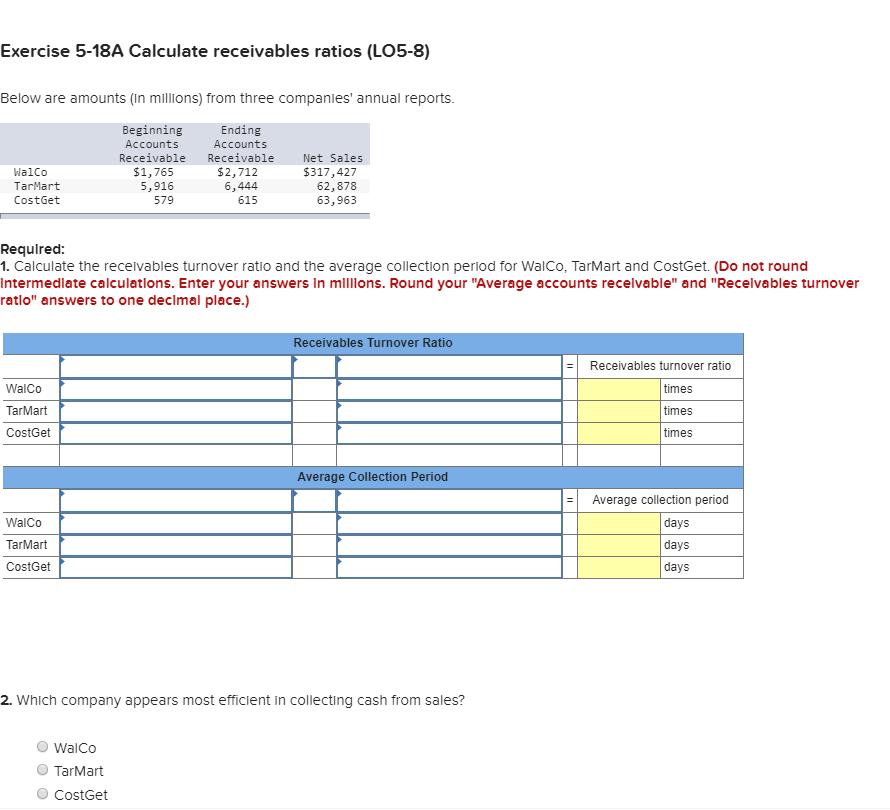

Exercise 5-18A Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable Ending Accounts Receivable $2,712 6,444

Exercise 5-18A Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable Ending Accounts Receivable $2,712 6,444 615 WalCo TarMart CostGet WalCo TarMart CostGet Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round Intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.) WalCo TarMart CostGet $1,765 5,916 579 Net Sales $317,427 62,878 63,963 WalCo TarMart CostGet Receivables Turnover Ratio Average Collection Period 2. Which company appears most efficient in collecting cash from sales? || 11 Receivables turnover ratio times times times Average collection period days days days

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Net Credit Sales Walco 31742700 TarMart 6287800 CostGet ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started