Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Acme Metals needs a new machine to make (um, let's say) rebars for an eight-year project. The receive the following quote from a

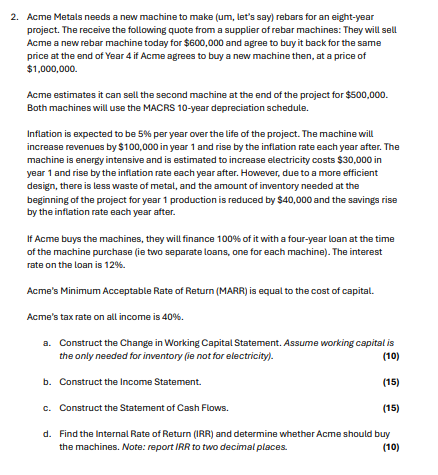

2. Acme Metals needs a new machine to make (um, let's say) rebars for an eight-year project. The receive the following quote from a supplier of rebar machines: They will sell Acme a new rebar machine today for $600,000 and agree to buy it back for the same price at the end of Year 4 if Acme agrees to buy a new machine then, at a price of $1,000,000. Acme estimates it can sell the second machine at the end of the project for $500,000. Both machines will use the MACRS 10-year depreciation schedule. Inflation is expected to be 5% per year over the life of the project. The machine will increase revenues by $100,000 in year 1 and rise by the inflation rate each year after. The machine is energy intensive and is estimated to increase electricity costs $30,000 in year 1 and rise by the inflation rate each year after. However, due to a more efficient design, there is less waste of metal, and the amount of inventory needed at the beginning of the project for year 1 production is reduced by $40,000 and the savings rise by the inflation rate each year after. If Acme buys the machines, they will finance 100% of it with a four-year loan at the time of the machine purchase (ie two separate loans, one for each machine). The interest rate on the loan is 12%. Acme's Minimum Acceptable Rate of Return (MARR) is equal to the cost of capital. Acme's tax rate on all income is 40%. a. Construct the Change in Working Capital Statement. Assume working capital is the only needed for inventory (ie not for electricity). b. Construct the Income Statement. c. Construct the Statement of Cash Flows. (10) (15) (15) d. Find the Internal Rate of Return (IRR) and determine whether Acme should buy the machines. Note: report IRR to two decimal places. (10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started