Answered step by step

Verified Expert Solution

Question

1 Approved Answer

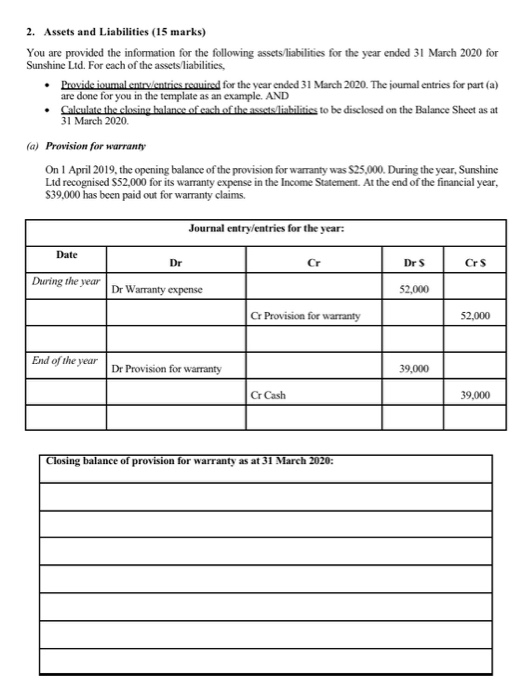

2. Assets and Liabilities (15 marks) You are provided the information for the following assets/liabilities for the year ended 31 March 2020 for Sunshine Ltd.

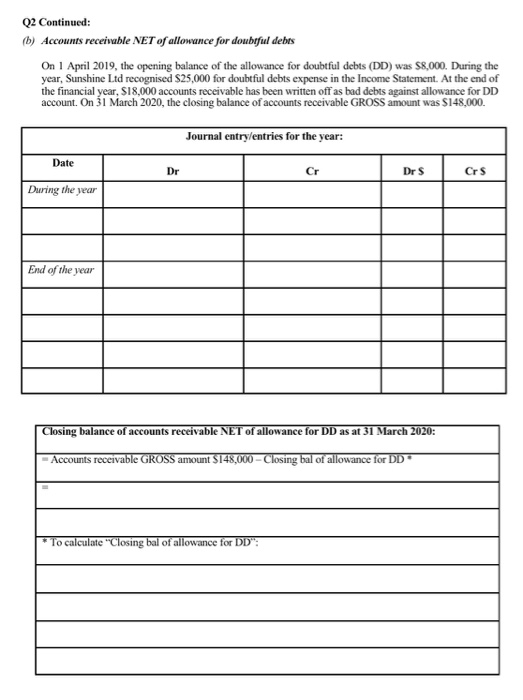

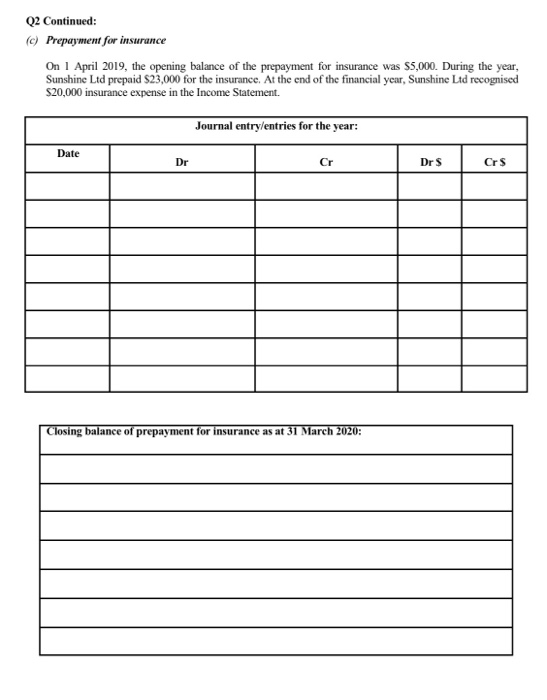

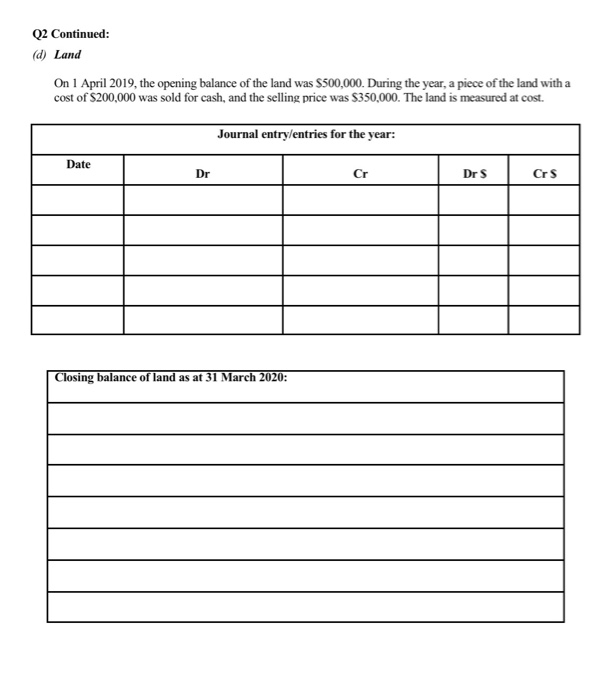

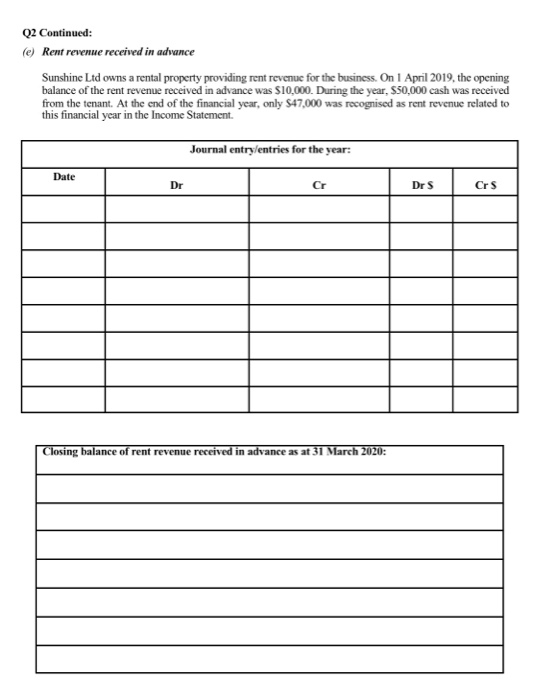

2. Assets and Liabilities (15 marks) You are provided the information for the following assets/liabilities for the year ended 31 March 2020 for Sunshine Ltd. For each of the assets. liabilities, Provide oumal entry entries required for the year ended 31 March 2020. The journal entries for part (a) are done for you in the template as an example. AND Calculate the closing balance of each of the assets liabilities to be disclosed on the Balance Sheet as at 31 March 2020 (a) Provision for warranty On 1 April 2019, the opening balance of the provision for warranty was $25.000. During the year, Sunshine Lid recognised S$2,000 for its warranty expense in the Income Statement. At the end of the financial year, $39,000 has been paid out for warranty claims. Journal entry/entries for the year: Date During the year Dr Warranty expense 52,000 Gr Provision for warranty $2.000 $2,000 End of the year Dr Provision for warranty 39,000 a Cash 39,000 Closing balance of provision for warranty as at 31 March 2020: Q2 Continued: (b) Accounts receivable NET of allowance for doubrful debes On 1 April 2019, the opening balance of the allowance for doubtful debts (DD) was $8,000. During the year, Sunshine Ltd recognised S25,000 for doubtful debts expense in the Income Statement. At the end of the financial year, S18,000 accounts receivable has been written off as bad debts against allowance for DD account. On 31 March 2020, the closing balance of accounts receivable GROSS amount was $148,000 Journal entry/entries for the year: Date Dr Or DrS c rs During the year End of the year Closing balance of accounts receivable NET of allowance for DD as at 31 March 2020: - Accounts receivable GROSS amount $148,000 - Closing bal of allowance for DD To calculate "Closing bal of allowance for DD": Q2 Continued: (c) Prepayment for insurance On 1 April 2019, the opening balance of the prepayment for insurance was $5,000. During the year, Sunshine Ltd prepaid $23,000 for the insurance. At the end of the financial year, Sunshine Ltd recognised $20,000 insurance expense in the Income Statement. Journal entry/entries for the year: Date Dr C Drs ars Closing balance of prepayment for insurance as at 31 March 2020: Q2 Continued: (d) Land On 1 April 2019, the opening balance of the land was $500,000. During the year, a piece of the land with a cost of $200,000 was sold for cash, and the selling price was $350,000. The land is measured at cost. Journal entry/entries for the year: Date Dr C Drs as Closing balance of land as at 31 March 2020: Q2 Continued: (e) Rent revenue received in advance Sunshine Ltd owns a rental property providing rent revenue for the business. On 1 April 2019, the opening balance of the rent revenue received in advance was $10,000. During the year, $50,000 cash was received from the tenant. At the end of the financial year, only $47,000 was recognised as rent revenue related to this financial year in the Income Statement. Journal entry entries for the year: Date Closing balance of rent revenue received in advance as at 31 March 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started