Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. A property is bought 7 years ago for $350,000 putting 10% down and financing the rest for 30 years with a fixed rate

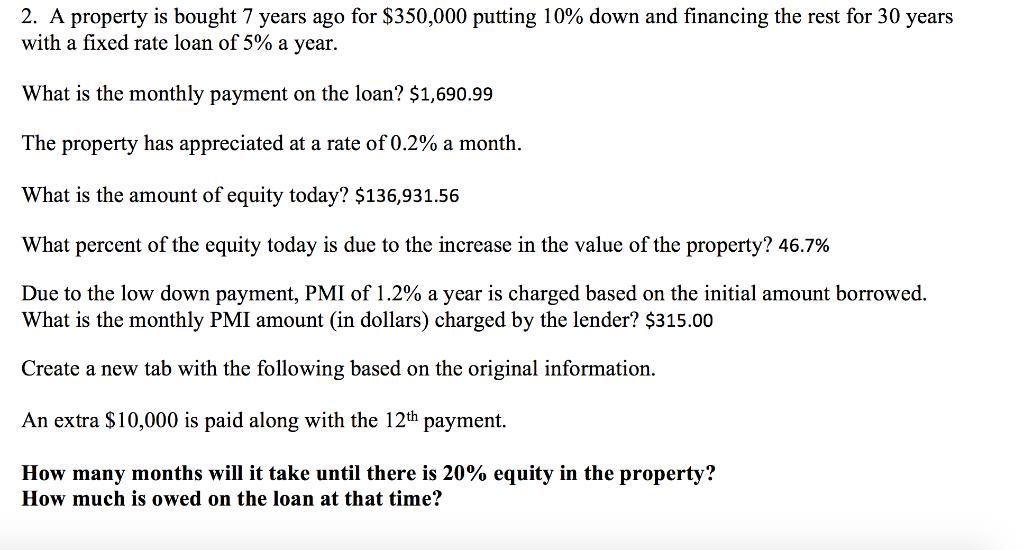

2. A property is bought 7 years ago for $350,000 putting 10% down and financing the rest for 30 years with a fixed rate loan of 5% a year. What is the monthly payment on the loan? $1,690.99 The property has appreciated at a rate of 0.2% a month. What is the amount of equity today? $136,931.56 What percent of the equity today is due to the increase in the value of the property? 46.7% Due to the low down payment, PMI of 1.2% a year is charged based on the initial amount borrowed. What is the monthly PMI amount (in dollars) charged by the lender? $315.00 Create a new tab with the following based on the original information. An extra $10,000 is paid along with the 12th payment. How many months will it take until there is 20% equity in the property? How much is owed on the loan at that time?

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

2Value of property 350000 Down payment35000010 35000 Loan amount 315000 Monthly payment on the above loan amt of 315000 can be found by using the form...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started