Question

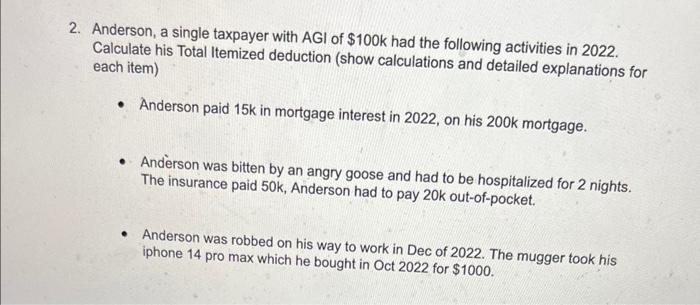

2. Anderson, a single taxpayer with AGI of $100k had the following activities in 2022. Calculate his Total Itemized deduction (show calculations and detailed

2. Anderson, a single taxpayer with AGI of $100k had the following activities in 2022. Calculate his Total Itemized deduction (show calculations and detailed explanations for each item) Anderson paid 15k in mortgage interest in 2022, on his 200k mortgage. Anderson was bitten by an angry goose and had to be hospitalized for 2 nights. The insurance paid 50k, Anderson had to pay 20k out-of-pocket. Anderson was robbed on his way to work in Dec of 2022. The mugger took his iphone 14 pro max which he bought in Oct 2022 for $1000.

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Deductions in taxation I As per IRS there are some expenses which can be allowed for deductio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Taxation 2015

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler, Jinhee Trone

8th Edition

1259293092, 978-1259293122, 1259293122, 978-1259293092

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App