Answered step by step

Verified Expert Solution

Question

1 Approved Answer

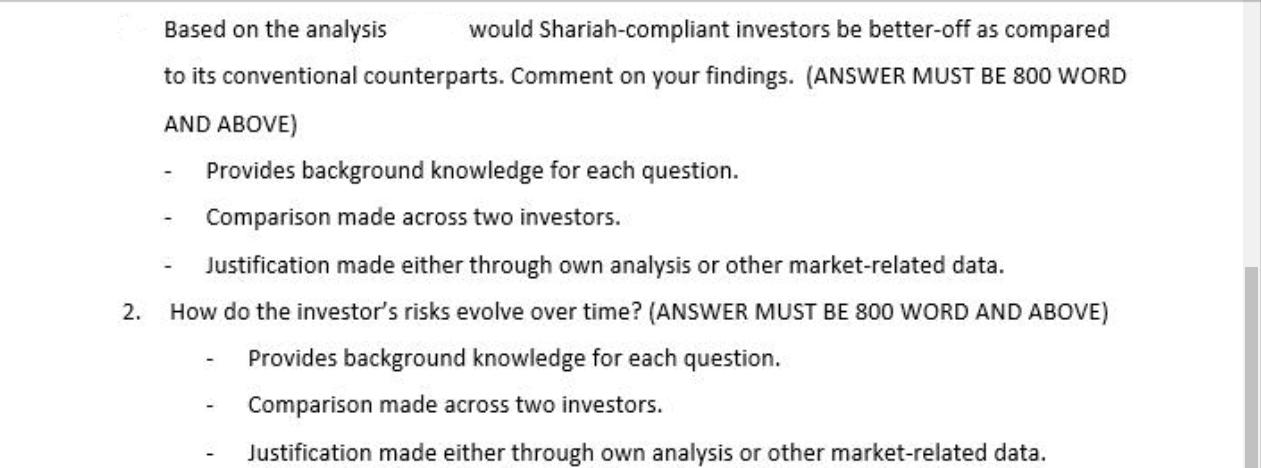

2. Based on the analysis would Shariah-compliant investors be better-off as compared to its conventional counterparts. Comment on your findings. (ANSWER MUST BE 800

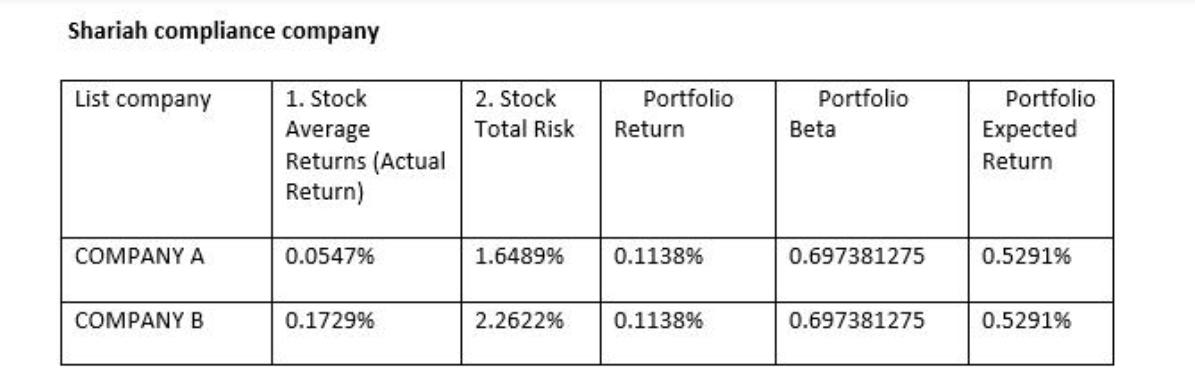

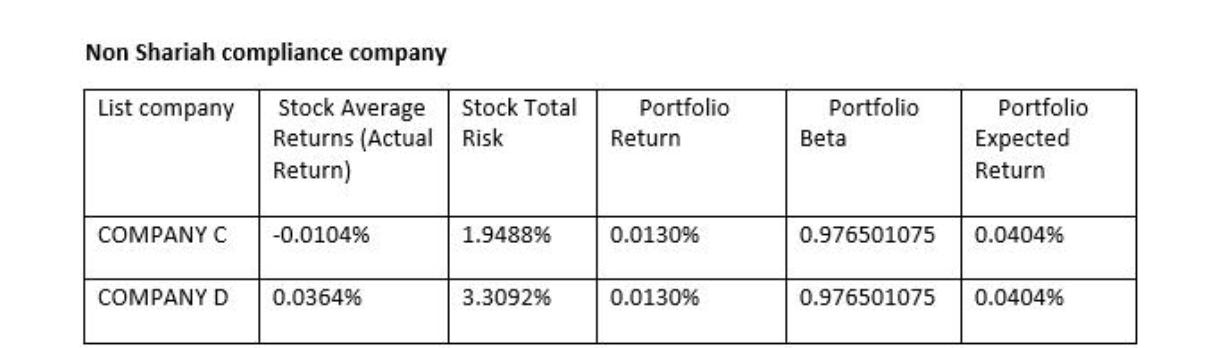

2. Based on the analysis would Shariah-compliant investors be better-off as compared to its conventional counterparts. Comment on your findings. (ANSWER MUST BE 800 WORD AND ABOVE) Provides background knowledge for each question. Comparison made across two investors. Justification made either through own analysis or other market-related data. How do the investor's risks evolve over time? (ANSWER MUST BE 800 WORD AND ABOVE) Provides background knowledge for each question. Comparison made across two investors. Justification made either through own analysis or other market-related data. - Shariah compliance company List company COMPANY A COMPANY B 1. Stock Average Returns (Actual Return) 0.0547% 0.1729% 2. Stock Total Risk 1.6489% Portfolio Return 0.1138% 2.2622% 0.1138% Portfolio Beta 0.697381275 0.697381275 Portfolio Expected Return 0.5291% 0.5291% Non Shariah compliance company List company Stock Average Returns (Actual Return) COMPANY C COMPANY D -0.0104% 0.0364% Stock Total Risk 1.9488% 3.3092% Portfolio Return 0.0130% 0.0130% Portfolio Beta Portfolio Expected Return 0.976501075 0.0404% 0.976501075 0.0404%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer ShariahCompliant vs Conventional Investments A Comparative Analysis Background Shariahcompliant investments adhere to Islamic principles avoiding certain sectors like alcohol gambling and inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started