2. A business signed a sales contract that the business will receive $2M 6 months from now. The business has a cash outflow 8

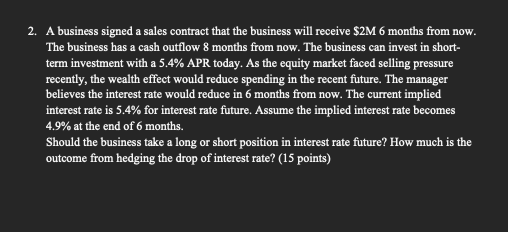

2. A business signed a sales contract that the business will receive $2M 6 months from now. The business has a cash outflow 8 months from now. The business can invest in short- term investment with a 5.4% APR today. As the equity market faced selling pressure recently, the wealth effect would reduce spending in the recent future. The manager believes the interest rate would reduce in 6 months from now. The current implied interest rate is 5.4% for interest rate future. Assume the implied interest rate becomes 4.9% at the end of 6 months. Should the business take a long or short position in interest rate future? How much is the outcome from hedging the drop of interest rate? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Initial Investment Calculation The business is expecting 2 million in 6 months They can invest thi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started