Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Arkin Co's controller has prepared a flexible budget for the year just ended, adjusting the original static budget for the unexpected large increase

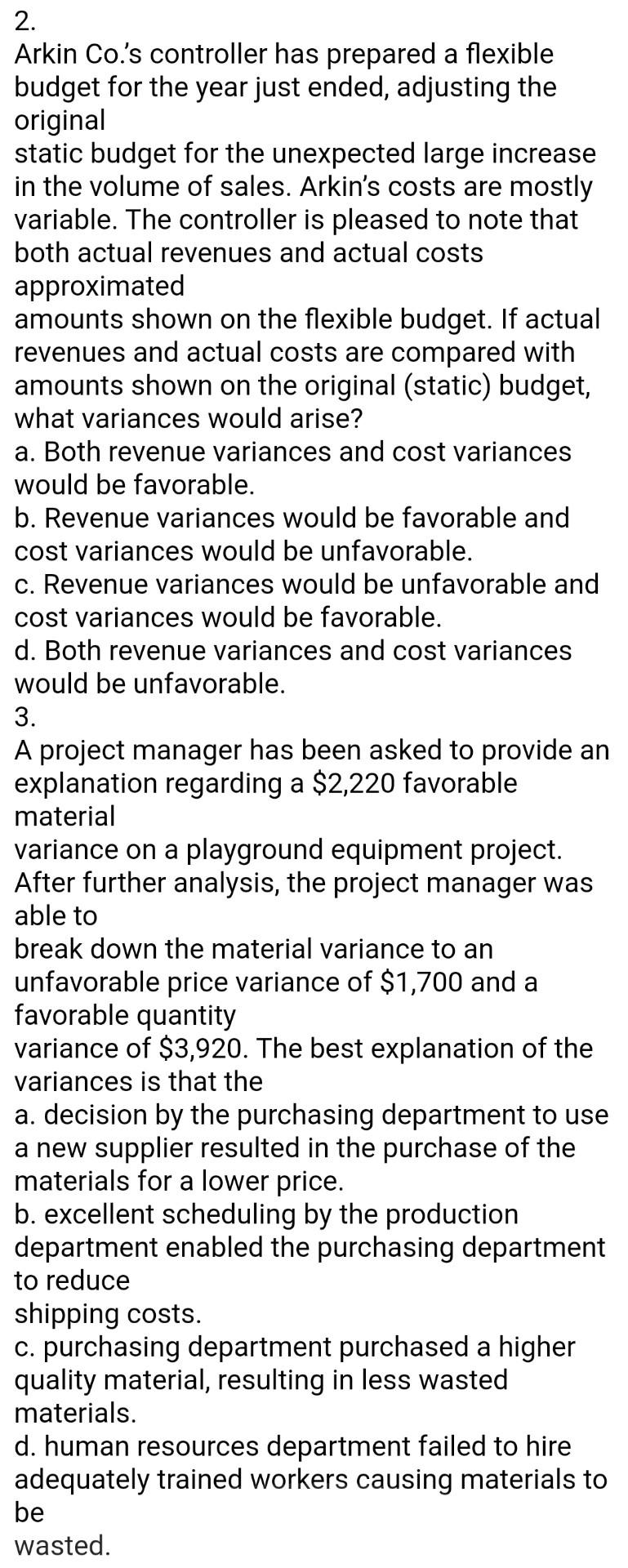

2. Arkin Co's controller has prepared a flexible budget for the year just ended, adjusting the original static budget for the unexpected large increase in the volume of sales. Arkin's costs are mostly variable. The controller is pleased to note that both actual revenues and actual costs approximated amounts shown on the flexible budget. If actual revenues and actual costs are compared with amounts shown on the original (static) budget, what variances would arise? a. Both revenue variances and cost variances would be favorable. b. Revenue variances would be favorable and cost variances would be unfavorable. c. Revenue variances would be unfavorable and cost variances would be favorable. d. Both revenue variances and cost variances would be unfavorable. 3. A project manager has been asked to provide an explanation regarding a $2,220 favorable material variance on a playground equipment project. After further analysis, the project manager was able to break down the material variance to an unfavorable price variance of $1,700 and a favorable quantity variance of $3,920. The best explanation of the variances is that the a. decision by the purchasing department to use a new supplier resulted in the purchase of the materials for a lower price. b. excellent scheduling by the production department enabled the purchasing department to reduce shipping costs. c. purchasing department purchased a higher quality material, resulting in less wasted materials. d. human resources department failed to hire adequately trained workers causing materials to be wasted.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Description Question Arkin Cos controller has prepared a flexible budget for the year just en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started