each contract is for 5,000 bushels. What are the bakery's gains or losses from its futures position? (5 points) 3) Suppose that the standard deviation of quarterly changes in the prices of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.82, and the coefficient of correlation between the two changes is 0.7. What is the optimal hedge ratio for a three-month contract? What does it mean? (5 points) 4) On July 1, an investor holds 50,000 shares of a certain stock. The market price is $50 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S\&P 500 futures contract. The index is currently 2,000 and one contract is for delivery of $50 times the index. The beta of the stock is 1.09. What strategy should the investor follow? (5 points) 5) Suppose that in September 2019 a company takes a long position on 16 contracts on May 2020 crude oil futures. It closes out its position in March 2020. The futures price (per barrel) is $56 when it enters into the contract, $65.30 when it closes out its position, and $61.00 at the end of December 2019 . One contract is for the delivery of 1,000 barrels. What is the company's total profit? When is it realized? How is it taxed if it is (a) a hedger and (b) a speculator? Assume that the company has a December 31 year-end. (10 points) 6) Suppose that you enter into a six-month forward contract on a non-dividend-paying stock when the stock price is $36 and the risk-free interest rate (with quarterly compounding) is 9.614% per annum. a) What is equivalent continuously compounding rate? (in percentage rounded up to one decimal place, e.g. 3.5%) b) What is the forward price (round to the nearest cent)? (10 points) 7) The forward price of a stock for delivery in six months is $40.45, while the spot price is $36.00. The six-month continuously compounded interest rate is 9.5% per annum. Is there an arbitrage opportunity? If so, show the cash flows involved in the arbitrage and write the necessary actions (steps) to take advantage of this opportunity. (12 points) 8) A long forward contract that was negotiated some time ago will expire in three months and has a delivery price of $97.00. The spot price of the underlying asset is $104.32, while its current three-month forward price is $106.43. The three-month risk-free interest rate with continuous compounding is 8%. What, to the nearest cent, is the value of the long forward contract? (10 points) 9) The spot price of a bond that pays an annual coupon of $60 semiannually ( $30 every six months) is $957.00. The risk-free rate for all maturities (with continuous compounding) is 7.8%. a. What, to the nearest cent, should a six-month forward price be? (assume that the next coupon payment is due exactly in six months) b. If the current forward price for the bond is 965.06, is there an arbitrage opportunity? If so, please explain why there is an arbitrage opportunity and what position (long or short) you would take on the forward market, if any. Note: you do not need to show how to exploit the arbitrage opportunity, if any; only state whether you would buy or sell forward the bond. ( 12 points) 10) A trader buys six July futures contracts on wheat. Each contract is for the delivery of 5,000 bushels. The current futures price is 546 cents per bushel, the initial margin is $4,500 per contract, and the maintenance margin is $2,000 per contract. At what price, dollar per bushel, will the trader receive a margin call? ( 6 points) 11) An investor enters into a short futures position in 2 contracts in gold at a futures price of $1,890 per oz. The size of one futures contract is 100oz. The initial margin per contract is $9,500, and the maintenance margin per contract is $6,900. Assume the following evolution of gold prices over the next five days, and compute the margin account assuming that the investor meets all margin calls. What is the total loss or profit if the investor closes out the position on 10/14/2021? ( 12 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started