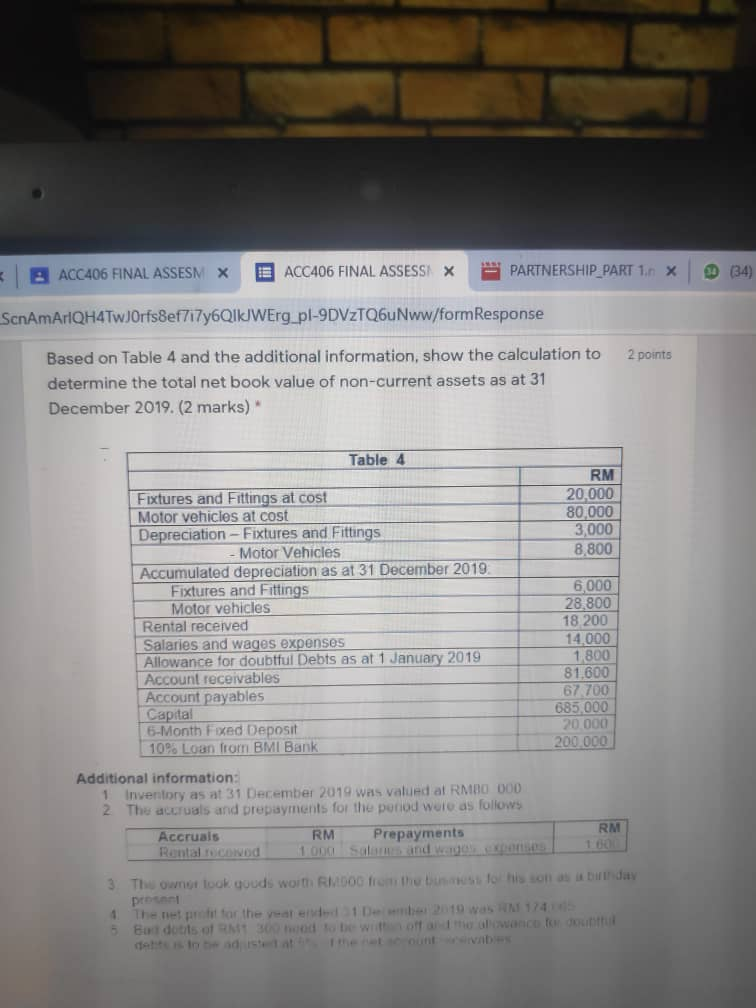

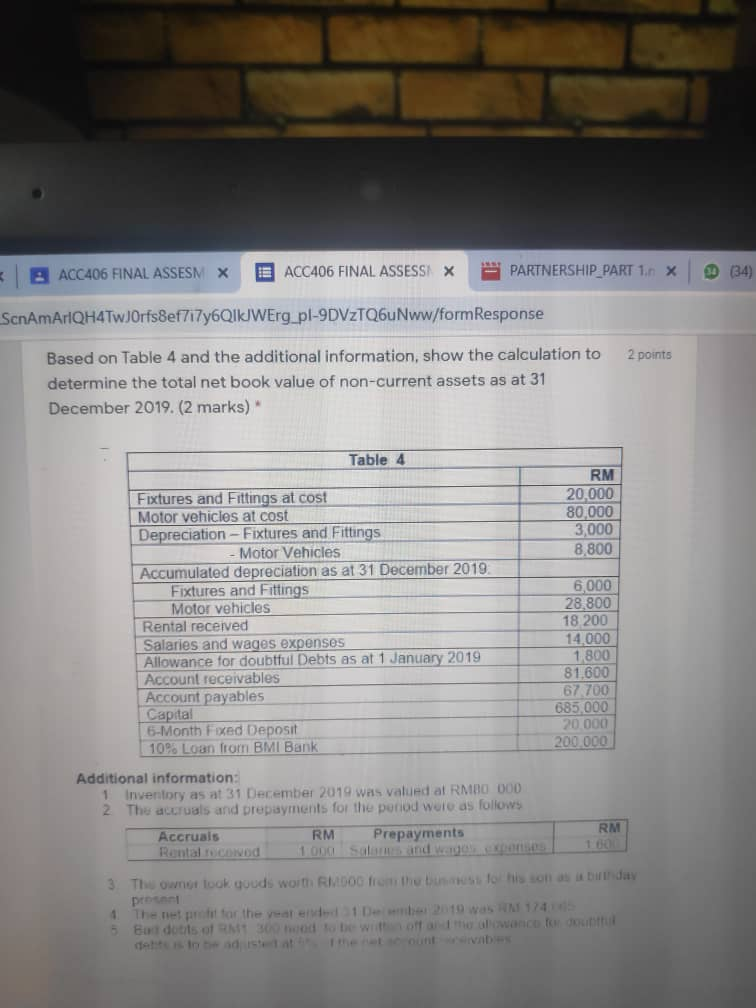

2 ACC406 FINAL ASSESM X E ACC406 FINAL ASSESSI X *** PARTNERSHIP_PART 1. X 30 (34) ScnAmArIQH4TwJOrfs8ef717y6QIKJWErg_pl-9DVZTQ6uNww/formResponse 2 points Based on Table 4 and the additional information, show the calculation to determine the total net book value of non-current assets as at 31 December 2019. (2 marks) Table 4 RM Fixtures and Fittings at cost 20,000 Motor vehicles at cost 80,000 Depreciation - Fixtures and Fittings 3,000 Motor Vehicles 8.800 Accumulated depreciation as at 31 December 2019 Fixtures and Fittings 6,000 Motor vehicles 28.800 Rental received 18 200 Salaries and wages expenses 14.000 Allowance for doubtful Debts as at 1 January 2019 1.800 Account receivables 81.600 Account payables 67 700 Capital 685,000 6-Month Fixed Deposit 20.000 10% Loan from BMI Bank 200.000 Additional information: 1 inventory as at 31 December 2019 was valued at RMNO 000 2 The accruals and prepayments for the period wore as follows Accruals RM Prepayments RM Runtal comod 3. The ownot look gouds worth RMDG from the bus his son day procent 1 The net pritor the year endd 1 D10 WH 1741 Bardotits of RM 300 hod to be with off the lowance for our 2 ACC406 FINAL ASSESM X E ACC406 FINAL ASSESSI X *** PARTNERSHIP_PART 1. X 30 (34) ScnAmArIQH4TwJOrfs8ef717y6QIKJWErg_pl-9DVZTQ6uNww/formResponse 2 points Based on Table 4 and the additional information, show the calculation to determine the total net book value of non-current assets as at 31 December 2019. (2 marks) Table 4 RM Fixtures and Fittings at cost 20,000 Motor vehicles at cost 80,000 Depreciation - Fixtures and Fittings 3,000 Motor Vehicles 8.800 Accumulated depreciation as at 31 December 2019 Fixtures and Fittings 6,000 Motor vehicles 28.800 Rental received 18 200 Salaries and wages expenses 14.000 Allowance for doubtful Debts as at 1 January 2019 1.800 Account receivables 81.600 Account payables 67 700 Capital 685,000 6-Month Fixed Deposit 20.000 10% Loan from BMI Bank 200.000 Additional information: 1 inventory as at 31 December 2019 was valued at RMNO 000 2 The accruals and prepayments for the period wore as follows Accruals RM Prepayments RM Runtal comod 3. The ownot look gouds worth RMDG from the bus his son day procent 1 The net pritor the year endd 1 D10 WH 1741 Bardotits of RM 300 hod to be with off the lowance for our