Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. A. Your firm is considering purchase of a $50,000 machine. The firm is going to find the machine with $10,000 worth of bank debt,

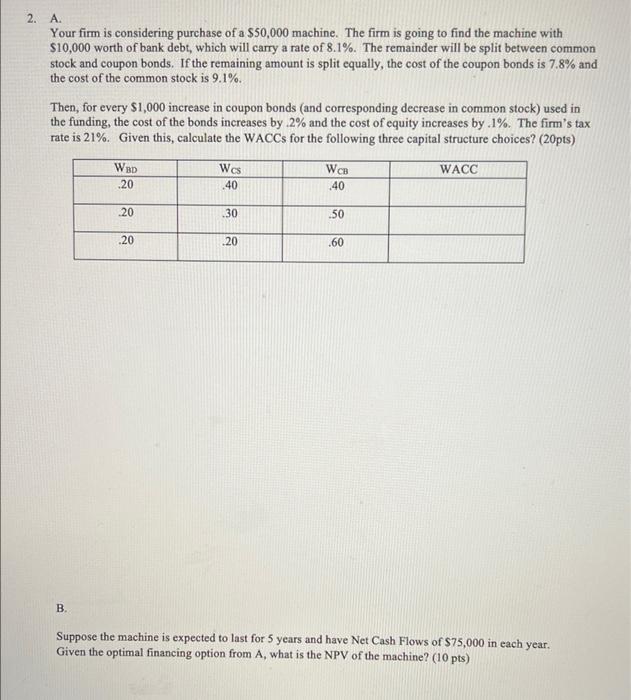

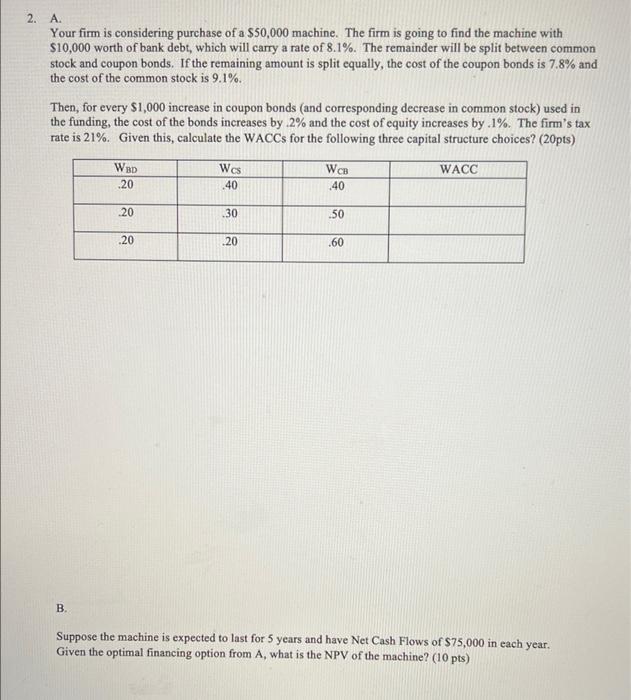

2. A. Your firm is considering purchase of a $50,000 machine. The firm is going to find the machine with $10,000 worth of bank debt, which will carry a rate of 8.1%. The remainder will be split between common stock and coupon bonds. If the remaining amount is split equally, the cost of the coupon bonds is 7.8% and the cost of the common stock is 9.1%. Then, for every $1,000 increase in coupon bonds (and corresponding decrease in common stock) used in the funding, the cost of the bonds increases by .2% and the cost of equity increases by .1%. The firm's tax rate is 21%. Given this, calculate the WACCS for the following three capital structure choices? (20pts) WACC B. WBD 20 .20 .20 Wes .40 .30 .20 WCB 40 .50 .60 Suppose the machine is expected to last for 5 years and have Net Cash Flows of $75,000 in each year. Given the optimal financing option from A, what is the NPV of the machine? (10 pts)

2. A. Your firm is considering purchase of a $50,000 machine. The firm is going to find the machine with $10,000 worth of bank debt, which will carry a rate of 8.1%. The remainder will be split between common stock and coupon bonds. If the remaining amount is split equally, the cost of the coupon bonds is 7.8% and the cost of the common stock is 9.1%. Then, for every $1,000 increase in coupon bonds (and corresponding decrease in common stock) used in the funding, the cost of the bonds increases by .2% and the cost of equity increases by .1%. The firm's tax rate is 21%. Given this, calculate the WACCS for the following three capital structure choices? (20pts) WACC B. WBD 20 .20 .20 Wes .40 .30 .20 WCB 40 .50 .60 Suppose the machine is expected to last for 5 years and have Net Cash Flows of $75,000 in each year. Given the optimal financing option from A, what is the NPV of the machine? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started