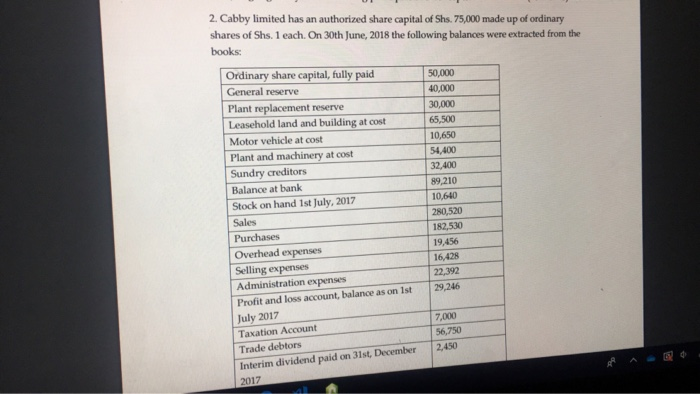

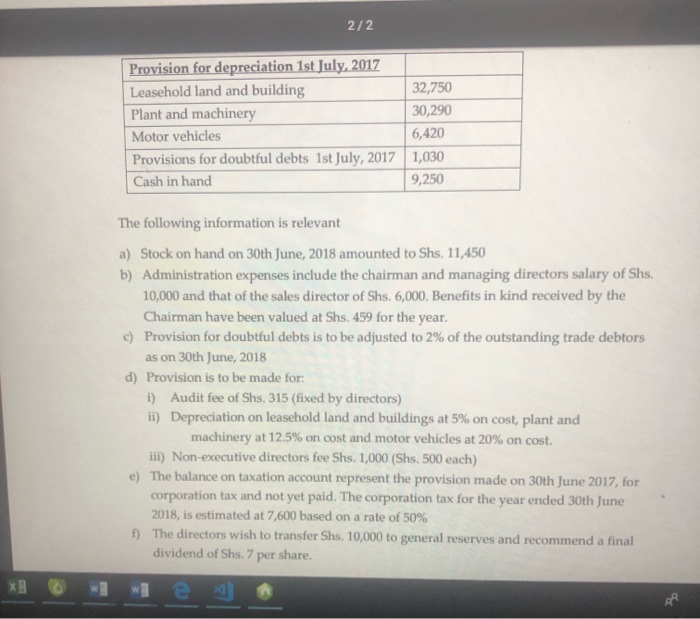

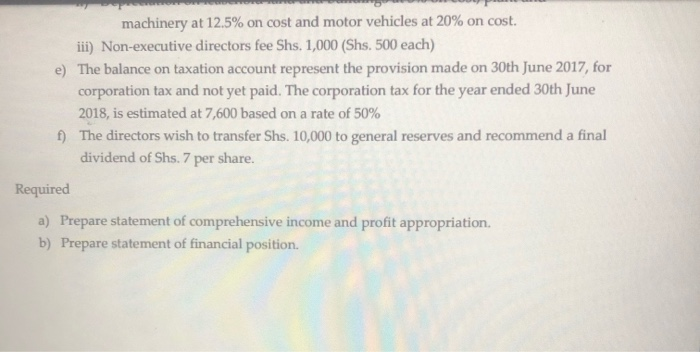

2. Cabby limited has an authorized share capital of Shs. 75,000 made up of ordinary shares of Shs. 1 each. On 30th June, 2018 the following balances were extracted from the books: Ordinary share capital, fully paid 50,000 General reserve 40,000 Plant replacement reserve 30,000 Leasehold land and building at cost 65,500 Motor vehicle at cost 10,650 Plant and machinery at cost 54,400 Sundry creditors 32,400 Balance at bank 89,210 Stock on hand 1st July, 2017 10,640 Sales 280,520 Purchases 182.530 Overhead expenses 19,456 16,428 Selling expenses 22,392 Administration expenses 29,246 Profit and loss account balance as on 1st July 2017 Taxation Account Trade debtors Interim dividend paid on 31st December 2017 7,000 56,750 2,450 2/2 Provision for depreciation 1st July, 2017 Leasehold land and building Plant and machinery Motor vehicles Provisions for doubtful debts 1st July, 2017 Cash in hand 32,750 30,290 6,420 1,030 9,250 The following information is relevant a) Stock on hand on 30th June, 2018 amounted to Shs. 11,450 b) Administration expenses include the chairman and managing directors salary of Shs. 10,000 and that of the sales director of Shs. 6,000. Benefits in kind received by the Chairman have been valued at Shs. 459 for the year. c) Provision for doubtful debts is to be adjusted to 2% of the outstanding trade debtors as on 30th June, 2018 d) Provision is to be made for: i) Audit fee of Shs. 315 (fixed by directors) ii) Depreciation on leasehold land and buildings at 5% on cost, plant and machinery at 12.5% on cost and motor vehicles at 20% on cost. iii) Non-executive directors fee Shs. 1,000 (Shs 500 each) e) The balance on taxation account represent the provision made on 30th June 2017, for corporation tax and not yet paid. The corporation tax for the year ended 30th June 2018, is estimated at 7,600 based on a rate of 50% 1) The directors wish to transfer Shs. 10,000 to general reserves and recommend a final dividend of Shs. 7 per share. machinery at 12.5% on cost and motor vehicles at 20% on cost. iii) Non-executive directors fee Shs. 1,000 (Shs. 500 each) e) The balance on taxation account represent the provision made on 30th June 2017, for corporation tax and not yet paid. The corporation tax for the year ended 30th June 2018, is estimated at 7,600 based on a rate of 50% 1) The directors wish to transfer Shs. 10,000 to general reserves and recommend a final dividend of Shs. 7 per share. Required a) Prepare statement of comprehensive income and profit appropriation, b) Prepare statement of financial position. 2. Cabby limited has an authorized share capital of Shs. 75,000 made up of ordinary shares of Shs. 1 each. On 30th June, 2018 the following balances were extracted from the books: Ordinary share capital, fully paid 50,000 General reserve 40,000 Plant replacement reserve 30,000 Leasehold land and building at cost 65,500 Motor vehicle at cost 10,650 Plant and machinery at cost 54,400 Sundry creditors 32,400 Balance at bank 89,210 Stock on hand 1st July, 2017 10,640 Sales 280,520 Purchases 182.530 Overhead expenses 19,456 16,428 Selling expenses 22,392 Administration expenses 29,246 Profit and loss account balance as on 1st July 2017 Taxation Account Trade debtors Interim dividend paid on 31st December 2017 7,000 56,750 2,450 2/2 Provision for depreciation 1st July, 2017 Leasehold land and building Plant and machinery Motor vehicles Provisions for doubtful debts 1st July, 2017 Cash in hand 32,750 30,290 6,420 1,030 9,250 The following information is relevant a) Stock on hand on 30th June, 2018 amounted to Shs. 11,450 b) Administration expenses include the chairman and managing directors salary of Shs. 10,000 and that of the sales director of Shs. 6,000. Benefits in kind received by the Chairman have been valued at Shs. 459 for the year. c) Provision for doubtful debts is to be adjusted to 2% of the outstanding trade debtors as on 30th June, 2018 d) Provision is to be made for: i) Audit fee of Shs. 315 (fixed by directors) ii) Depreciation on leasehold land and buildings at 5% on cost, plant and machinery at 12.5% on cost and motor vehicles at 20% on cost. iii) Non-executive directors fee Shs. 1,000 (Shs 500 each) e) The balance on taxation account represent the provision made on 30th June 2017, for corporation tax and not yet paid. The corporation tax for the year ended 30th June 2018, is estimated at 7,600 based on a rate of 50% 1) The directors wish to transfer Shs. 10,000 to general reserves and recommend a final dividend of Shs. 7 per share. machinery at 12.5% on cost and motor vehicles at 20% on cost. iii) Non-executive directors fee Shs. 1,000 (Shs. 500 each) e) The balance on taxation account represent the provision made on 30th June 2017, for corporation tax and not yet paid. The corporation tax for the year ended 30th June 2018, is estimated at 7,600 based on a rate of 50% 1) The directors wish to transfer Shs. 10,000 to general reserves and recommend a final dividend of Shs. 7 per share. Required a) Prepare statement of comprehensive income and profit appropriation, b) Prepare statement of financial position