Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (a) Explain what analytical procedures are and explain how the auditor uses analytical procedures during the course of the audit. [4 marks) You are

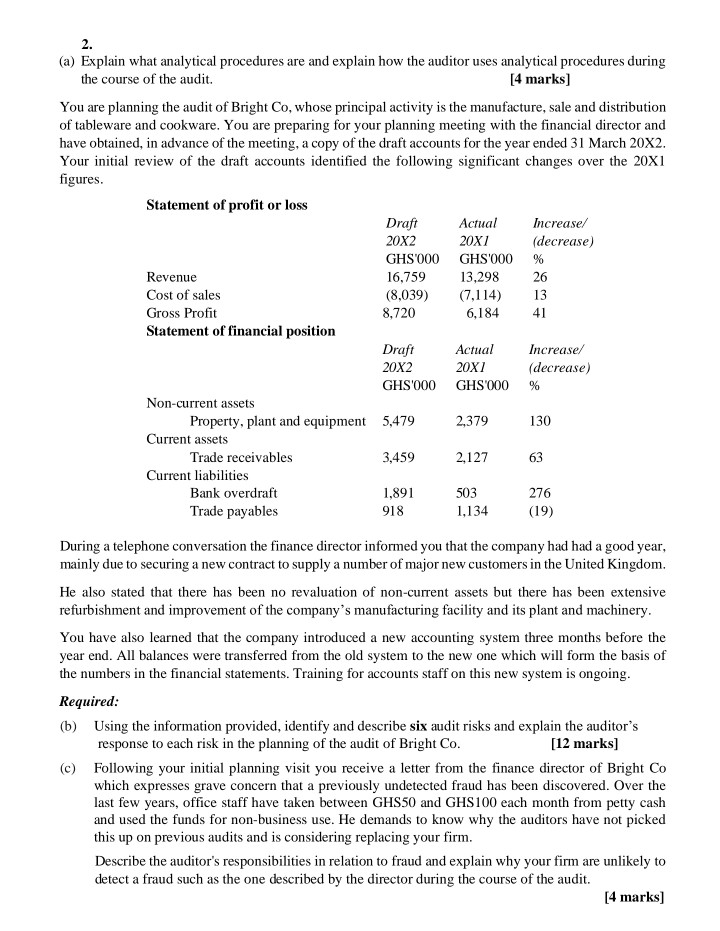

2. (a) Explain what analytical procedures are and explain how the auditor uses analytical procedures during the course of the audit. [4 marks) You are planning the audit of Bright Co, whose principal activity is the manufacture, sale and distribution of tableware and cookware. You are preparing for your planning meeting with the financial director and have obtained, in advance of the meeting, a copy of the draft accounts for the year ended 31 March 20X2. Your initial review of the draft accounts identified the following significant changes over the 20X1 figures. Statement of profit or loss Draft Actual Increase/ 20X2 20X1 (decrease) GHS 000 GHS'000 % Revenue 16,759 13,298 26 Cost of sales (8,039) (7,114) 13 Gross Profit 8,720 6,184 41 Statement of financial position Draft Actual Increase/ 20X2 20X1 (decrease) GHS'000 GHS'000 Non-current assets Property, plant and equipment 5,479 2,379 130 Current assets Trade receivables 3,459 2,127 Current liabilities Bank overdraft 1,891 503 276 Trade payables 918 1,134 (19) % 63 During a telephone conversation the finance director informed you that the company had had a good year, mainly due to securing a new contract to supply a number of major new customers in the United Kingdom. He also stated that there has been no revaluation of non-current assets but there has been extensive refurbishment and improvement of the company's manufacturing facility and its plant and machinery. You have also learned that the company introduced a new accounting system three months before the year end. All balances were transferred from the old system to the new one which will form the basis of the numbers in the financial statements. Training for accounts staff on this new system is ongoing. Required: (b) Using the information provided, identify and describe six audit risks and explain the auditor's response to each risk in the planning of the audit of Bright Co. [12 marks] (c) Following your initial planning visit you receive a letter from the finance director of Bright Co which expresses grave concern that a previously undetected fraud has been discovered. Over the last few years, office staff have taken between GHS50 and GHS100 each month from petty cash and used the funds for non-business use. He demands to know why the auditors have not picked this up on previous audits and is considering replacing your firm. Describe the auditor's responsibilities in relation to fraud and explain why your firm are unlikely to detect a fraud such as the one described by the director during the course of the audit. [4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started