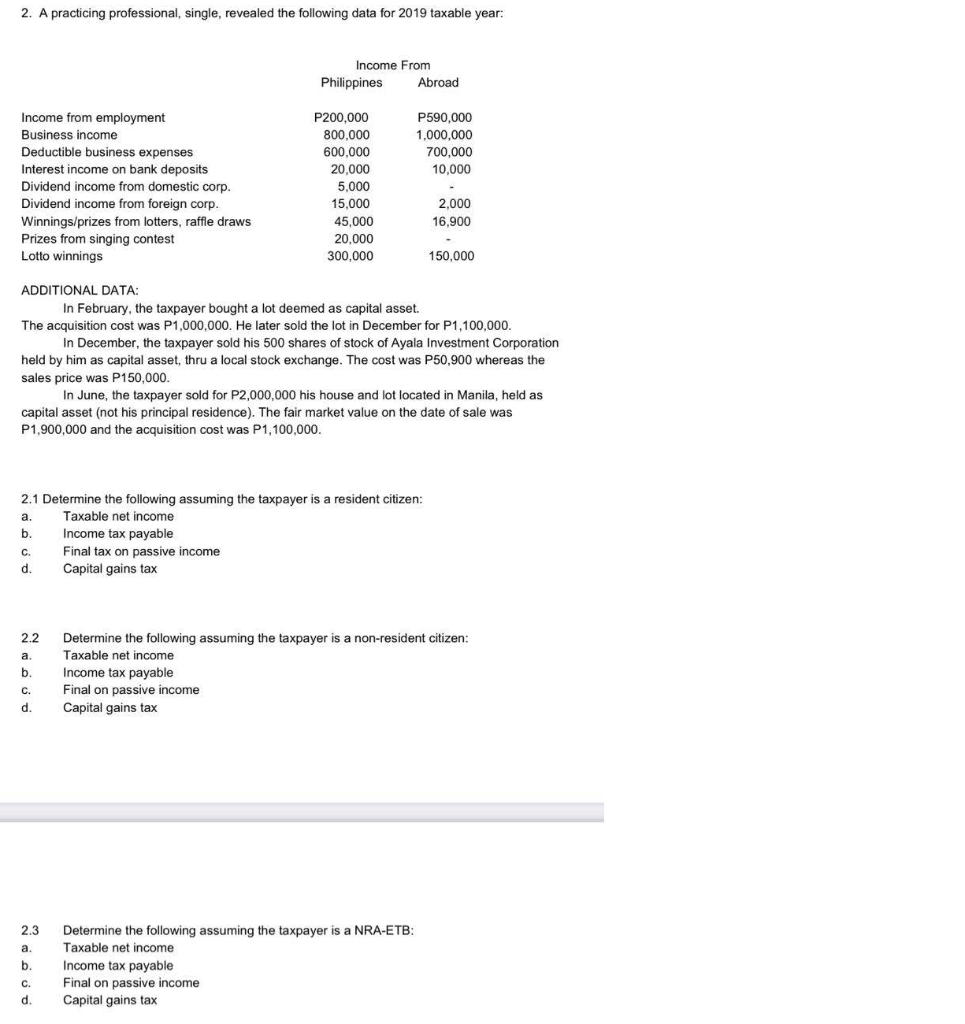

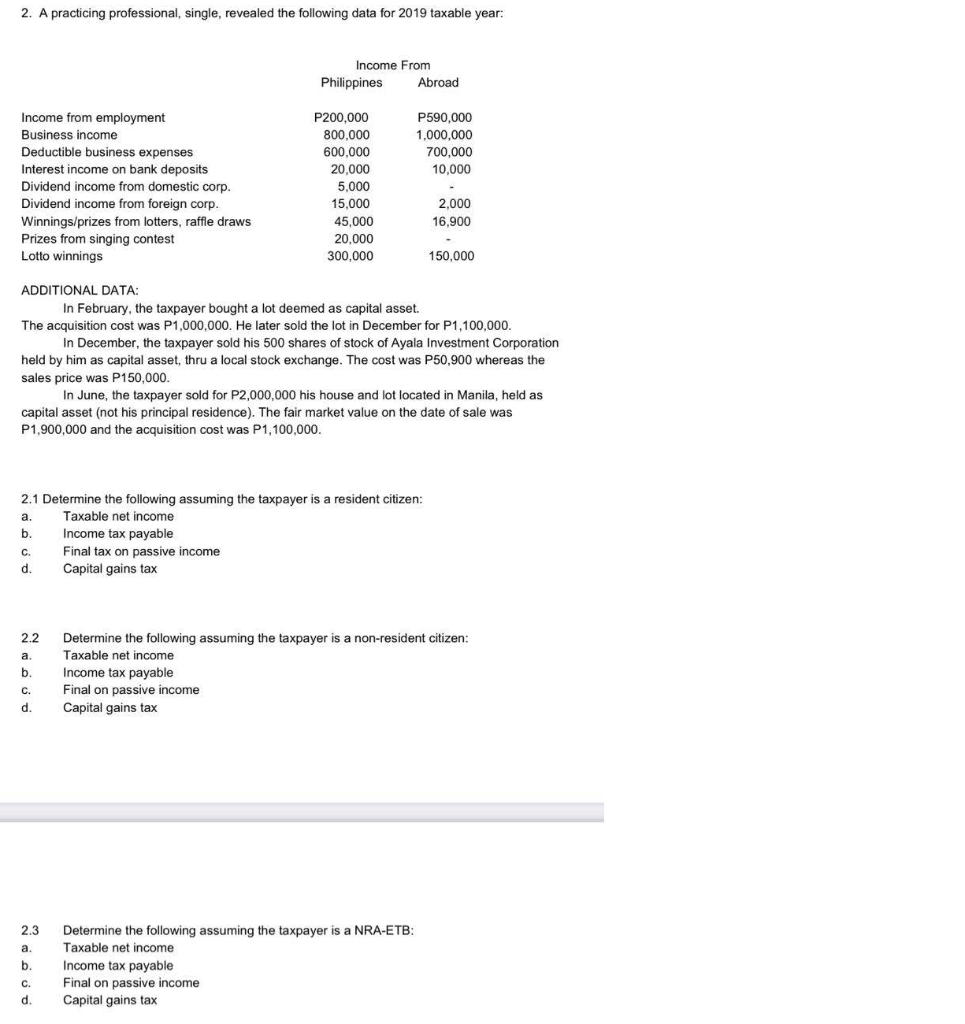

2. A practicing professional, single, revealed the following data for 2019 taxable year: Income From Philippines Abroad P590,000 1,000,000 700,000 10,000 Income from employment Business income Deductible business expenses Interest income on bank deposits Dividend income from domestic corp. Dividend income from foreign corp. Winnings/prizes from lotters, raffle draws Prizes from singing contest Lotto winnings P200,000 800,000 600,000 20,000 5,000 15.000 45,000 20,000 300,000 2,000 16,900 150,000 ADDITIONAL DATA: In February, the taxpayer bought a lot deemed as capital asset. The acquisition cost was P1,000,000. He later sold the lot in December for P1,100,000. In December, the taxpayer sold his 500 shares of stock of Ayala Investment Corporation held by him as capital asset, thru a local stock exchange. The cost was P50,900 whereas the sales price was P150,000. In June, the taxpayer sold for P2,000,000 his house and lot located in Manila, held as capital asset (not his principal residence). The fair market value on the date of sale was P1,900,000 and the acquisition cost was P1,100,000. 2.1 Determine the following assuming the taxpayer is a resident citizen: a. Taxable net income b. Income tax payable C. Final tax on passive income d. Capital gains tax 2.2 a b. Determine the following assuming the taxpayer is a non-resident citizen: Taxable net income Income tax payable Final on passive income Capital gains tax C. d. 2.3 a. b. c. d. Determine the following assuming the taxpayer is a NRA-ETB: Taxable net income Income tax payable Final on passive income Capital gains tax 2. A practicing professional, single, revealed the following data for 2019 taxable year: Income From Philippines Abroad P590,000 1,000,000 700,000 10,000 Income from employment Business income Deductible business expenses Interest income on bank deposits Dividend income from domestic corp. Dividend income from foreign corp. Winnings/prizes from lotters, raffle draws Prizes from singing contest Lotto winnings P200,000 800,000 600,000 20,000 5,000 15.000 45,000 20,000 300,000 2,000 16,900 150,000 ADDITIONAL DATA: In February, the taxpayer bought a lot deemed as capital asset. The acquisition cost was P1,000,000. He later sold the lot in December for P1,100,000. In December, the taxpayer sold his 500 shares of stock of Ayala Investment Corporation held by him as capital asset, thru a local stock exchange. The cost was P50,900 whereas the sales price was P150,000. In June, the taxpayer sold for P2,000,000 his house and lot located in Manila, held as capital asset (not his principal residence). The fair market value on the date of sale was P1,900,000 and the acquisition cost was P1,100,000. 2.1 Determine the following assuming the taxpayer is a resident citizen: a. Taxable net income b. Income tax payable C. Final tax on passive income d. Capital gains tax 2.2 a b. Determine the following assuming the taxpayer is a non-resident citizen: Taxable net income Income tax payable Final on passive income Capital gains tax C. d. 2.3 a. b. c. d. Determine the following assuming the taxpayer is a NRA-ETB: Taxable net income Income tax payable Final on passive income Capital gains tax