Answered step by step

Verified Expert Solution

Question

1 Approved Answer

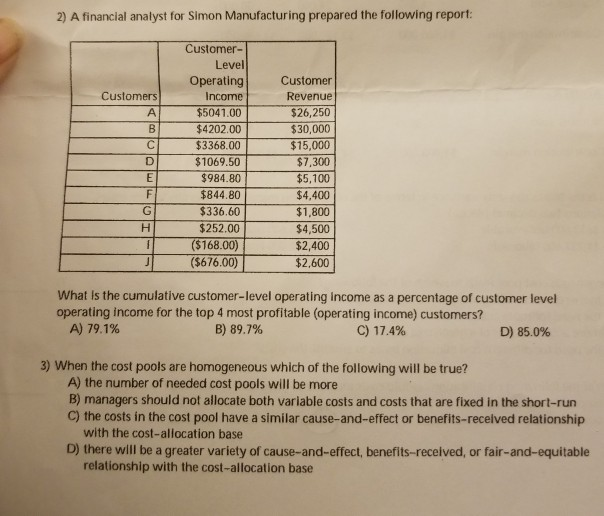

2) A financial analyst for Simon Manufacturing prepared the following report: Customer- Level Operating Income $5041.00 $4202.00 C$3368.00 $1069.50 $984.80 $844.80 $336.60 $252.00 ($168.00) ($676.00)

2) A financial analyst for Simon Manufacturing prepared the following report: Customer- Level Operating Income $5041.00 $4202.00 C$3368.00 $1069.50 $984.80 $844.80 $336.60 $252.00 ($168.00) ($676.00) Customer Revenue $26,250 $30,000 $15,000 $7,300 $5,100 $4,400 $1,800 $4,500 $2,400 $2,600 Customers What Is the cumulative customer-level operating income as a percentage of customer level operating income for the top 4 most profitable (operating income) customers? A) 79.1% B) 89.7% C) 17.4% D) 85.0% 3) When the cost pools are homogeneous which of the following will be true? A) the number of needed cost pools will be more B) managers should not allocate both variable costs and costs that are fixed in the short-run C) the costs in the cost pool have a similar cause-and-effect or benefits-recelved relationship with the cost-allocation base D) there will be a greater variety of cause-and-effect, benefits-recelved, or fair-and-equitable relationship with the cost-allocation base

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started