Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Al Dahabi Flour Mills's Income Statement shows OMR 297,500 profit for the year 2019. The following information are provided to arrive the taxable income.

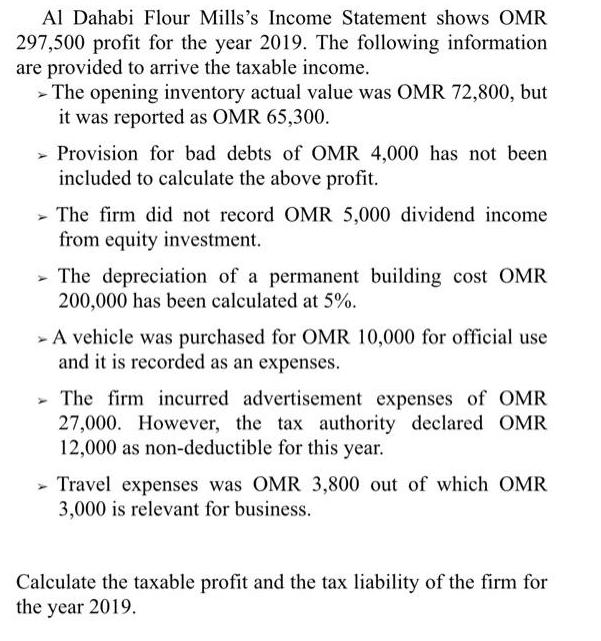

Al Dahabi Flour Mills's Income Statement shows OMR 297,500 profit for the year 2019. The following information are provided to arrive the taxable income. > The opening inventory actual value was OMR 72,800, but it was reported as OMR 65,300. > Provision for bad debts of OMR 4,000 has not been included to calculate the above profit. - The firm did not record OMR 5,000 dividend income from equity investment. - The depreciation of a permanent building cost OMR 200,000 has been calculated at 5%. - A vehicle was purchased for OMR 10,000 for official use and it is recorded as an expenses. - The firm incurred advertisement expenses of OMR 27,000. However, the tax authority declared OMR 12,000 as non-deductible for this year. - Travel expenses was OMR 3,800 out of which OMR 3,000 is relevant for business. Calculate the taxable profit and the tax liability of the firm for the year 2019.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of taxable income is as follows Particulars Amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started