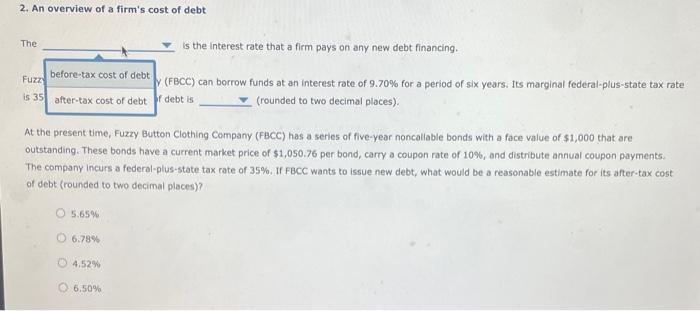

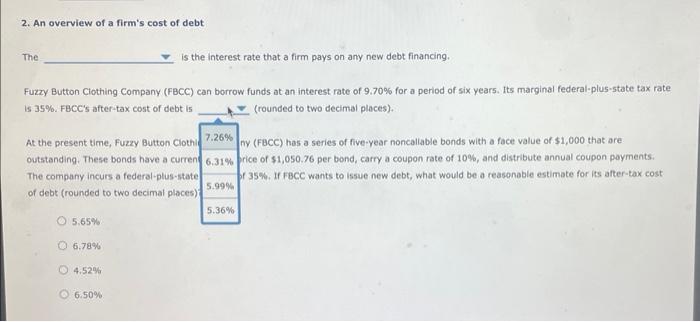

2. An overview of a firm's cost of debt The is the interest rate that a firm pays on any new debt financing. Furz (FBCC) can borrow funds at an interest rate of 9.70% for a period of six years. Its marginal federal-plus-state tax rate is 35 debt is (rounded to two decimal places). At the present time, Fuzzy Button Clothing Company (FBCC) has a series of five-year noncallable bonds with a face value of s1,000 that are outstanding. These bonds have a current market price of $1,050.76 per bond, carry a coupon rate of 10%6, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 35%. If FBCC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 2. An overview of a firm's cost of debt The is the interest rate that a firm pays on any new debt financing. Fuzzy Button Clothing Company (FBCC) can borrow funds at an interest rate of 9.70% for a perlod of six year5. Its marginal federal-plus-state tax rate is 35%. FBCC's after-tax cost of debt is (rounded to two decimal places). At the present time, Fuzzy Button Ciothl 7.26% ny (FBCC) has a series of five-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a curren 6.31% rice of $1,050.76 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal-plus-state 5.59% f 35%. If FBCC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two 5.65% 6.78% 4,524 6.50% The Is the interest rate that a firm pays on any new debt financing. Fuzzy Button Clothing Company (FBCC) can borrow funds at an interest rate of 9.70% for a period of six years. Its marginal federai-plus-state tax rate is 35%. FBCC's after-tax cost of debt is (rounded to two decimal places). At the present time, Fuzzy Button Clothing Company (FBCC) has a series of five-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,050.76 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 35%. if FBCC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 5.65% 6.78% 4.52% 6.50%