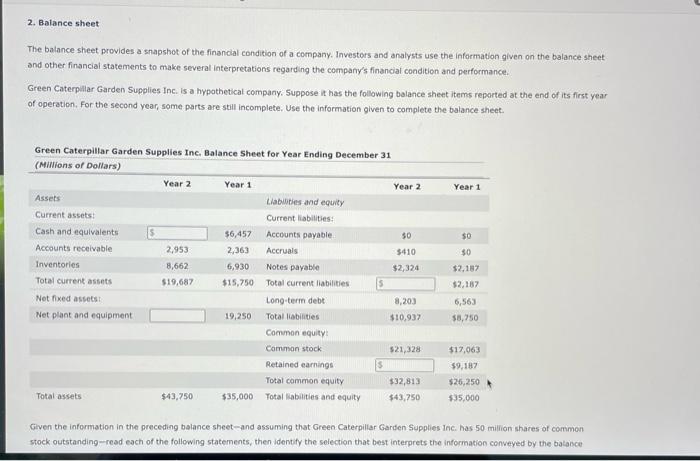

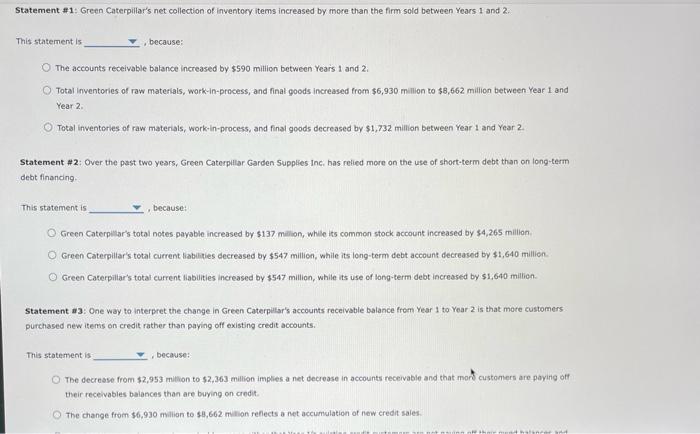

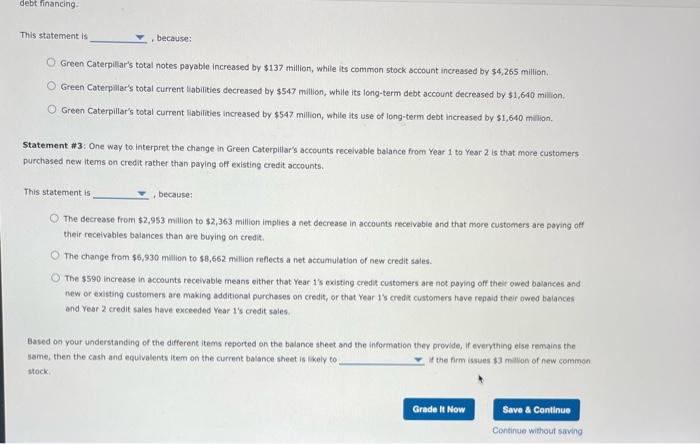

2. Balance sheet The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance. Green Caterpillar Garden Supplies Inc. is a hypathetical company. Suppose it has the following balance sheet items reparted at the end of its first year of operation, For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Green Caterpillar Garden Supplies Inc. Balance Sheet for Year Ending December 31 Given the information in the preceding balance sheet-and assuming that Green Caterpillar Garden Supplies Inc. has 50 million shares of cammon stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance Statement # 1: Green Caterpillar's net collection of inventory items increased by more than the firm sold between Years 1 and 2. This statement is , because: The accounts receivable balance increased by $590 mition between Years 1 and 2 . Total inventories of raw materials, work-in-process, and final goods increased from $6,930 million to $8,662 million between Year 1 and Year 2. Total inventeries of raw materials, work-in-process, and final goods decreased by $1,732 million between Year 1 and Year 2. Statement #2: Over the past two years, Green Caterpillar Garden Supplies Inc. has relied more on the use of short-term debt than on long-term debt finanding. This statement is , because: Green Caterpllar's total notes payable increased by $137 milison, while its common stock account increased by $4,265 mililon. Green Caterpiliar's total current liabilies decreased by $547 million, while its long-term debt account decreased by $1,640 millien. Green Caterpiliar's total current liabities increased by $547 million, while its use of long-term debt increased by $1,640 milien. Statement w3: One way to interpret the change in Green Caterpilar's accounts receivable balance from Year 1 to Year 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. This statement is - because: The decrease from $2,953 miltion to $2,363 million implies a net decrease in accounts receivable and that mork customiers are payirig off their receivables balances than are buying on credit. The change from $6,930 milian to 58,662 minon reflects a net accumalation of new credit sales. This staterment is , because: Green Caterpiliar's total notes payable increased by $137 million, while its common stock account increased by $4,265 million, Green Caterpillar's total current liabilities decreased by $547 millon, while its long-term debt account decreased by $1,640 million. Green Caterpillar's total current liabilities increased by $547 million, whille its use of Iong-term debt increased by $1,640 malion. Statement #3: One way to interpret the change in Green Caterpiliar's accounts receivable balance from Year 1 to Year 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. This staterment is because: The decrease from $2,953 million to $2,363 mililon implies a net decrease in accounts receivable and that more customers are paying off their receivables balances than are buying on credit. The change from $6,930 million to $8,662 million reflects a net accumulation of new credit sales. The $590 increase in accounts receivable means either that Year 1 's existing credit customers are not paying off their owed balances and new or existang custamers are making additical purchases on credic, or that Year 1 's credt customers have repaid their owed balances and Year 2 credit sales have exceeded Year 1's credit sales. Based on your undersanding of the different items reported on the balance sheet and the information they provide, if everything eise remains the same, then the cash and equivalents item on the current balance sheet is likely to the firm issues 13 milion of new common stock