Answered step by step

Verified Expert Solution

Question

1 Approved Answer

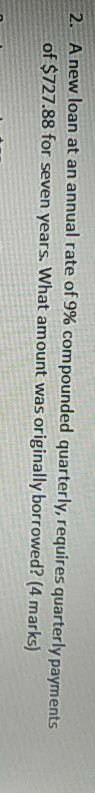

2. A new loan at an annual rate of 9% compounded quarterly, requires quarterly payments of $727.88 for seven years. What amount was originally borrowed?

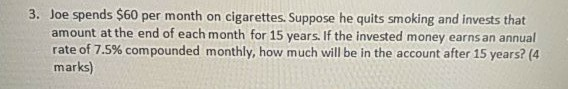

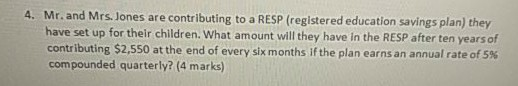

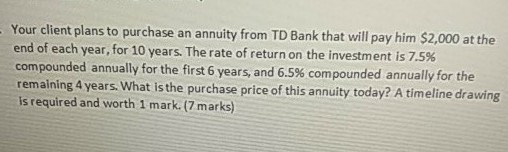

2. A new loan at an annual rate of 9% compounded quarterly, requires quarterly payments of $727.88 for seven years. What amount was originally borrowed? (4 marks) 3. Joe spends $60 per month on cigarettes. Suppose he quits smoking and invests that amount at the end of each month for 15 years. If the invested money earns an annual rate of 7.5% compounded monthly, how much will be in the account after 15 years? (4 marks) 4. Mr. and Mrs. Jones are contributing to a RESP (registered education savings plan) they have set up for their children. What amount will they have in the RESP after ten years of contributing $2,550 at the end of every six months if the plan earns an annual rate of 5% compounded quarterly? (4 marks) Your client plans to purchase an annuity from TD Bank that will pay him $2,000 at the end of each year, for 10 years. The rate of return on the investment is 7.5% compounded annually for the first 6 years, and 6.5% compounded annually for the remaining 4 years. What is the purchase price of this annuity today? A timeline drawing is required and worth 1 mark. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started