Answered step by step

Verified Expert Solution

Question

1 Approved Answer

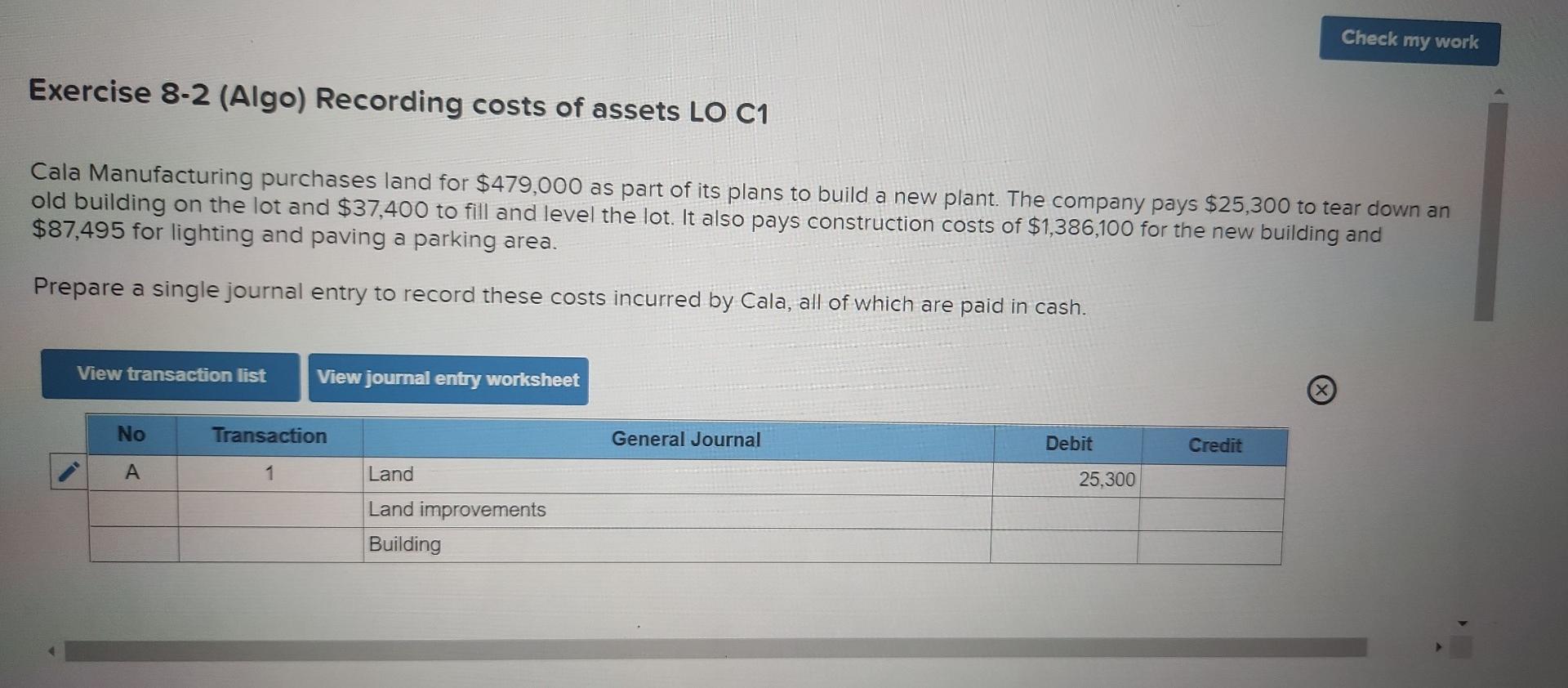

2 asap please Check my work Exercise 8-2 (Algo) Recording costs of assets LO C1 Cala Manufacturing purchases land for $479,000 as part of its

2

asap please

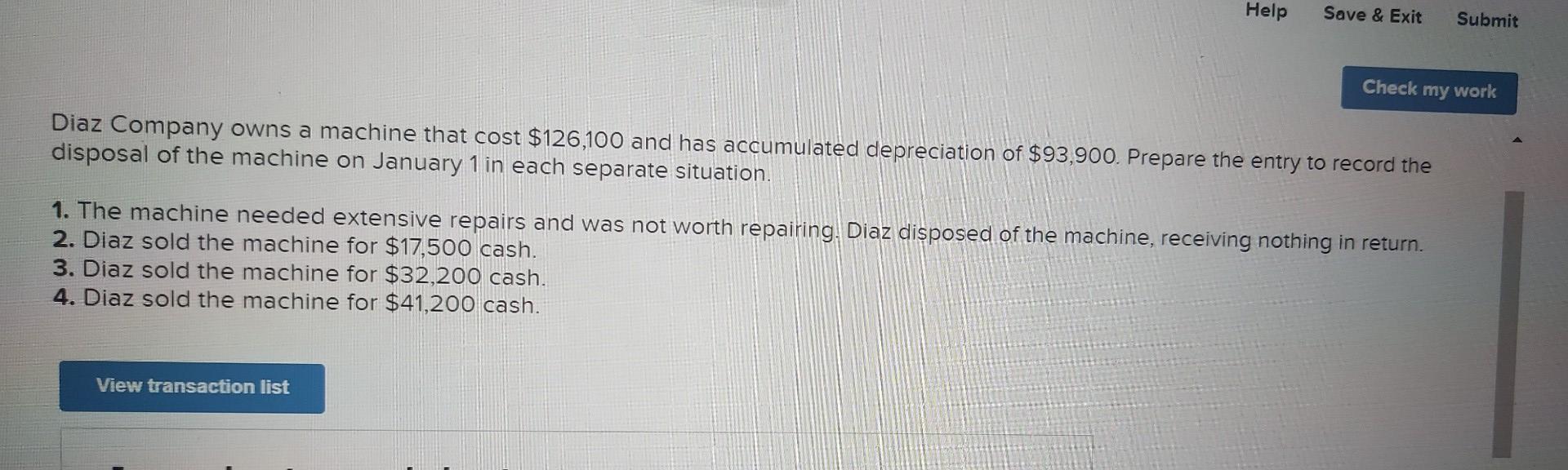

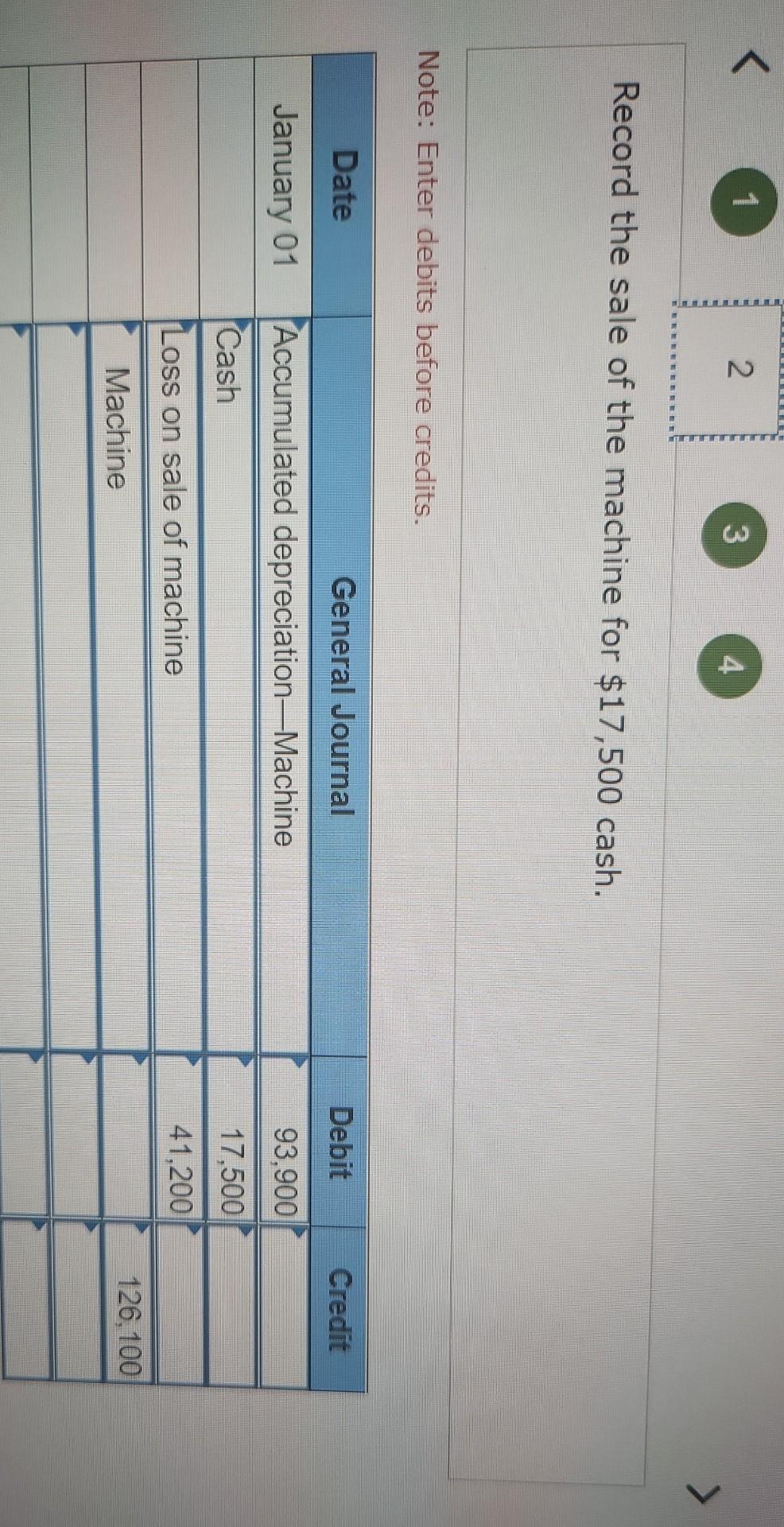

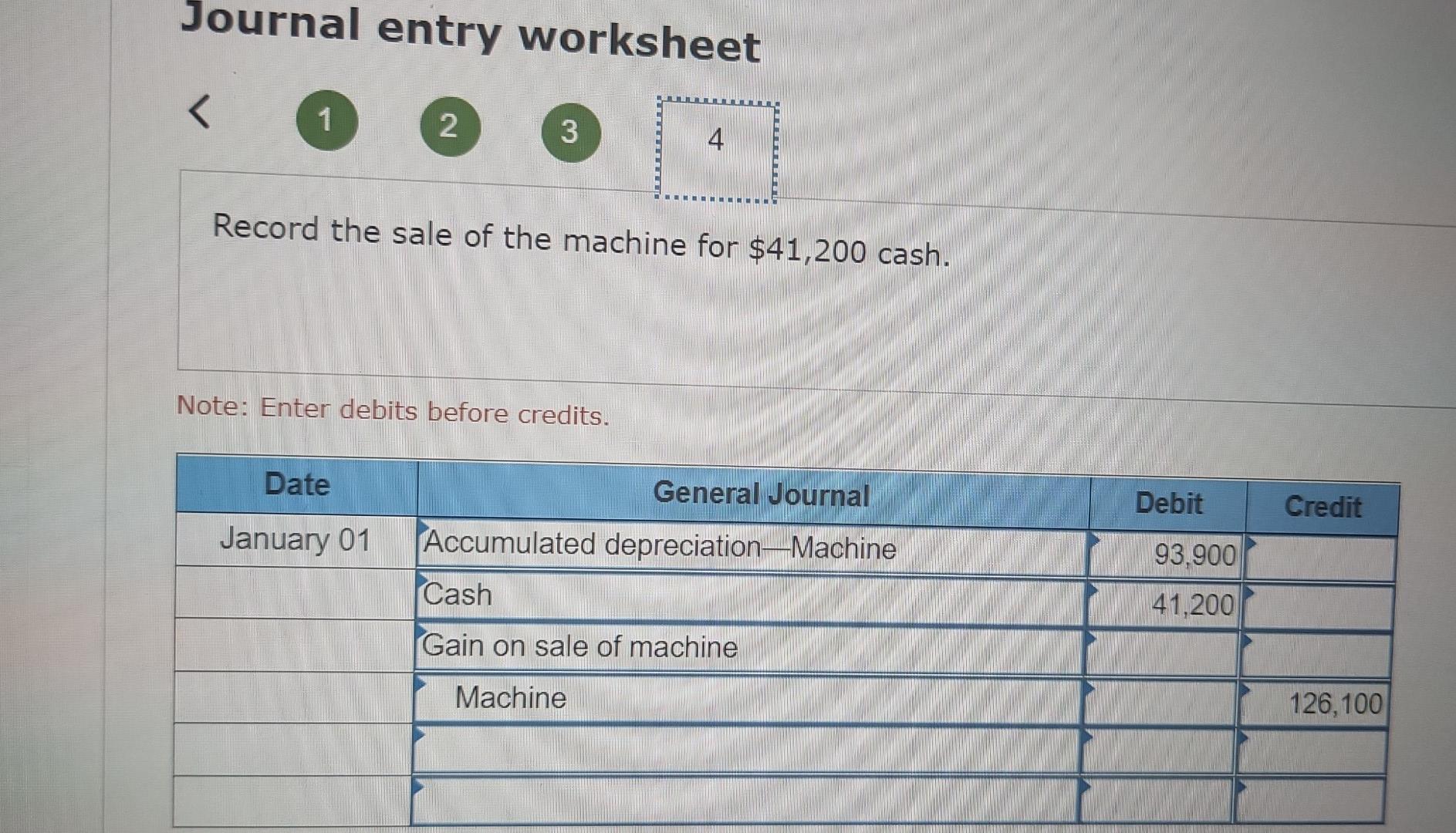

Check my work Exercise 8-2 (Algo) Recording costs of assets LO C1 Cala Manufacturing purchases land for $479,000 as part of its plans to build a new plant. The company pays $25,300 to tear down an old building on the lot and $37,400 to fill and level the lot. It also pays construction costs of $1,386,100 for the new building and $87,495 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 Land 25.300 Land improvements Building Help Save & Exit Submit Check my work Diaz Company owns a machine that cost $126,100 and has accumulated depreciation of $93,900. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $17,500 cash. 3. Diaz sold the machine for $32,200 cash. 4. Diaz sold the machine for $41,200 cash. View transaction list 1 2. 3 4 > Record the sale of the machine for $17,500 cash. Note: Enter debits before credits. Date General Journal Debit Credit January 01 Accumulated depreciationMachine 93,900 Cash 17.500 Loss on sale of machine 41,200 Machine 126, 100 Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started