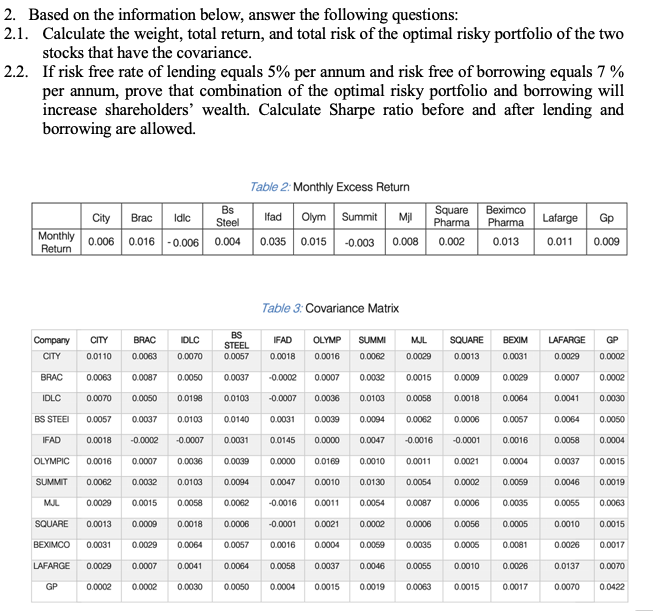

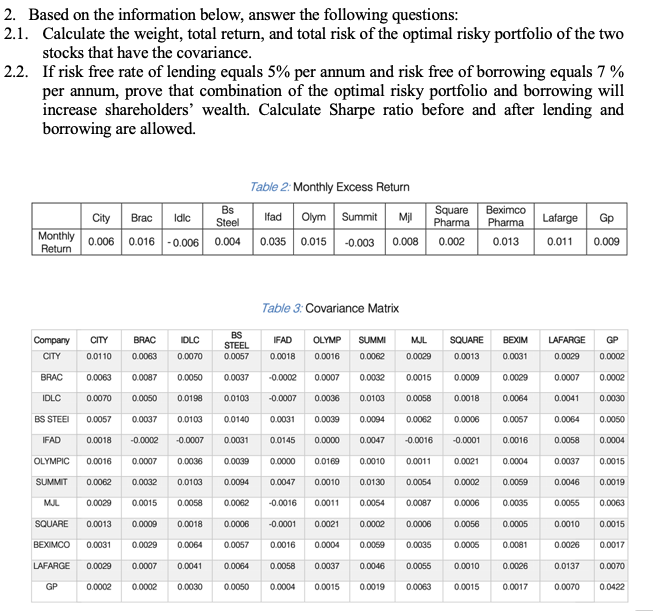

2. Based on the information below, answer the following questions: 2.1. Calculate the weight, total return, and total risk of the optimal risky portfolio of the two stocks that have the covariance. 2.2. If risk free rate of lending equals 5% per annum and risk free of borrowing equals 7 % per annum, prove that combination of the optimal risky portfolio and borrowing will increase shareholders' wealth. Calculate Sharpe ratio before and after lending and borrowing are allowed. Bs Steel Table 2 Monthly Excess Return Ifad Olym Summit Mjl 0.035 0.015 -0.003 0.008 Square Pharma City Brac Idlc 0.006 0.016 -0.006 Beximco Pharma 0.013 Monthly Return Lafarge Gp 0.011 0.009 0.004 0.002 Table 3. Covariance Matrix Company CITY CITY 0.0110 BRAC 0.0063 IDLC 0.0070 BS STEEL 0.0057 IFAD 0.0018 OLYMP 0.0016 0.0007 SUMMI 0.0062 MUL 0.0029 SQUARE 0.0013 BEXIM 0.0031 LAFARGE 0.0029 GP 0.0002 BRAC 0.0063 0.0087 0.0050 0.0037 -0.0002 0.0032 0.0015 0.0009 0.0029 0.0007 0.0002 IDLC 0.0070 0.0050 0.0198 0.0103 -0.0007 0.0036 0.0103 0.0058 0.0018 0.0064 0.0041 0.0030 BS STEEI 0.0057 0.0037 0.0103 0.0140 0.0031 0.0039 0.0094 0.0062 0.0006 0.0067 0.0064 0.0050 IFAD 0.0018 -0.0002 -0.0007 0.0031 0.0145 0.0000 0.0047 -0.0016 -0.0001 0.0016 0.0058 0.0004 OLYMPIC 0.0016 0.0007 0.0036 0.0039 0.0000 0.0169 0.0010 0.0011 0.0021 0.0004 0.0037 0.0015 SUMMIT 0.0062 0.0032 0.0103 0.0094 0.0047 0.0010 0.0130 0.0054 0.0002 0.0059 0.0046 0.0019 MUL 0.0029 0.0015 0.0058 0.0062 -0.0016 0.0011 0.0054 0.0087 0.0006 0.0035 0.0055 0.0063 SQUARE 0.0013 0.0009 0.0018 0.0006 -0.0001 0.0021 0.0002 0.0006 0.0056 0.0005 0.0010 0.0015 BEXIMCO 0.0031 0.0029 0.0064 0.0057 0.0016 0.0004 0.0069 0.0035 0.0006 0.0081 0.0026 0.0017 LAFARGE 0.0029 0.0007 0.0041 0.0084 0.0058 0.0037 0.0046 0.0055 0.0010 0.0026 0.0137 0.0070 GP 0.0002 0.0002 0.0030 0.0050 0.0004 0.0015 0.0019 0.0063 0.0015 0.0017 0.0070 0.0422 2. Based on the information below, answer the following questions: 2.1. Calculate the weight, total return, and total risk of the optimal risky portfolio of the two stocks that have the covariance. 2.2. If risk free rate of lending equals 5% per annum and risk free of borrowing equals 7 % per annum, prove that combination of the optimal risky portfolio and borrowing will increase shareholders' wealth. Calculate Sharpe ratio before and after lending and borrowing are allowed. Bs Steel Table 2 Monthly Excess Return Ifad Olym Summit Mjl 0.035 0.015 -0.003 0.008 Square Pharma City Brac Idlc 0.006 0.016 -0.006 Beximco Pharma 0.013 Monthly Return Lafarge Gp 0.011 0.009 0.004 0.002 Table 3. Covariance Matrix Company CITY CITY 0.0110 BRAC 0.0063 IDLC 0.0070 BS STEEL 0.0057 IFAD 0.0018 OLYMP 0.0016 0.0007 SUMMI 0.0062 MUL 0.0029 SQUARE 0.0013 BEXIM 0.0031 LAFARGE 0.0029 GP 0.0002 BRAC 0.0063 0.0087 0.0050 0.0037 -0.0002 0.0032 0.0015 0.0009 0.0029 0.0007 0.0002 IDLC 0.0070 0.0050 0.0198 0.0103 -0.0007 0.0036 0.0103 0.0058 0.0018 0.0064 0.0041 0.0030 BS STEEI 0.0057 0.0037 0.0103 0.0140 0.0031 0.0039 0.0094 0.0062 0.0006 0.0067 0.0064 0.0050 IFAD 0.0018 -0.0002 -0.0007 0.0031 0.0145 0.0000 0.0047 -0.0016 -0.0001 0.0016 0.0058 0.0004 OLYMPIC 0.0016 0.0007 0.0036 0.0039 0.0000 0.0169 0.0010 0.0011 0.0021 0.0004 0.0037 0.0015 SUMMIT 0.0062 0.0032 0.0103 0.0094 0.0047 0.0010 0.0130 0.0054 0.0002 0.0059 0.0046 0.0019 MUL 0.0029 0.0015 0.0058 0.0062 -0.0016 0.0011 0.0054 0.0087 0.0006 0.0035 0.0055 0.0063 SQUARE 0.0013 0.0009 0.0018 0.0006 -0.0001 0.0021 0.0002 0.0006 0.0056 0.0005 0.0010 0.0015 BEXIMCO 0.0031 0.0029 0.0064 0.0057 0.0016 0.0004 0.0069 0.0035 0.0006 0.0081 0.0026 0.0017 LAFARGE 0.0029 0.0007 0.0041 0.0084 0.0058 0.0037 0.0046 0.0055 0.0010 0.0026 0.0137 0.0070 GP 0.0002 0.0002 0.0030 0.0050 0.0004 0.0015 0.0019 0.0063 0.0015 0.0017 0.0070 0.0422