Answered step by step

Verified Expert Solution

Question

1 Approved Answer

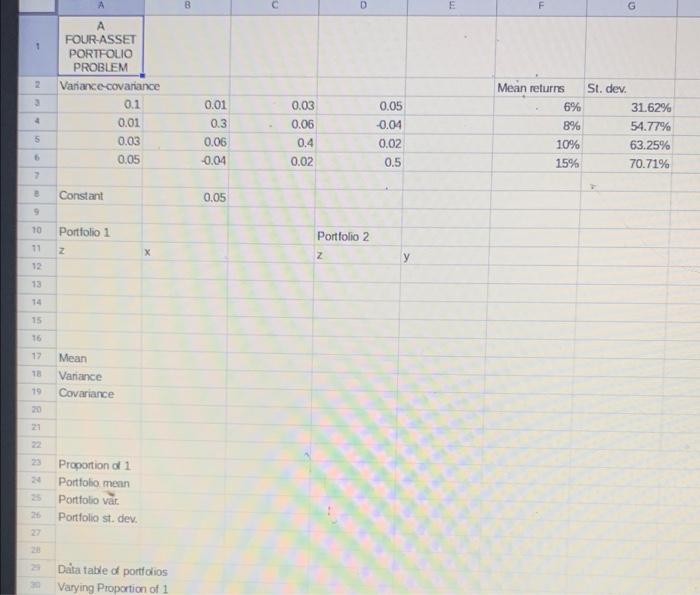

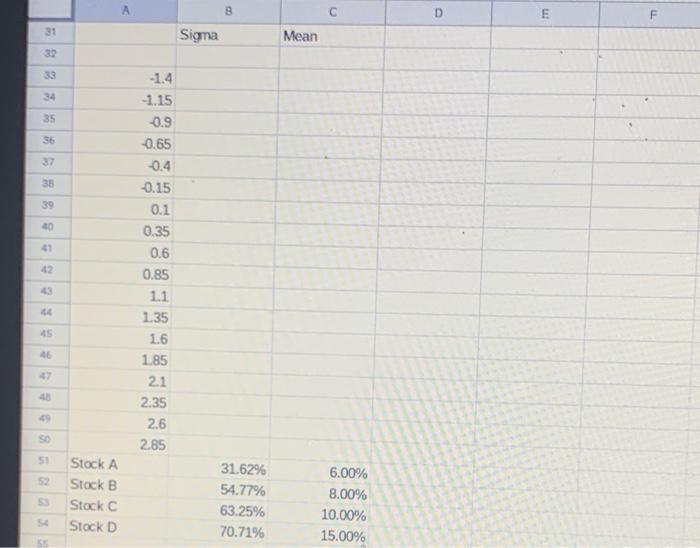

2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. B D

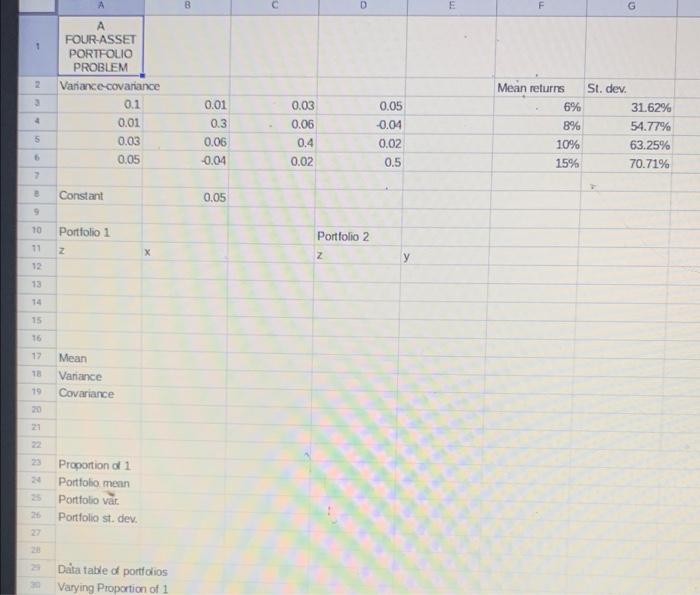

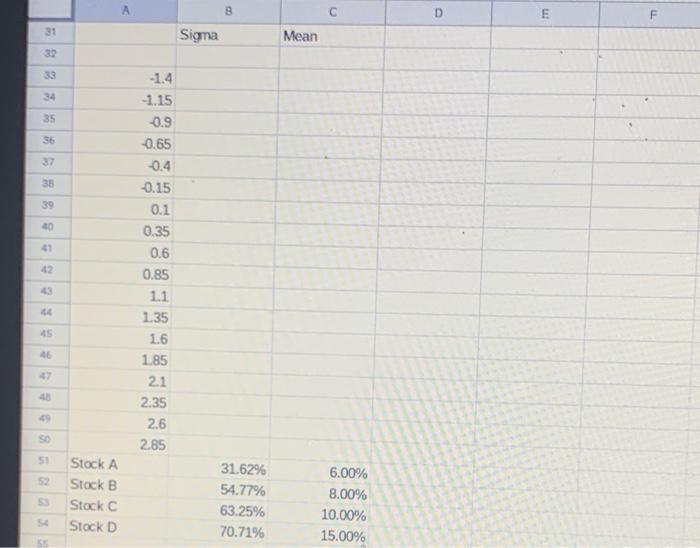

2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. B D E F G 1 2 A FOUR-ASSET PORTFOLIO PROBLEM Varance covariance 0.1 0.01 0.03 0.05 Mean returns 6% 2 4 8% 0.01 0.3 0.06 -0.04 0.03 0.05 0.4 0.02 0.05 -0.04 0.02 0.5 St. dev. 31.62% 54.77% 63.25% 70.71% 5 6 10% 15% B Constant 0.05 9 10 Portfolio 1 Portfolio 2 z X 11 12 Z y 13 14 15 16 12 18 Mean Varance Covariance 19 20 23 3D 2D Proportion of 1 Portfolio menn Portfolio var Portfolio st.dev. 25 20 20 Data table of portfolios Varying Proportion of 1 B E F 15 Sigma Mean 33 34 35 36 37 35 8 % 39 30 -1.4 -1.15 -0.9 -0.65 -0.4 0.15 0.1 0.35 0.6 0.85 11 135 1.6 185 2.1 2.35 2.6 2.85 2 45 GE SO 51 52 Stock A Stock B Stock C Stock D 5 31.62% 54.77% 63.25% 70.71% 6.00% 8.00% 10.00% 15.00% 2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. B D E F G 1 2 A FOUR-ASSET PORTFOLIO PROBLEM Varance covariance 0.1 0.01 0.03 0.05 Mean returns 6% 2 4 8% 0.01 0.3 0.06 -0.04 0.03 0.05 0.4 0.02 0.05 -0.04 0.02 0.5 St. dev. 31.62% 54.77% 63.25% 70.71% 5 6 10% 15% B Constant 0.05 9 10 Portfolio 1 Portfolio 2 z X 11 12 Z y 13 14 15 16 12 18 Mean Varance Covariance 19 20 23 3D 2D Proportion of 1 Portfolio menn Portfolio var Portfolio st.dev. 25 20 20 Data table of portfolios Varying Proportion of 1 B E F 15 Sigma Mean 33 34 35 36 37 35 8 % 39 30 -1.4 -1.15 -0.9 -0.65 -0.4 0.15 0.1 0.35 0.6 0.85 11 135 1.6 185 2.1 2.35 2.6 2.85 2 45 GE SO 51 52 Stock A Stock B Stock C Stock D 5 31.62% 54.77% 63.25% 70.71% 6.00% 8.00% 10.00% 15.00%

2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. B D E F G 1 2 A FOUR-ASSET PORTFOLIO PROBLEM Varance covariance 0.1 0.01 0.03 0.05 Mean returns 6% 2 4 8% 0.01 0.3 0.06 -0.04 0.03 0.05 0.4 0.02 0.05 -0.04 0.02 0.5 St. dev. 31.62% 54.77% 63.25% 70.71% 5 6 10% 15% B Constant 0.05 9 10 Portfolio 1 Portfolio 2 z X 11 12 Z y 13 14 15 16 12 18 Mean Varance Covariance 19 20 23 3D 2D Proportion of 1 Portfolio menn Portfolio var Portfolio st.dev. 25 20 20 Data table of portfolios Varying Proportion of 1 B E F 15 Sigma Mean 33 34 35 36 37 35 8 % 39 30 -1.4 -1.15 -0.9 -0.65 -0.4 0.15 0.1 0.35 0.6 0.85 11 135 1.6 185 2.1 2.35 2.6 2.85 2 45 GE SO 51 52 Stock A Stock B Stock C Stock D 5 31.62% 54.77% 63.25% 70.71% 6.00% 8.00% 10.00% 15.00% 2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. B D E F G 1 2 A FOUR-ASSET PORTFOLIO PROBLEM Varance covariance 0.1 0.01 0.03 0.05 Mean returns 6% 2 4 8% 0.01 0.3 0.06 -0.04 0.03 0.05 0.4 0.02 0.05 -0.04 0.02 0.5 St. dev. 31.62% 54.77% 63.25% 70.71% 5 6 10% 15% B Constant 0.05 9 10 Portfolio 1 Portfolio 2 z X 11 12 Z y 13 14 15 16 12 18 Mean Varance Covariance 19 20 23 3D 2D Proportion of 1 Portfolio menn Portfolio var Portfolio st.dev. 25 20 20 Data table of portfolios Varying Proportion of 1 B E F 15 Sigma Mean 33 34 35 36 37 35 8 % 39 30 -1.4 -1.15 -0.9 -0.65 -0.4 0.15 0.1 0.35 0.6 0.85 11 135 1.6 185 2.1 2.35 2.6 2.85 2 45 GE SO 51 52 Stock A Stock B Stock C Stock D 5 31.62% 54.77% 63.25% 70.71% 6.00% 8.00% 10.00% 15.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started