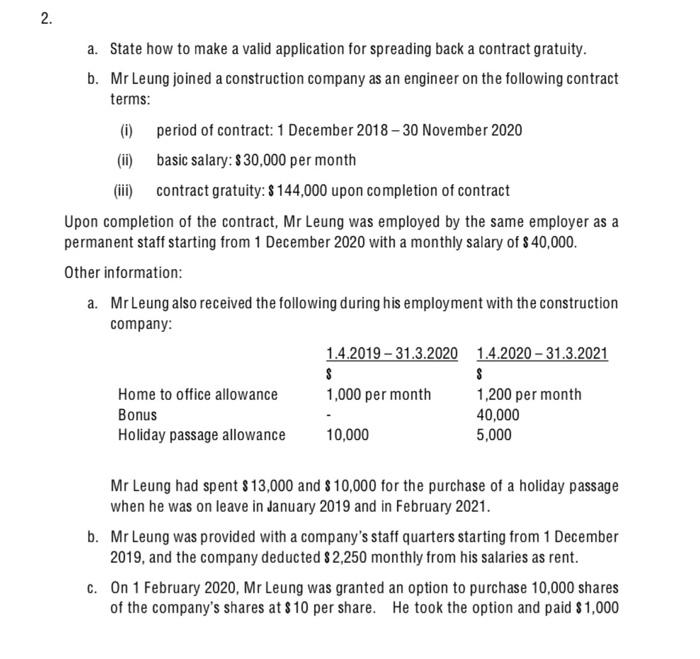

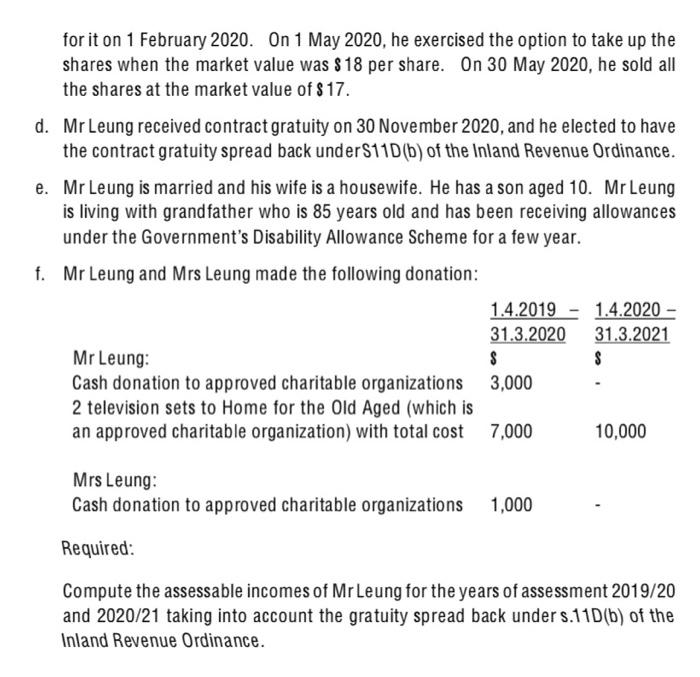

2. a. State how to make a valid application for spreading back a contract gratuity. b. Mr Leung joined a construction company as an engineer on the following contract terms: (1) period of contract: 1 December 2018 - 30 November 2020 (ii) basic salary: $30,000 per month (ii) contract gratuity: $144,000 upon completion of contract Upon completion of the contract, Mr Leung was employed by the same employer as a permanent staff starting from 1 December 2020 with a monthly salary of $ 40,000. Other information: a. Mr Leung also received the following during his employment with the construction company: 1.4.2019 - 31.3.2020 1.4.2020 - 31.3.2021 $ $ Home to office allowance 1,000 per month 1,200 per month Bonus 40,000 Holiday passage allowance 10,000 5,000 Mr Leung had spent $13,000 and $10,000 for the purchase of a holiday passage when he was on leave in January 2019 and in February 2021. b. Mr Leung was provided with a company's staff quarters starting from 1 December 2019, and the company deducted $2,250 monthly from his salaries as rent. c. On 1 February 2020, Mr Leung was granted an option to purchase 10,000 shares of the company's shares at $10 per share. He took the option and paid $1,000 for it on 1 February 2020. On 1 May 2020, he exercised the option to take up the shares when the market value was $ 18 per share. On 30 May 2020, he sold all the shares at the market value of $ 17. d. Mr Leung received contract gratuity on 30 November 2020, and he elected to have the contract gratuity spread back under $11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: 1.4.2019 - 1.4.2020 31.3.2020 31.3.2021 Mr Leung: S Cash donation to approved charitable organizations 3,000 2 television sets to Home for the Old Aged (which is an approved charitable organization) with total cost 7,000 10,000 Mrs Leung: Cash donation to approved charitable organizations 1,000 Required: Compute the assessable incomes of Mr Leung for the years of assessment 2019/20 and 2020/21 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance. 2. a. State how to make a valid application for spreading back a contract gratuity. b. Mr Leung joined a construction company as an engineer on the following contract terms: (1) period of contract: 1 December 2018 - 30 November 2020 (ii) basic salary: $30,000 per month (ii) contract gratuity: $144,000 upon completion of contract Upon completion of the contract, Mr Leung was employed by the same employer as a permanent staff starting from 1 December 2020 with a monthly salary of $ 40,000. Other information: a. Mr Leung also received the following during his employment with the construction company: 1.4.2019 - 31.3.2020 1.4.2020 - 31.3.2021 $ $ Home to office allowance 1,000 per month 1,200 per month Bonus 40,000 Holiday passage allowance 10,000 5,000 Mr Leung had spent $13,000 and $10,000 for the purchase of a holiday passage when he was on leave in January 2019 and in February 2021. b. Mr Leung was provided with a company's staff quarters starting from 1 December 2019, and the company deducted $2,250 monthly from his salaries as rent. c. On 1 February 2020, Mr Leung was granted an option to purchase 10,000 shares of the company's shares at $10 per share. He took the option and paid $1,000 for it on 1 February 2020. On 1 May 2020, he exercised the option to take up the shares when the market value was $ 18 per share. On 30 May 2020, he sold all the shares at the market value of $ 17. d. Mr Leung received contract gratuity on 30 November 2020, and he elected to have the contract gratuity spread back under $11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: 1.4.2019 - 1.4.2020 31.3.2020 31.3.2021 Mr Leung: S Cash donation to approved charitable organizations 3,000 2 television sets to Home for the Old Aged (which is an approved charitable organization) with total cost 7,000 10,000 Mrs Leung: Cash donation to approved charitable organizations 1,000 Required: Compute the assessable incomes of Mr Leung for the years of assessment 2019/20 and 2020/21 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance