Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(2) Although the project's after-tax operating costs are fairly certain at $100,000 per year, the estimated after-tax cash inflows depend critically on whether 21st

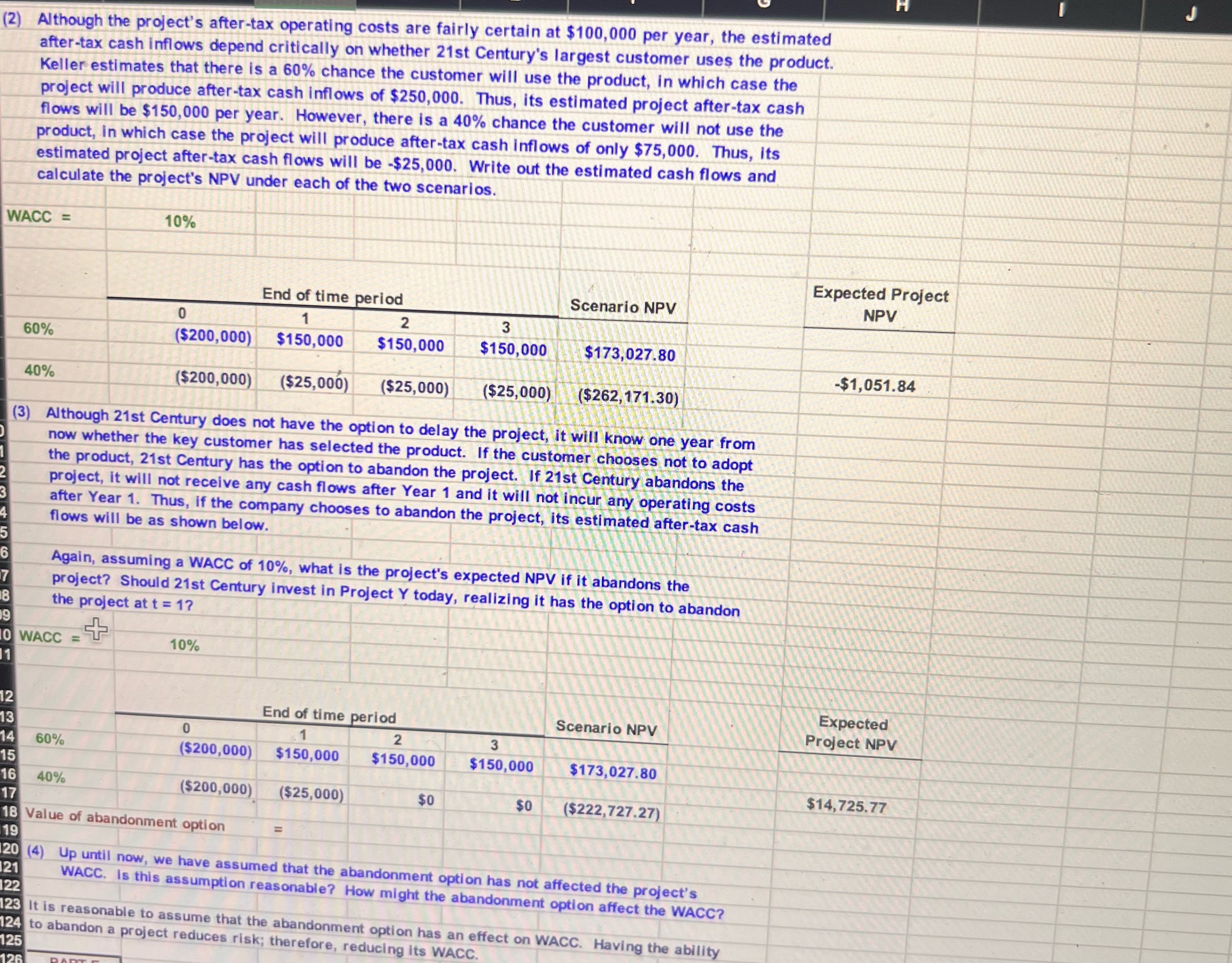

(2) Although the project's after-tax operating costs are fairly certain at $100,000 per year, the estimated after-tax cash inflows depend critically on whether 21st Century's largest customer uses the product. Keller estimates that there is a 60% chance the customer will use the product, in which case the project will produce after-tax cash inflows of $250,000. Thus, its estimated project after-tax cash flows will be $150,000 per year. However, there is a 40% chance the customer will not use the product, in which case the project will produce after-tax cash inflows of only $75,000. Thus, its estimated project after-tax cash flows will be -$25,000. Write out the estimated cash flows and calculate the project's NPV under each of the two scenarios. WACC= 10% Expected Project End of time period Scenario NPV NPV 0 1 2 3 60% ($200,000) $150,000 $150,000 $150,000 $173,027.80 -$1,051.84 40% ($200,000) ($25,000) ($25,000) ($25,000) ($262,171.30) 5 6 7 8 1 (3) Although 21st Century does not have the option to delay the project, it will know one year from now whether the key customer has selected the product. If the customer chooses not to adopt the product, 21st Century has the option to abandon the project. If 21st Century abandons the project, it will not receive any cash flows after Year 1 and it will not incur any operating costs after Year 1. Thus, if the company chooses to abandon the project, its estimated after-tax cash flows will be as shown below. Again, assuming a WACC of 10%, what is the project's expected NPV if it abandons the project? Should 21st Century invest in Project Y today, realizing it has the option to abandon the project at t = 1? 09 10 WACC = 10% 1 12 End of time period Scenario NPV 13 Expected Project NPV 0 14 60% ($200,000) 1 $150,000 2 $150,000 3 $150,000 $173,027.80 15 16 40% ($200,000) $14,725.77 ($25,000) $0 $0 17 ($222,727.27) 18 Value of abandonment option = 19 120 (4) Up until now, we have assumed that the abandonment option has not affected the project's WACC. Is this assumption reasonable? How might the abandonment option affect the WACC? 121 122 123 It is reasonable to assume that the abandonment option has an effect on WACC. Having the ability 124 to abandon a project reduces risk; therefore, reducing its WACC 125 126 PART T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started