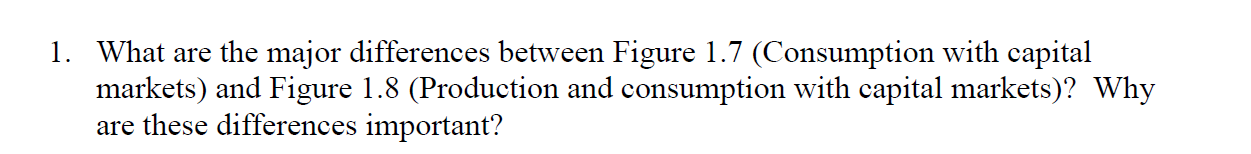

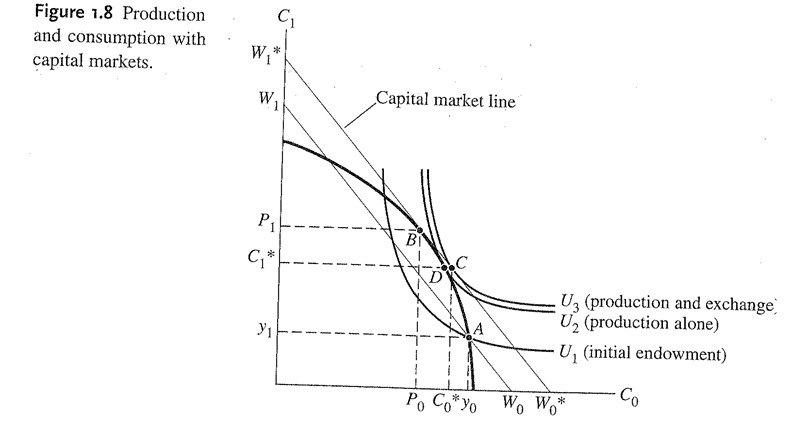

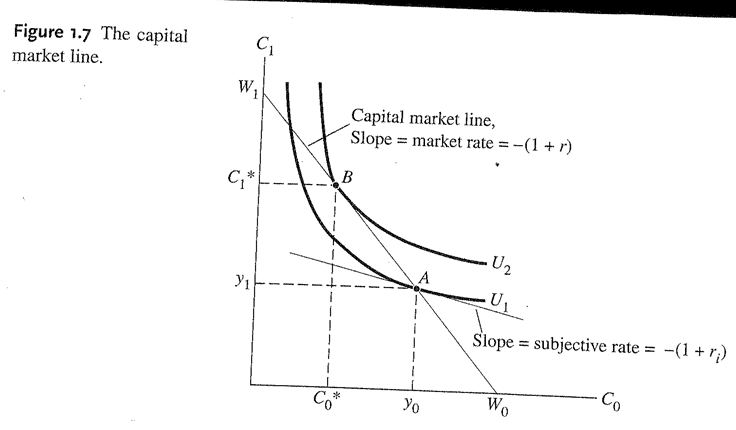

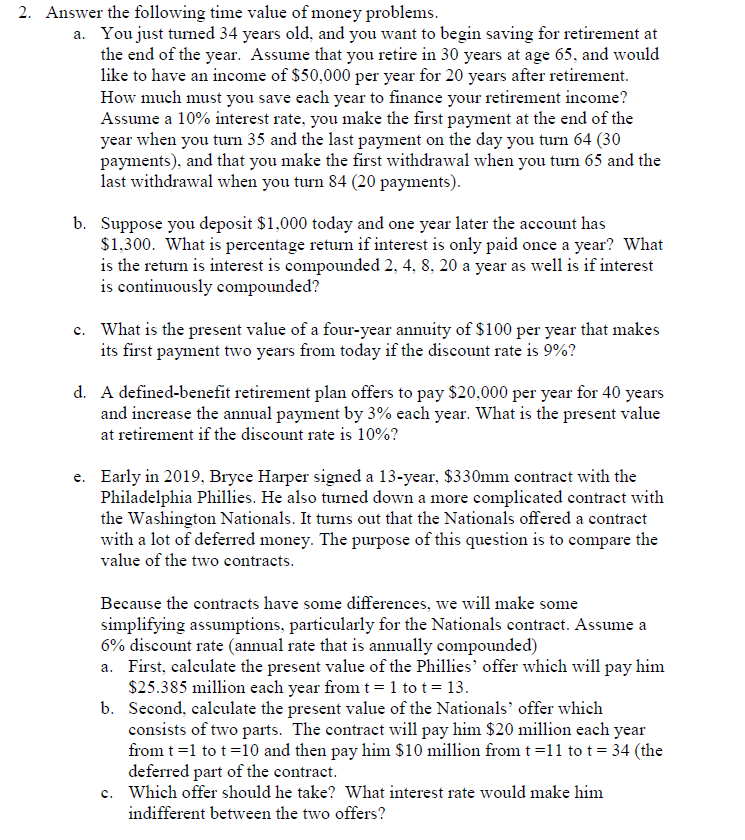

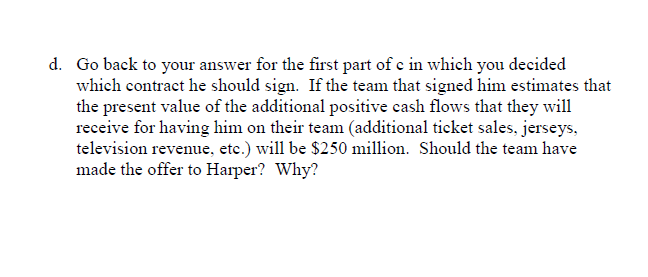

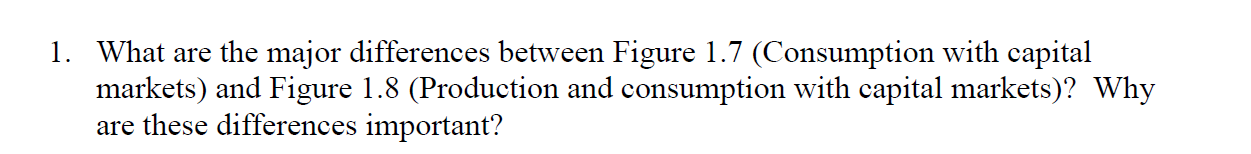

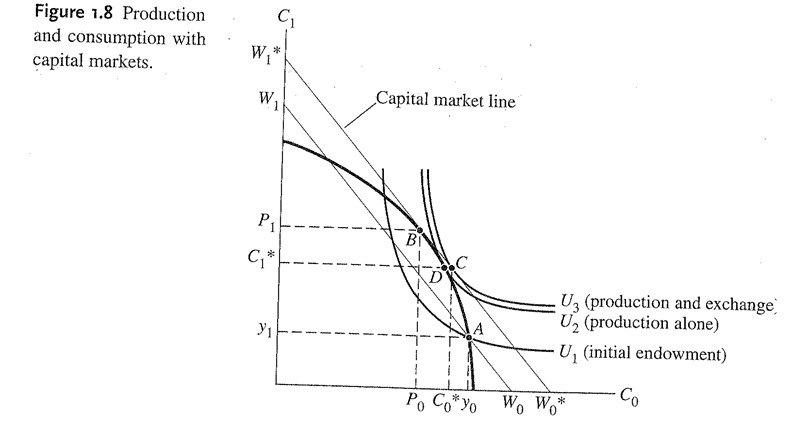

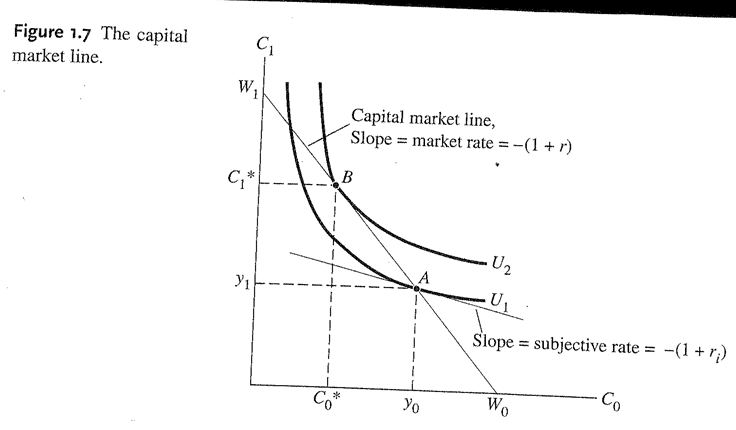

2. Answer the following time value of money problems. a. You just turned 34 years old, and you want to begin saving for retirement at the end of the year. Assume that you retire in 30 years at age 65, and would like to have an income of $50,000 per year for 20 years after retirement. How much must you save each year to finance your retirement income? Assume a 10% interest rate, you make the first payment at the end of the year when you turn 35 and the last payment on the day you turn 64 (30 payments), and that you make the first withdrawal when you tuin 65 and the last withdrawal when you turn 84 (20 payments). b. Suppose you deposit $1,000 today and one year later the account has $1,300. What is percentage return if interest is only paid once a year? What is the return is interest is compounded 2, 4, 8, 20 a year as well is if interest is continuously compounded? c. What is the present value of a four-year annuity of $100 per year that makes its first payment two years from today if the discount rate is 9%? d. A defined benefit retirement plan offers to pay $20,000 per year for 40 years and increase the annual payment by 3% each year. What is the present value at retirement if the discount rate is 10%? Early in 2019, Bryce Harper signed a 13-year, $330mm contract with the Philadelphia Phillies. He also turned down a more complicated contract with the Washington Nationals. It turns out that the Nationals offered a contract with a lot of deferred money. The purpose of this question is to compare the value of the two contracts. Because the contracts have some differences, we will make some simplifying assumptions, particularly for the Nationals contract. Assume a 6% discount rate (annual rate that is annually compounded) a. First, calculate the present value of the Phillies' offer which will pay him $25.385 million each year from t= 1 to t= 13. b. Second, calculate the present value of the Nationals' offer which consists of two parts. The contract will pay him $20 million each year from t=1 to t=10 and then pay him $10 million from t=11 to t = 34 (the deferred part of the contract. c. Which offer should he take? What interest rate would make him indifferent between the two offers? d. Go back to your answer for the first part of c in which you decided which contract he should sign. If the team that signed him estimates that the present value of the additional positive cash flows that they will receive for having him on their team (additional ticket sales, jerseys, television revenue, etc.) will be $250 million. Should the team have made the offer to Harper? Why? 1. What are the major differences between Figure 1.7 (Consumption with capital markets) and Figure 1.8 (Production and consumption with capital markets)? Why are these differences important? C Figure 1.8 Production and consumption with capital markets. Capital market line Pi ----- * Uz (production and exchange U (production alone) -U, (initial endowment) Po Co*yo W. W* Figure 1.7 The capital market line. Capital market line, Slope = market rate = -(1 + r) VI --- Slope = subjective rate = -(1+r;) --- WC