Question

2. A) Verify the asked price on the 0.250 percent August 2014 T-note for Tuesday, July 16, 2013. The asked yield on the note is

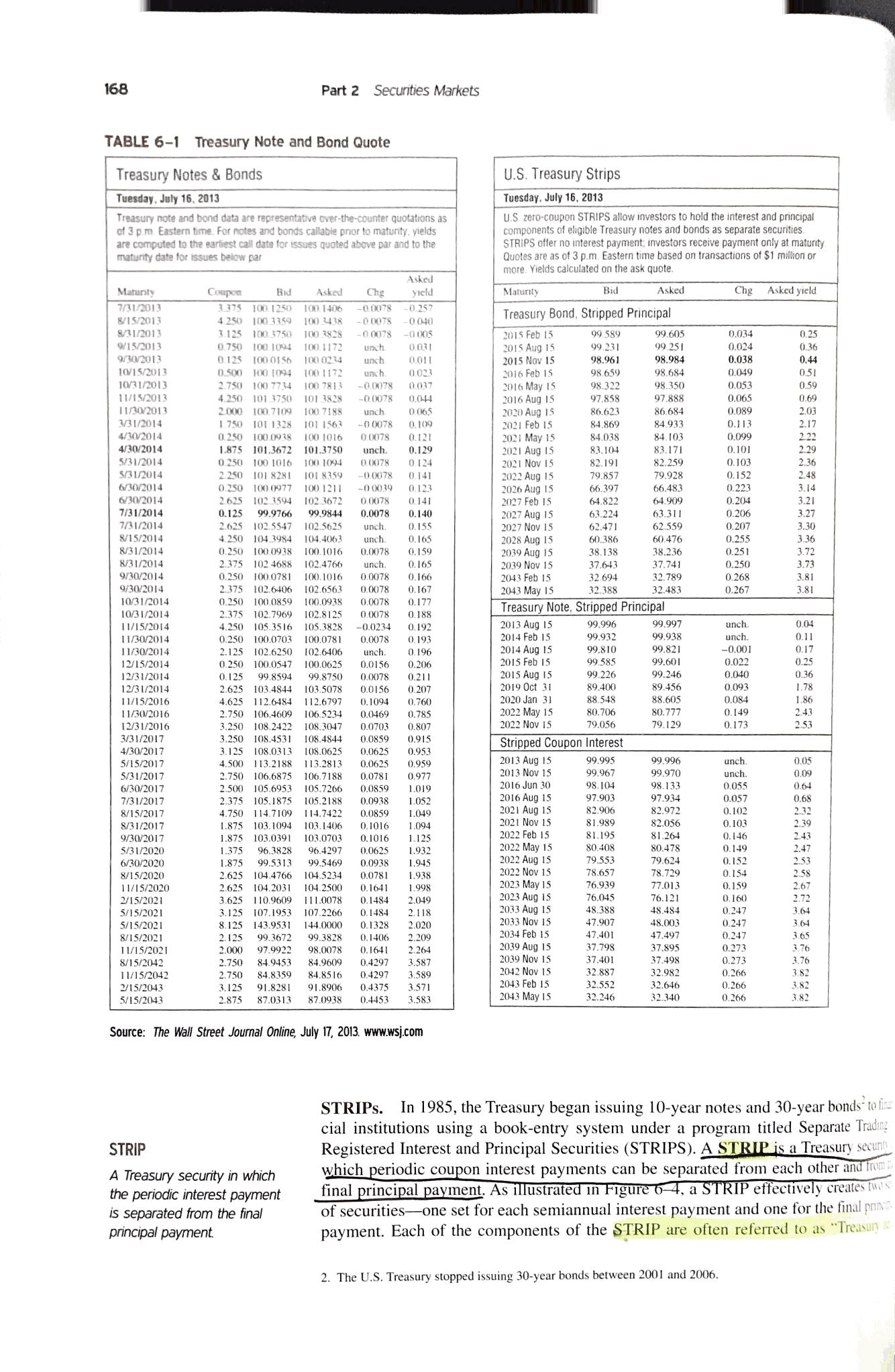

2. A) Verify the asked price on the 0.250 percent August 2014 T-note for Tuesday, July 16, 2013. The asked yield on the note is 0.159 percent and the note matures on August 31, 2014. Settlement occurs two business days after purchase. (You would take possession of the note on Thursday, July 18, 2013.

B) Verify the asked yield on the 0.250 percent May 2014 T-note for July 16, 2013. The asked price is 100.1094 and the note matures on May 31, 2014.

C) Verify the July 16, 2013, asked yield of 0.69 percent on the Treasury bond, stripped principal STRIP maturing August 2016. Use a two-day settlement period from the date of purchase. (Ownership occurs on Thursday July 18, 2013.) The STRIP matures on August 15, 2016.

D) Verify the asked price (62.559) on the Treasury note, stripped principal STRIP maturing in November 2027 (STRIP matures on November 15, 2027.)

Part 2 Securities Markets TABLE 6-1 Treasury Note and Bond Quote Treasury Notes & Bonds Tuesday, July 16, 2013 U.S. Treasury Strips Tuesday, July 16, 2013 Treasury note and bond data are representative over-the-counter quotations as of 3 p.m. Eastern time. For notes and bonds callable prior to maturity. yields are computed to the eartiest call date for issues quoted above par and to the maturity date for issues below par U.S zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securities STRIPS offer no interest payment, investors receive payment only at maturity Quotes are as of 3 p.m. Eastern time based on transactions of $1 miion or more. Yields calculated on the ask quote Asked ield 375 100 1250100 1406 00078 0 257 0 04 125 100 3750100 382S00078 -005 Coupon Bid Asked Chg Maturity Asked Chg Asked yield Treasury Bond, Stripped Principal 4.250 100 3359 831/2013 99.605 99.25 98.684 97.888 84 933 4.103 82.259 930/2013 10/15/2013 03 1/2013 11/15/2013 0156 100 0234 unch 0.049 0.51 0.500 00 1094 1001172 uch0.023 2.750 100 773400 7813 -0.0078 0.037 4.250 101 3750 101 3828 -00078 0.044 2.000 00.71091007188 unch 0 065 1.750 101 1328 101 1563 -0.0078 0.9 0.250 1000938 100 1016 00078 0.121 1875 101.3672 101.3750 unch 0.129 0.250 100 1016 100 19 0 0078 0.124 2016 Feb 98.322 97.858 ay Is 2016 Au 2020 Au 0.089 3/31/2014 4/30/2014 4/30/2014 5/31/2014 S3120 84.869 84.038 2021 Au 2021 Nov 0.103 64.822 2625 102 3594 102 367 0.125 99.9766 99.9844 0.0078 0.140 2.625 I02 5547 02.5625 unch 0.155 4.250 104.3984 104.4063 2027 Feb 15 64909 7/31/2014 2027 Aug 2028 Aug 15 2039 Nov 15 62.559 60.476 0.207 255 31/2014 unc 60.386 8/31/20 8/31/2014 9/30/2014 0.0078 0.159 2.375 102 4688 02.4766 nch 0.250 100078 100.1016 0.0078 0.166 0.165 643 32.789 000859 00.0938 0.0078 0.1 pped P 0/31/201 0.250 100.0703 100.07 nc 11/30/201 125 02.6250 02.6406 0.250 1000547 100.0625 0.01 99.601 12/31/20 99.226 2.625 103.4844 03.5078 0.0156 0.2 88.605 0 106.4609 16.5234 0.046 12/31/2016 108.4844 0.0859 0.91 0.0625 0.9 0.0625 0.9 Stripped Coupon Interest 08.06 99.996 nc 6/30/201 0.05 1.049 .094 8/15/201 1.8 1.87 0.0625 6/30/2020 79.553 04.4766 104.5 107 144.0000 0.1328 2.125 99.3672 99.3828 0.1406 84.9609 0.4297 /204 25 91.8281 91.8906 0.4375 3.5 5/15/2043 Source: The Wall Street Journal Online, July 17, 2013 www.wsj.com STRIP A Treasury security in which the periodic interest payment final principal payment. As illustrated m Figur is separated from the final principal payment STRIPs. In 1985, the Treasury began issuing 10-year notes and 30-year bonds to fi cial institutions using a book-entry system under a program titled Separate Trading Registered Interest and Principal Securities (STRIPS). A SI which periodic coupon interest payments can be separated from each othei final principal payment. As 1llustrate of securities-one set for each semiannual interest payment and one for the final prn payment. Each of the components of the STRIP are often referred to as "Treasury ury secunh a pay em reach semiannual STRIP are often referred to Tr 2. The U.S. Treasury stopped issuing 30-year bonds between 2001 and 2006Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started