Answered step by step

Verified Expert Solution

Question

1 Approved Answer

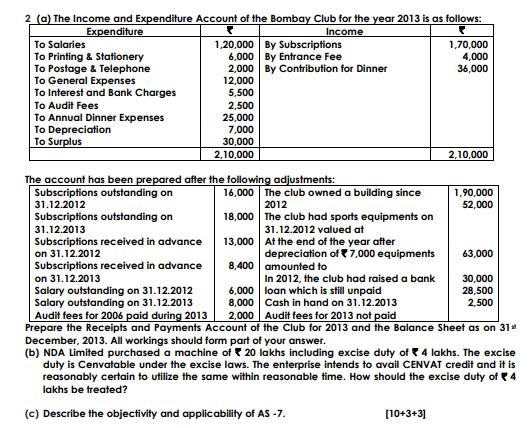

2 (a) The Income and Expenditure Account of the Bombay Club for the year 2013 is as follows: Expenditure To Salaries To Printing &

2 (a) The Income and Expenditure Account of the Bombay Club for the year 2013 is as follows: Expenditure To Salaries To Printing & Stationery Income 1,20,000 By Subscriptions 6,000 By Entrance Fee 2,000 By Contribution for Dinner 1,70,000 4,000 36,000 To Postage & Telephone To General Expenses 12,000 To Interest and Bank Charges 5,500 To Audit Fees 2,500 To Annual Dinner Expenses 25,000 To Depreciation To Surplus 7,000 30,000 2,10,000 2,10,000 The account has been prepared after the following adjustments: Subscriptions outstanding on 31.12.2012 Subscriptions outstanding on 31.12.2013 Subscriptions received in advance on 31.12.2012 Subscriptions received in advance on 31.12.2013 Salary outstanding on 31.12.2012 Salary outstanding on 31.12.2013 Audit fees for 2006 paid during 2013 16,000 The club owned a building since 1,90,000 2012 52,000 18,000 The club had sports equipments on 31.12.2012 valued at 13,000 At the end of the year after depreciation of 7,000 equipments 8,400 amounted to 63,000 6,000 In 2012, the club had raised a bank loan which is still unpaid 30,000 28,500 8,000 Cash in hand on 31.12.2013 2,500 2,000 Audit fees for 2013 not paid Prepare the Receipts and Payments Account of the Club for 2013 and the Balance Sheet as on 31 December, 2013. All workings should form part of your answer. (b) NDA Limited purchased a machine of 20 lakhs including excise duty of 4 lakhs. The excise duty is Cenvatable under the excise laws. The enterprise intends to avail CENVAT credit and it is reasonably certain to utilize the same within reasonable time. How should the excise duty of 4 lakhs be treated? (c) Describe the objectivity and applicability of AS-7. [10+3+3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started