Answered step by step

Verified Expert Solution

Question

1 Approved Answer

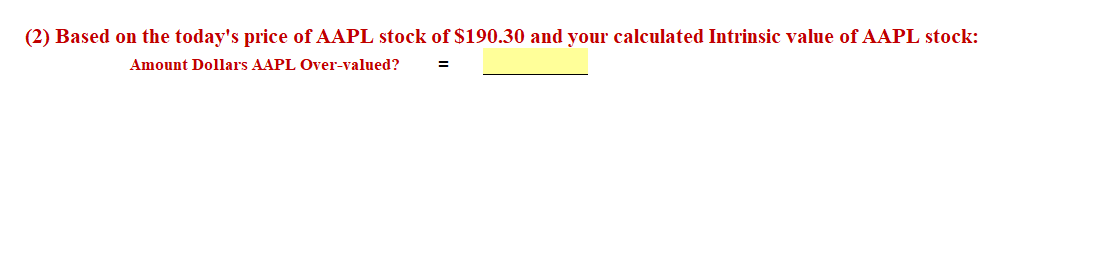

(2) Based on the today's price of AAPL stock of $190.30 and your calculated Intrinsic value of AAPL stock: Amount Dollars AAPL Over-valued? =

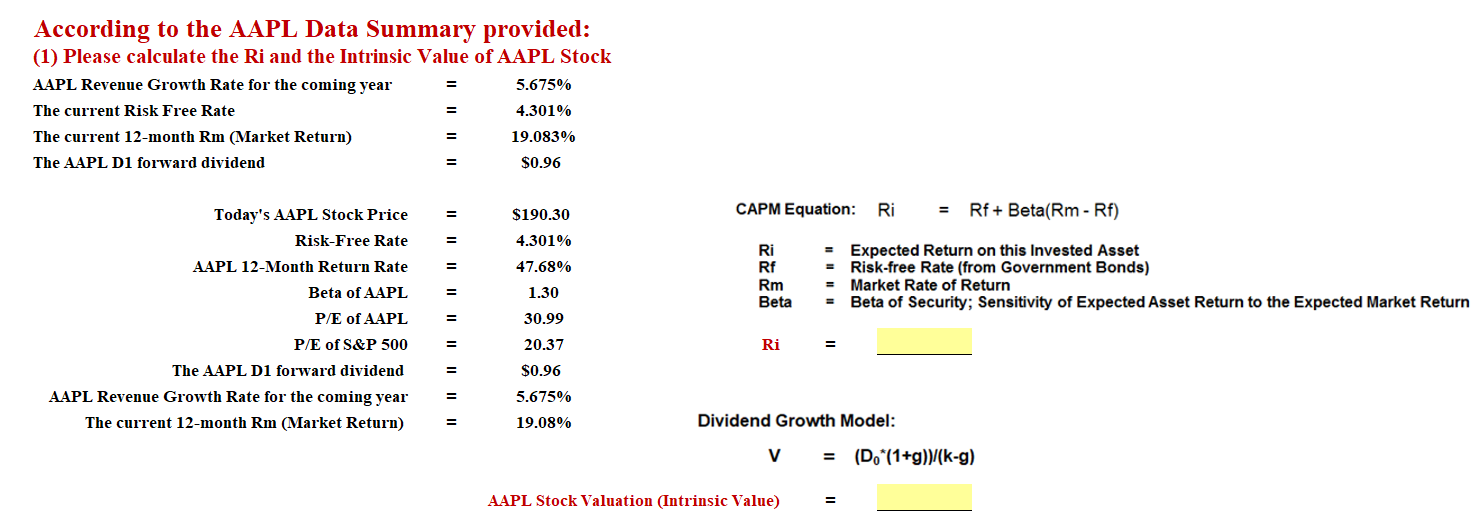

(2) Based on the today's price of AAPL stock of $190.30 and your calculated Intrinsic value of AAPL stock: Amount Dollars AAPL Over-valued? = According to the AAPL Data Summary provided: (1) Please calculate the Ri and the Intrinsic Value of AAPL Stock AAPL Revenue Growth Rate for the coming year The current Risk Free Rate 5.675% = = 4.301% The current 12-month Rm (Market Return) The AAPL D1 forward dividend = 19.083% = $0.96 Today's AAPL Stock Price = $190.30 CAPM Equation: Ri = Rf + Beta(Rm - Rf) Risk-Free Rate = 4.301% Ri = Expected Return on this Invested Asset AAPL 12-Month Return Rate = 47.68% Rf = Risk-free Rate (from Government Bonds) Rm = Market Rate of Return Beta of AAPL = 1.30 Beta = Beta of Security; Sensitivity of Expected Asset Return to the Expected Market Return P/E of AAPL = 30.99 P/E of S&P 500 = 20.37 Ri The AAPL D1 forward dividend $0.96 AAPL Revenue Growth Rate for the coming year = 5.675% The current 12-month Rm (Market Return) 19.08% Dividend Growth Model: v = (D. (1+g))/(k-g) AAPL Stock Valuation (Intrinsic Value)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets say your calculated intrinsic value for AAPL stock is 22...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started