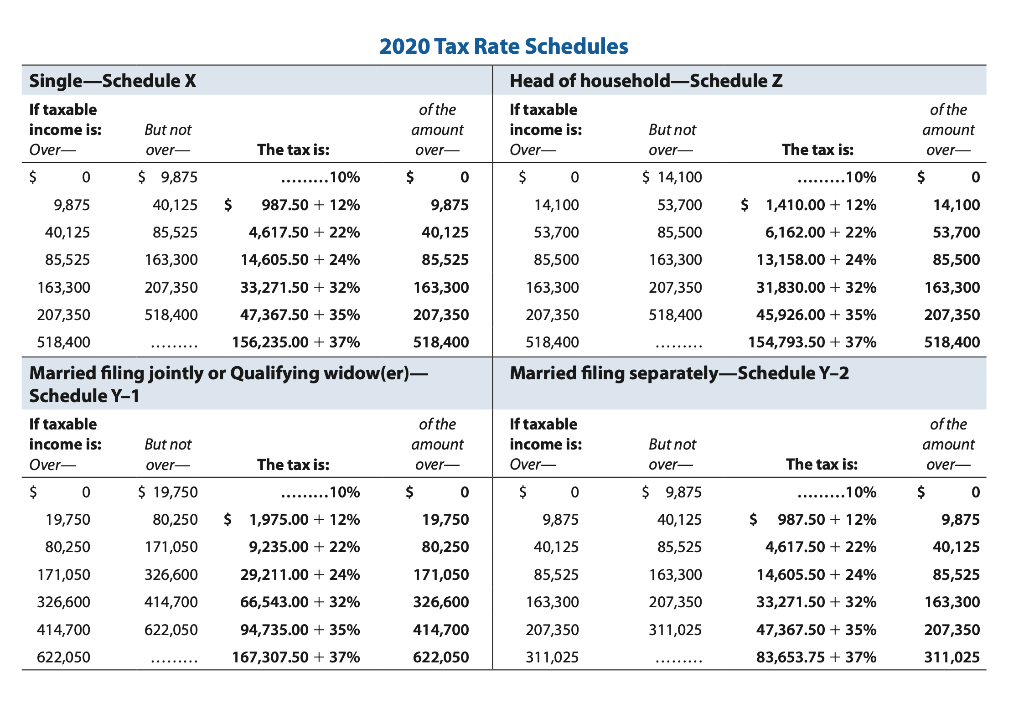

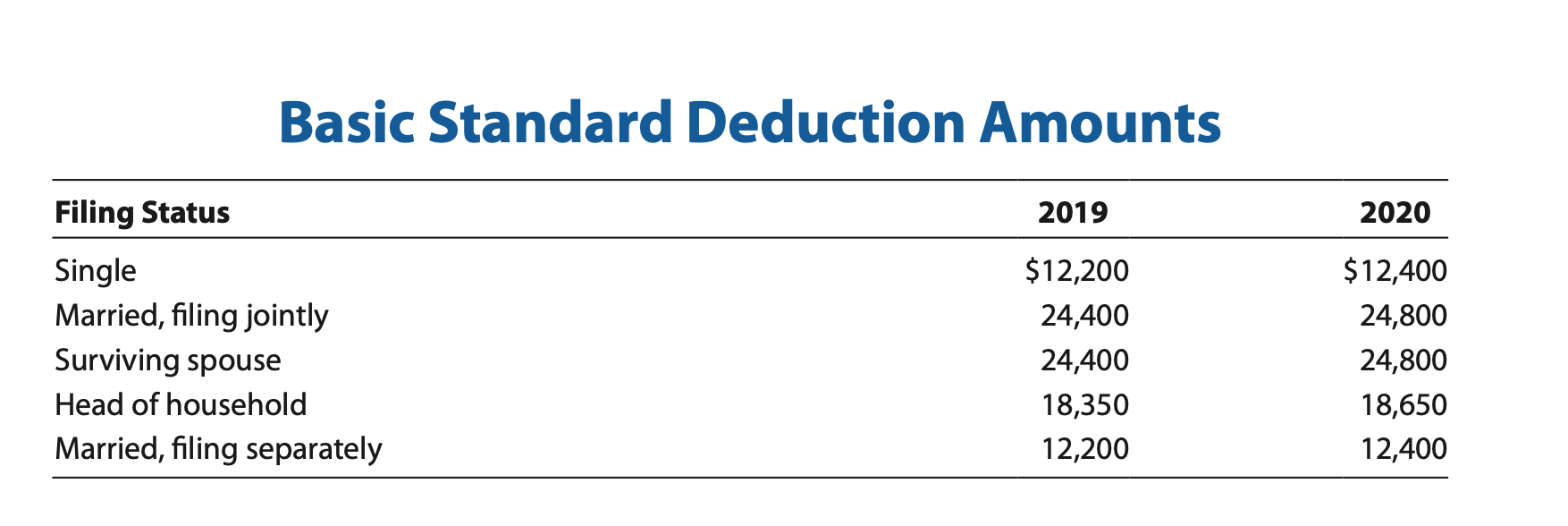

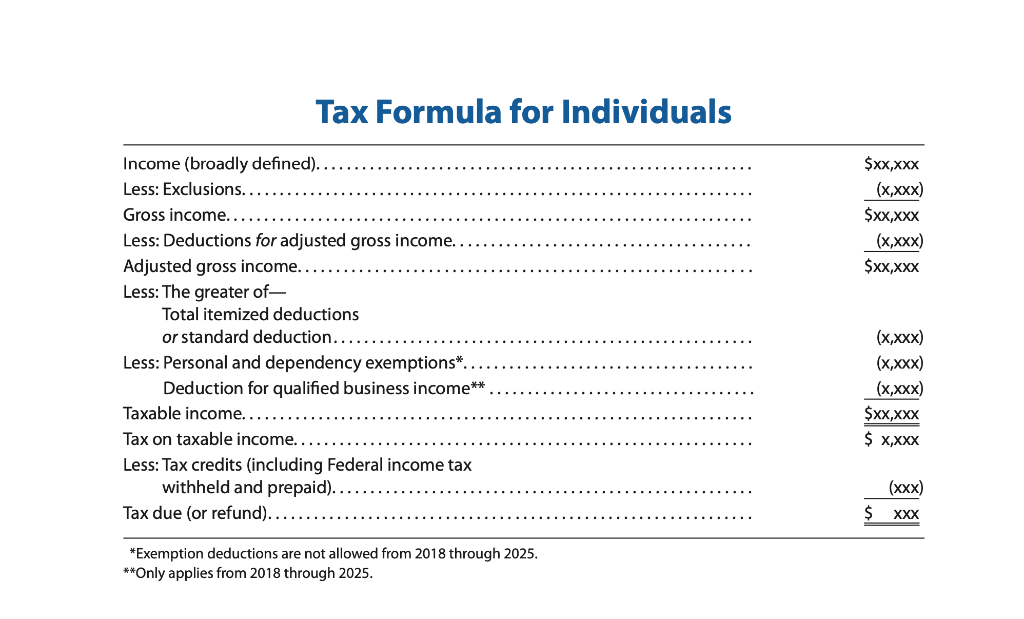

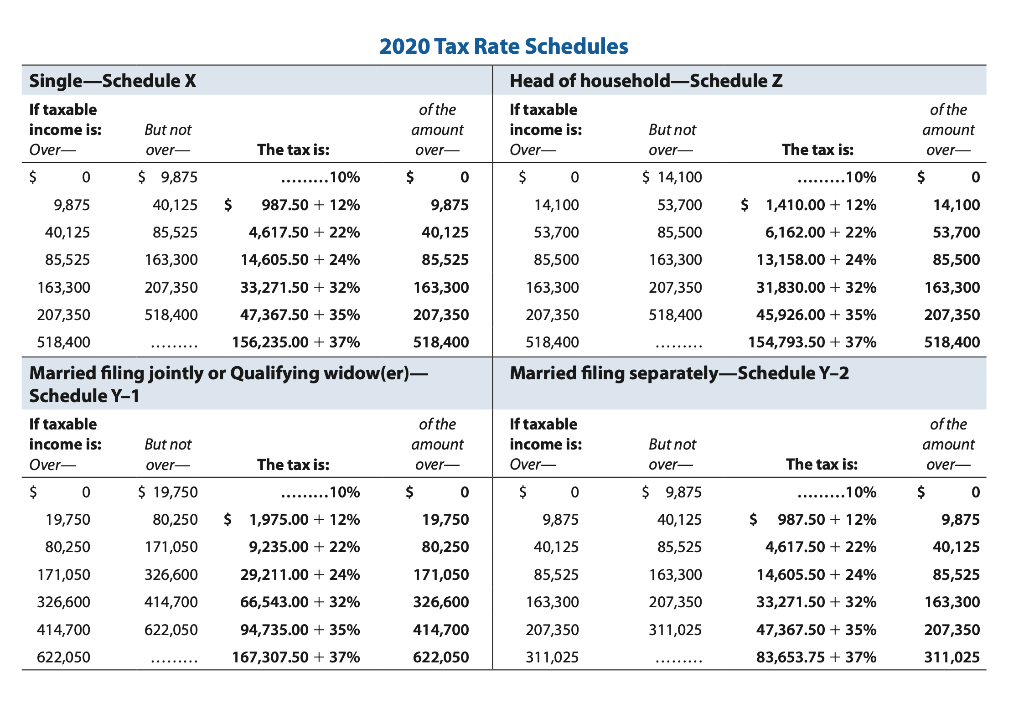

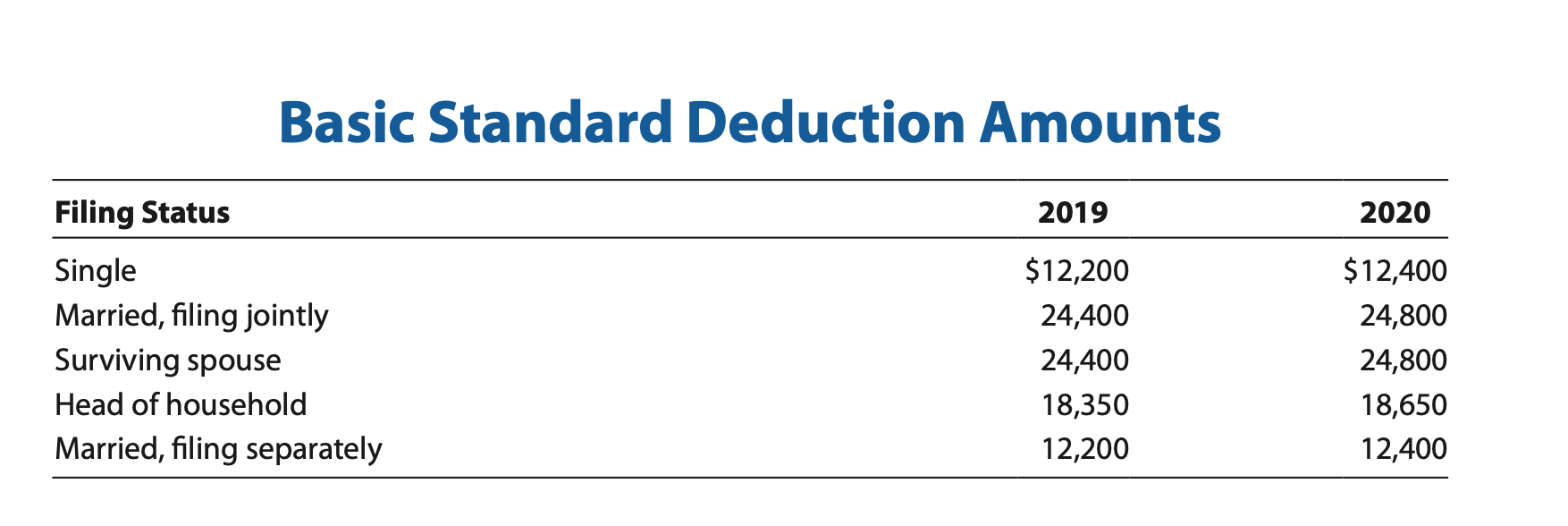

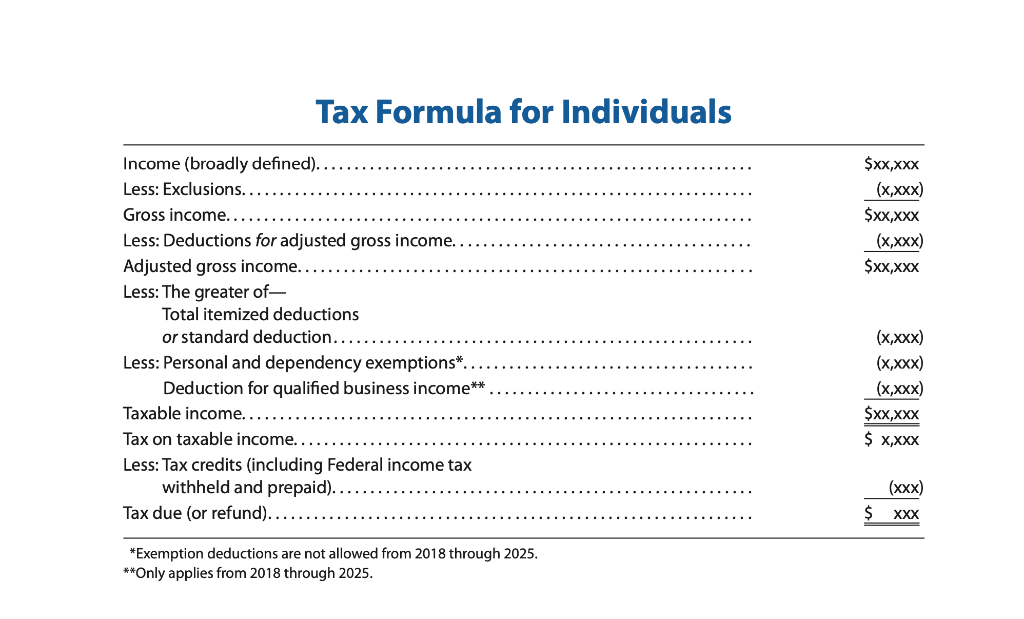

2. Calculate the 2020 taxable income for the following taxpayer (follow the formula on pg. 1-16, Exhibit 1.2): . 0 Single taxpayer Life insurance proceeds received (excluded income) $4,000 W-2 Wages $52,000 Deductions for AGI $1,000 Potential Itemized Deductions 4,000 (Hint: the standard deduction can be found on page G-3 and on Blackboard (Welcome page, Tax Schedules and Formulas pdf file). Use basic and ignore the "additional standard deduction) 0 Source: of the amount over- ..... 10% $ 0 14,100 53,700 85,500 163,300 207,350 518,400 2020 Tax Rate Schedules Single-Schedule X Head of householdSchedule Z If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over- Over- over- The tax is: $ 0 $ 9,875 $ 0 $ 0 $ 14,100 ......... 10% 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 + 24% 85,525 85,500 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er)- Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over over- The tax is: $ 0 $ 19,750 $ 0 $ 0 $ 9,875 ......... 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 414,700 622,050 94,735.00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% of the amount over- . 10% $ 0 9,875 40,125 85,525 163,300 207,350 311,025 Basic Standard Deduction Amounts 2019 2020 Filing Status Single Married, filing jointly Surviving spouse Head of household Married, filing separately $12,200 24,400 24,400 18,350 12,200 $12,400 24,800 24,800 18,650 12,400 Tax Formula for Individuals $xx,xxx (x,xxx) $xx,xxx (x,xxx) $xx,xxx Income (broadly defined).. Less: Exclusions... Gross income... Less: Deductions for adjusted gross income.. Adjusted gross income. Less: The greater of- Total itemized deductions or standard deduction. Less: Personal and dependency exemptions*.. Deduction for qualified business income** Taxable income... Tax on taxable income.. Less: Tax credits (including Federal income tax withheld and prepaid). Tax due (or refund).. (x,xxx) (x,xxx) (x,xxx) $XX,XXX $ X,XXX (xxx) $ XXX *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025. 2. Calculate the 2020 taxable income for the following taxpayer (follow the formula on pg. 1-16, Exhibit 1.2): . 0 Single taxpayer Life insurance proceeds received (excluded income) $4,000 W-2 Wages $52,000 Deductions for AGI $1,000 Potential Itemized Deductions 4,000 (Hint: the standard deduction can be found on page G-3 and on Blackboard (Welcome page, Tax Schedules and Formulas pdf file). Use basic and ignore the "additional standard deduction) 0 Source: of the amount over- ..... 10% $ 0 14,100 53,700 85,500 163,300 207,350 518,400 2020 Tax Rate Schedules Single-Schedule X Head of householdSchedule Z If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over- Over- over- The tax is: $ 0 $ 9,875 $ 0 $ 0 $ 14,100 ......... 10% 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 + 24% 85,525 85,500 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er)- Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over over- The tax is: $ 0 $ 19,750 $ 0 $ 0 $ 9,875 ......... 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 414,700 622,050 94,735.00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% of the amount over- . 10% $ 0 9,875 40,125 85,525 163,300 207,350 311,025 Basic Standard Deduction Amounts 2019 2020 Filing Status Single Married, filing jointly Surviving spouse Head of household Married, filing separately $12,200 24,400 24,400 18,350 12,200 $12,400 24,800 24,800 18,650 12,400 Tax Formula for Individuals $xx,xxx (x,xxx) $xx,xxx (x,xxx) $xx,xxx Income (broadly defined).. Less: Exclusions... Gross income... Less: Deductions for adjusted gross income.. Adjusted gross income. Less: The greater of- Total itemized deductions or standard deduction. Less: Personal and dependency exemptions*.. Deduction for qualified business income** Taxable income... Tax on taxable income.. Less: Tax credits (including Federal income tax withheld and prepaid). Tax due (or refund).. (x,xxx) (x,xxx) (x,xxx) $XX,XXX $ X,XXX (xxx) $ XXX *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025