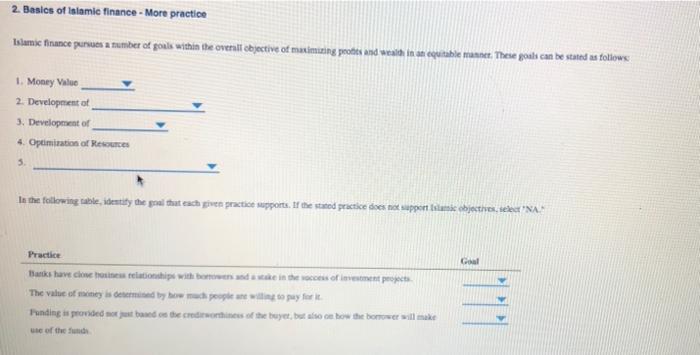

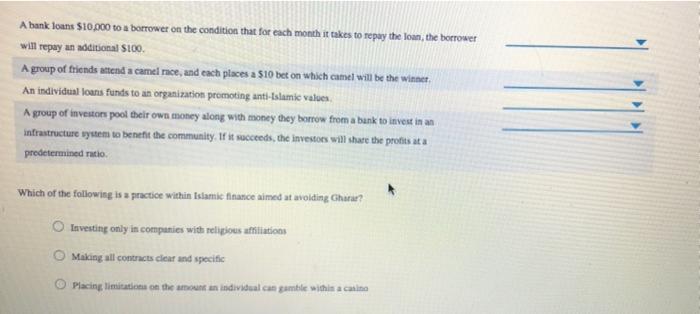

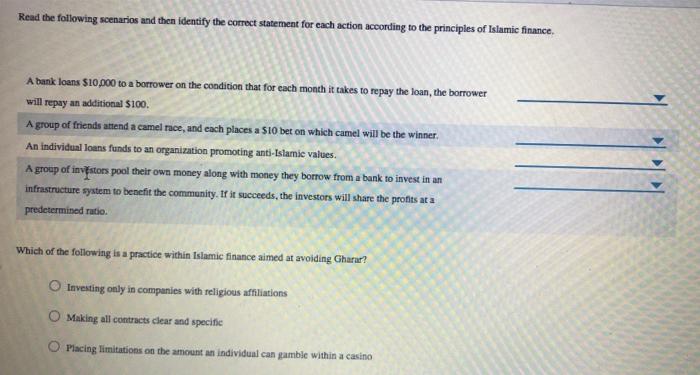

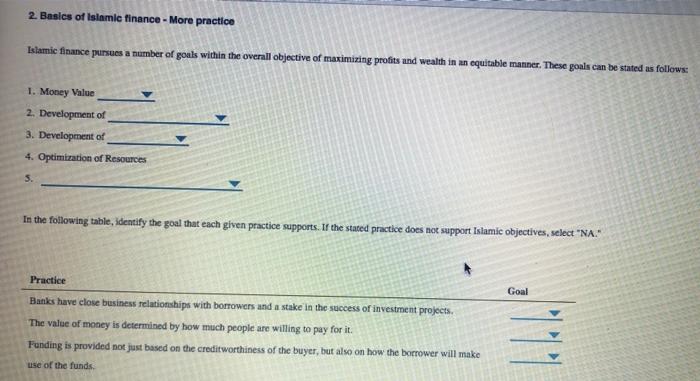

2. Basics of Islamic finance - More practice Islamic finance pursues a tumber of gouls within the overalt objective of maximizing poodies and wealth in an equitable manner. These goals can be stated as followe 1. Money Value 2. Development of 3. Development of 4. Optimization of Rescue 5 Is the following table, identify the goal that each wee practice supports. If the stated practice does not support stane objectives, see Practice G Banks have close relationship with book in the occs of investment projects The value of ney is determined by how much poplane w pay for it Funding is provided to the credities of the buyet, but also a bow the borrower will make use of the und A bank loans $10.000 to a borrower on the condition that for each month it takes to repay the loan, the borrower will repay an additional S100 A group of friends attend a camel mee, and each places a $10 bet on which camel will be the winnet, An individual loans Punts to an organization promoting anti-Islamic values A group of investors pool their own money along with money they borrow from a bank to invest in an infrastructure system to benefit the community. If it succeeds, the investoes will share the profits at a predetermined ratio Which of the following is a practice within Islamic finance aimed at svolding Ghorae? Investing only in companies with religious affiliations Making all contracts clear and specific Placing limitations on the amount an individual can gamble within a casino Read the following scenarios and then identify the correct statement for each action according to the principles of Islamic finance. A bank loans $10,000 to a borrower on the condition that for each month it takes to repay the loan, the borrower will repay an additional $100 A group of friends attend a camel race, and each places a 510 bet on which camel will be the winner. An individual loans funds to an organization promoting anti-Islamic values. A group of invstors pool their own money along with money they borrow from a bank to invest in an infrastructure system to benefit the community. If it succeeds, the investors will share the profits at a predetermined ratio. >> Which of the following is a practice within Islamic finance aimed at avoiding Gharar? Investing only in companies with religious affiliations O Making all contracts clear and specific Placing limitations on the amount an individual can gamble within a casino 2. Basics of Islamie finance - More practice Islamic finance pursues a number of goals within the overall objective of maximizing profits and wealth in an equitable manner. These gonis can be stated as follows: 1. Money Value 2. Development of 3. Development of 4. Optimization of Resources In the following table, identify the goal that each given practice supports. If the stated practice does not support Islamic objectives, select "NA." Goal Practice Banks have close business relationships with borrowers and a stake in the success of investment projects. The value of money is determined by how much people are willing to pay for it. Funding is provided not just based on the creditworthiness of the buyer, but also on how the borrower will make use of the funds 2. Basics of Islamic finance - More practice Islamic finance pursues a tumber of gouls within the overalt objective of maximizing poodies and wealth in an equitable manner. These goals can be stated as followe 1. Money Value 2. Development of 3. Development of 4. Optimization of Rescue 5 Is the following table, identify the goal that each wee practice supports. If the stated practice does not support stane objectives, see Practice G Banks have close relationship with book in the occs of investment projects The value of ney is determined by how much poplane w pay for it Funding is provided to the credities of the buyet, but also a bow the borrower will make use of the und A bank loans $10.000 to a borrower on the condition that for each month it takes to repay the loan, the borrower will repay an additional S100 A group of friends attend a camel mee, and each places a $10 bet on which camel will be the winnet, An individual loans Punts to an organization promoting anti-Islamic values A group of investors pool their own money along with money they borrow from a bank to invest in an infrastructure system to benefit the community. If it succeeds, the investoes will share the profits at a predetermined ratio Which of the following is a practice within Islamic finance aimed at svolding Ghorae? Investing only in companies with religious affiliations Making all contracts clear and specific Placing limitations on the amount an individual can gamble within a casino Read the following scenarios and then identify the correct statement for each action according to the principles of Islamic finance. A bank loans $10,000 to a borrower on the condition that for each month it takes to repay the loan, the borrower will repay an additional $100 A group of friends attend a camel race, and each places a 510 bet on which camel will be the winner. An individual loans funds to an organization promoting anti-Islamic values. A group of invstors pool their own money along with money they borrow from a bank to invest in an infrastructure system to benefit the community. If it succeeds, the investors will share the profits at a predetermined ratio. >> Which of the following is a practice within Islamic finance aimed at avoiding Gharar? Investing only in companies with religious affiliations O Making all contracts clear and specific Placing limitations on the amount an individual can gamble within a casino 2. Basics of Islamie finance - More practice Islamic finance pursues a number of goals within the overall objective of maximizing profits and wealth in an equitable manner. These gonis can be stated as follows: 1. Money Value 2. Development of 3. Development of 4. Optimization of Resources In the following table, identify the goal that each given practice supports. If the stated practice does not support Islamic objectives, select "NA." Goal Practice Banks have close business relationships with borrowers and a stake in the success of investment projects. The value of money is determined by how much people are willing to pay for it. Funding is provided not just based on the creditworthiness of the buyer, but also on how the borrower will make use of the funds