Answered step by step

Verified Expert Solution

Question

1 Approved Answer

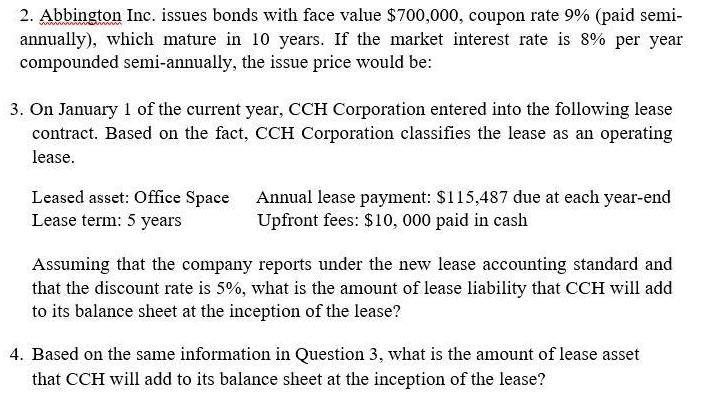

2. Abbington Inc. issues bonds with face value $700,000, coupon rate 9% (paid semi- annually), which mature in 10 years. If the market interest

2. Abbington Inc. issues bonds with face value $700,000, coupon rate 9% (paid semi- annually), which mature in 10 years. If the market interest rate is 8% per year compounded semi-annually, the issue price would be: 3. On January 1 of the current year, CCH Corporation entered into the following lease contract. Based on the fact, CCH Corporation classifies the lease as an operating lease. Leased asset: Office Space Lease term: 5 years Annual lease payment: $115,487 due at each year-end Upfront fees: $10,000 paid in cash Assuming that the company reports under the new lease accounting standard and that the discount rate is 5%, what is the amount of lease liability that CCH will add to its balance sheet at the inception of the lease? 4. Based on the same information in Question 3, what is the amount of lease asset that CCH will add to its balance sheet at the inception of the lease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 2 Abbington Inc Bond Issue Price Given Face Valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started