Answered step by step

Verified Expert Solution

Question

1 Approved Answer

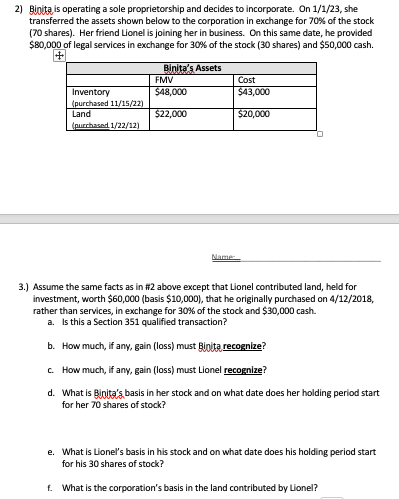

2) Binita is operating a sole proprietorship and decides to incorporate. On 1/1/23, she transferred the assets shown below to the corporation in exchange

2) Binita is operating a sole proprietorship and decides to incorporate. On 1/1/23, she transferred the assets shown below to the corporation in exchange for 70% of the stock (70 shares). Her friend Lionel is joining her in business. On this same date, he provided $80,000 of legal services in exchange for 30% of the stock (30 shares) and $50,000 cash. Inventory (purchased 11/15/22) Land (purchased 1/22/12) Binita's Assets FMV $48,000 $22,000 Name Cost $43,000 $20,000 0 3.) Assume the same facts as in #2 above except that Lionel contributed land, held for investment, worth $60,000 (basis $10,000), that he originally purchased on 4/12/2018, rather than services, in exchange for 30% of the stock and $30,000 cash. a. Is this a Section 351 qualified transaction? b. How much, if any, gain (loss) must Binita recognize? c. How much, if any, gain (loss) must Lionel recognize? d. What is Binita's basis in her stock and on what date does her holding period start for her 70 shares of stock? e. What is Lionel's basis in his stock and on what date does his holding period start for his 30 shares of stock? f. What is the corporation's basis in the land contributed by Lionel?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Yes this is a Section 351 qualified transaction as both Binita and Lionel transferred pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started