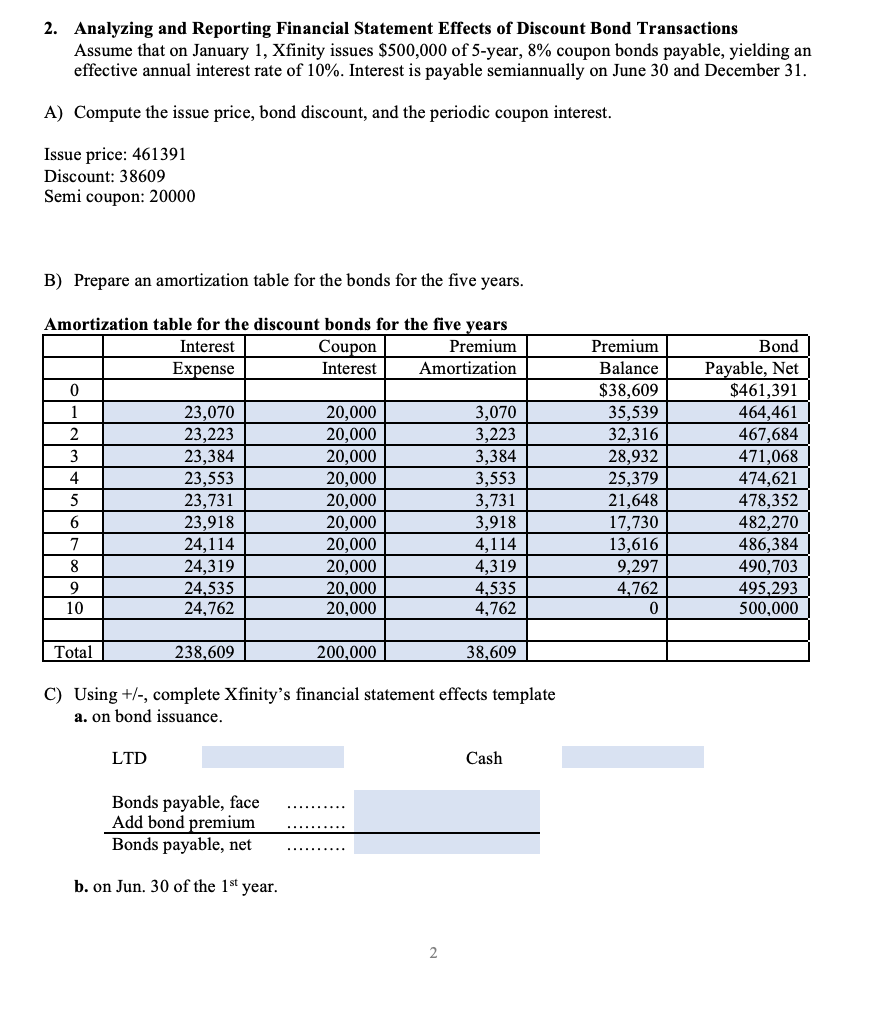

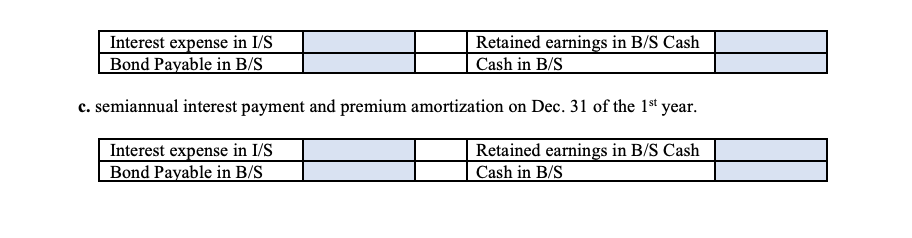

2. Analyzing and Reporting Financial Statement Effects of Discount Bond Transactions Assume that on January 1, Xfinity issues $500,000 of 5-year, 8% coupon bonds payable, yielding an effective annual interest rate of 10%. Interest is payable semiannually on June 30 and December 31. A) Compute the issue price, bond discount, and the periodic coupon interest. Issue price: 461391 Discount: 38609 Semi coupon: 20000 B) Prepare an amortization table for the bonds for the five years. Amortization table for the discount bonds for the five years Interest Coupon Premium Expense Interest Amortization 0 1 2 3 4 5 6 7 8 9 10 Total 23,070 23,223 23,384 23,553 23,731 23,918 24,114 24,319 24,535 24,762 LTD 238,609 20,000 20,000 20,000 Bonds payable, face Add bond premium Bonds payable, net b. on Jun. 30 of the 1st year. 20,000 20,000 20,000 20,000 20,000 20,000 20,000 200,000 3,070 3,223 2 3,384 3,553 3,731 3,918 4,114 4,319 C) Using +/-, complete Xfinity's financial statement effects template a. on bond issuance. 4,535 4,762 38,609 Cash Premium Balance $38,609 35,539 32,316 28,932 25,379 21,648 17,730 13,616 9,297 4,762 0 Bond Payable, Net $461,391 464,461 467,684 471,068 474,621 478,352 482,270 486,384 490,703 495,293 500,000 Interest expense in I/S Bond Payable in B/S Retained earnings in B/S Cash Cash in B/S c. semiannual interest payment and premium amortization on Dec. 31 of the 1st year. Interest expense in I/S Bond Payable in B/S Retained earnings in B/S Cash Cash in B/S 2. Analyzing and Reporting Financial Statement Effects of Discount Bond Transactions Assume that on January 1, Xfinity issues $500,000 of 5-year, 8% coupon bonds payable, yielding an effective annual interest rate of 10%. Interest is payable semiannually on June 30 and December 31. A) Compute the issue price, bond discount, and the periodic coupon interest. Issue price: 461391 Discount: 38609 Semi coupon: 20000 B) Prepare an amortization table for the bonds for the five years. Amortization table for the discount bonds for the five years Interest Coupon Premium Expense Interest Amortization 0 1 2 3 4 5 6 7 8 9 10 Total 23,070 23,223 23,384 23,553 23,731 23,918 24,114 24,319 24,535 24,762 LTD 238,609 20,000 20,000 20,000 Bonds payable, face Add bond premium Bonds payable, net b. on Jun. 30 of the 1st year. 20,000 20,000 20,000 20,000 20,000 20,000 20,000 200,000 3,070 3,223 2 3,384 3,553 3,731 3,918 4,114 4,319 C) Using +/-, complete Xfinity's financial statement effects template a. on bond issuance. 4,535 4,762 38,609 Cash Premium Balance $38,609 35,539 32,316 28,932 25,379 21,648 17,730 13,616 9,297 4,762 0 Bond Payable, Net $461,391 464,461 467,684 471,068 474,621 478,352 482,270 486,384 490,703 495,293 500,000 Interest expense in I/S Bond Payable in B/S Retained earnings in B/S Cash Cash in B/S c. semiannual interest payment and premium amortization on Dec. 31 of the 1st year. Interest expense in I/S Bond Payable in B/S Retained earnings in B/S Cash Cash in B/S