Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Bond Valuation: You are analyzing a bond. The bond has a $1,000 face value, matures in 15 years, and pays a 4.0% annual interest

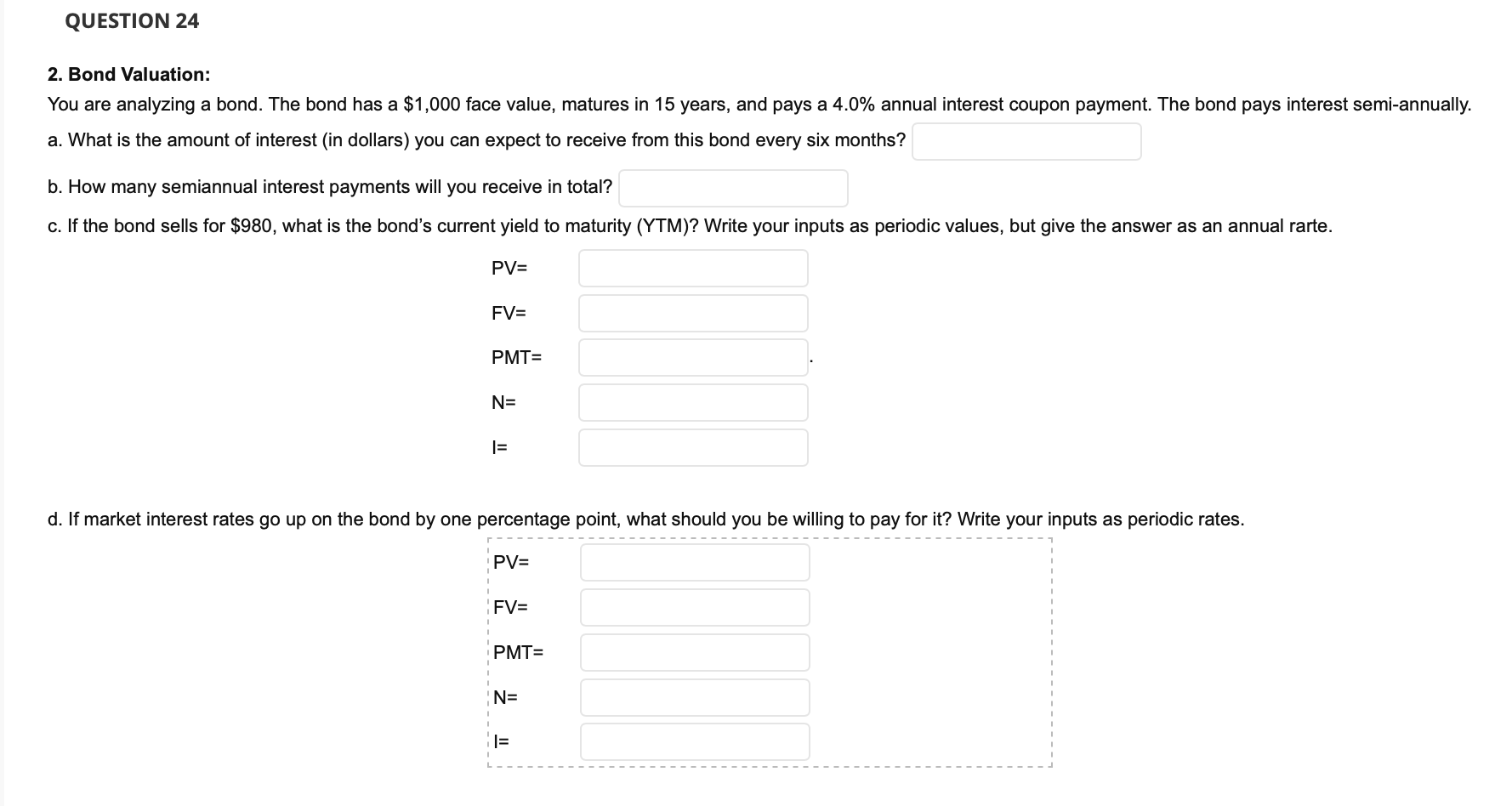

2. Bond Valuation: You are analyzing a bond. The bond has a $1,000 face value, matures in 15 years, and pays a 4.0% annual interest coupon payment. The bond pays interest semi-annually. a. What is the amount of interest (in dollars) you can expect to receive from this bond every six months? b. How many semiannual interest payments will you receive in total? c. If the bond sells for $980, what is the bond's current yield to maturity (YTM)? Write your inputs as periodic values, but give the answer as an annual rarte. PV=FV=PMT=N=I= d. If market interest rates go up on the bond by one percentage point, what should you be willing to pay for it? Write your inputs as periodic rates

2. Bond Valuation: You are analyzing a bond. The bond has a $1,000 face value, matures in 15 years, and pays a 4.0% annual interest coupon payment. The bond pays interest semi-annually. a. What is the amount of interest (in dollars) you can expect to receive from this bond every six months? b. How many semiannual interest payments will you receive in total? c. If the bond sells for $980, what is the bond's current yield to maturity (YTM)? Write your inputs as periodic values, but give the answer as an annual rarte. PV=FV=PMT=N=I= d. If market interest rates go up on the bond by one percentage point, what should you be willing to pay for it? Write your inputs as periodic rates Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started