Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Assume that fixed costs are incurred uniformly throughout the year. Compute the annual break-even sales, and the profit if 71,000 units are sold

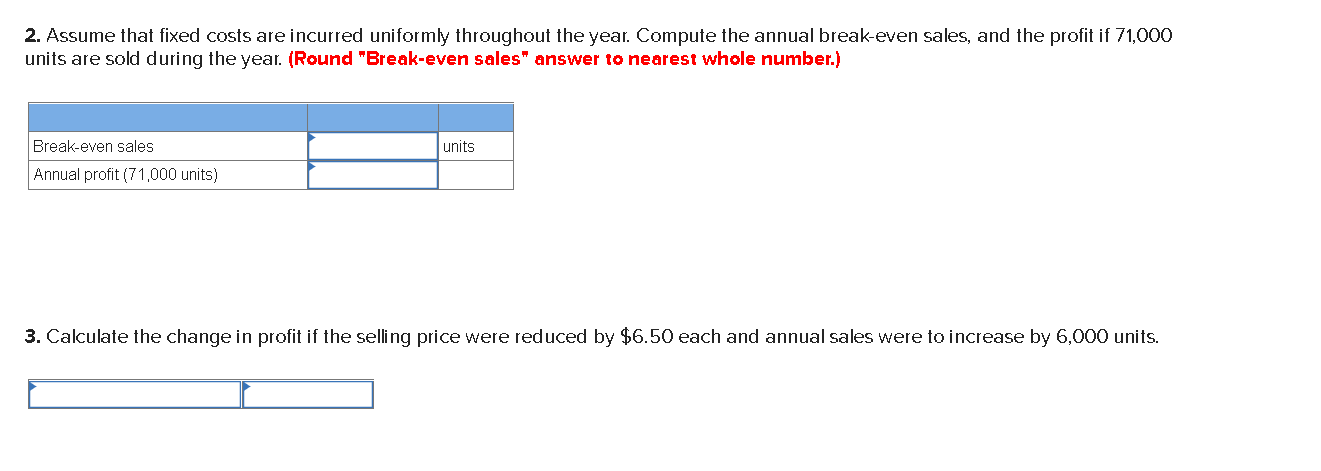

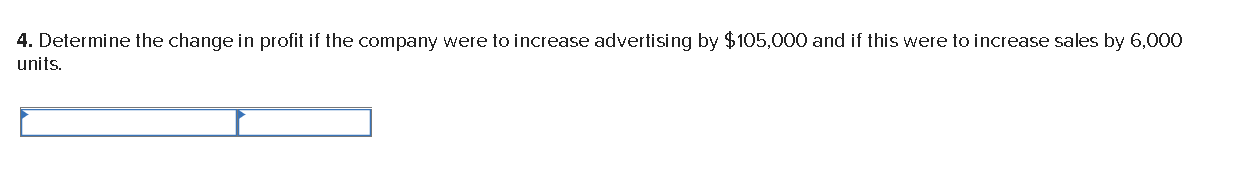

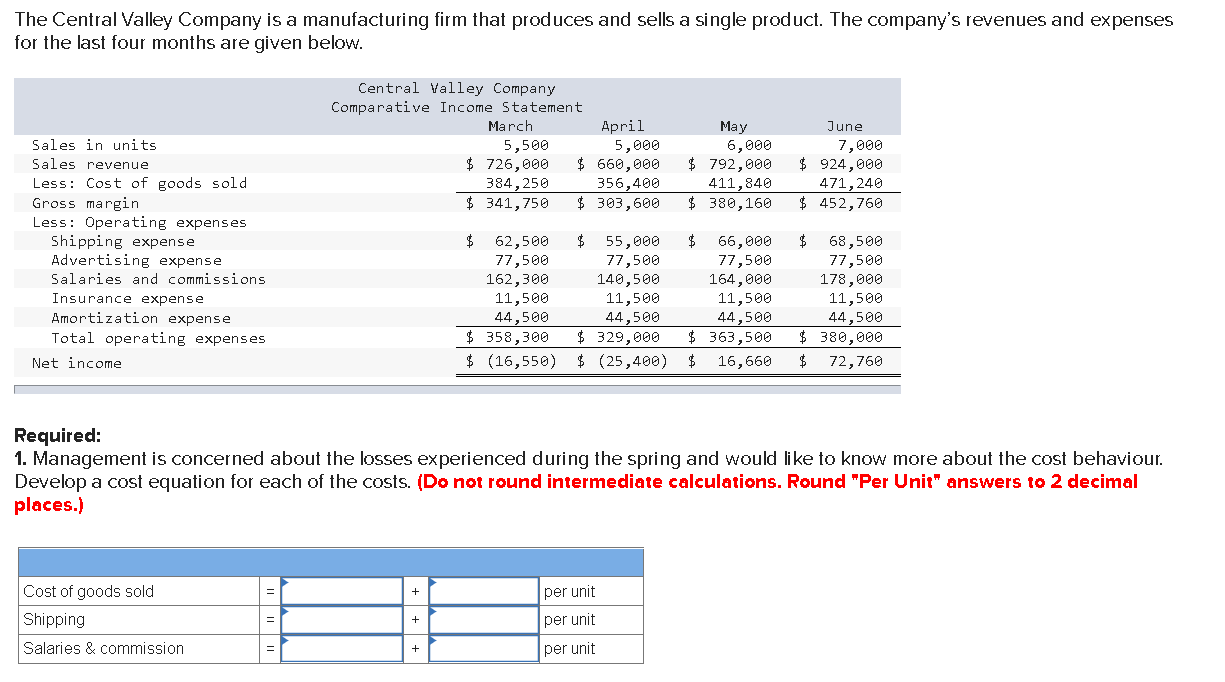

2. Assume that fixed costs are incurred uniformly throughout the year. Compute the annual break-even sales, and the profit if 71,000 units are sold during the year. (Round "Break-even sales" answer to nearest whole number.) Break-even sales Annual profit (71,000 units) units 3. Calculate the change in profit if the selling price were reduced by $6.50 each and annual sales were to increase by 6,000 units. 4. Determine the change in profit if the company were to increase advertising by $105,000 and if this were to increase sales by 6,000 units. The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Central Valley Company Comparative Income Statement March Sales in units Sales revenue Less: Cost of goods sold Gross margin Less: Operating expenses Shipping expense 5,500 $ 726,000 384,250 April 5,000 $ 660,000 356,400 $ 341,750 $ 303,600 May 6,000 $ 792,000 411,840 $ 380,160 June 7,000 $ 924,000 471,240 $ 452,760 $ 62,500 $ 55,000 $ 66,000 $ 68,500 Advertising expense 77,500 77,500 77,500 Salaries and commissions 162,300 140,500 164,000 77,500 178,000 Insurance expense Amortization expense Total operating expenses Net income $ 358,300 $ 329,000 $ (16,550) $ (25,400) $ 16,660 $ 72,760 11,500 11,500 11,500 11,500 44,500 44,500 44,500 44,500 $ 363,500 $ 380,000 Required: 1. Management is concerned about the losses experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. (Do not round intermediate calculations. Round "Per Unit" answers to 2 decimal places.) Cost of goods sold Shipping + per unit per unit Salaries & commission + per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started