Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Call option hedge on payables B 1. Contingency Graph 2. STEP: 1 of 2 Suppose that Mullen Co, a U.S.-based MNC, knows that

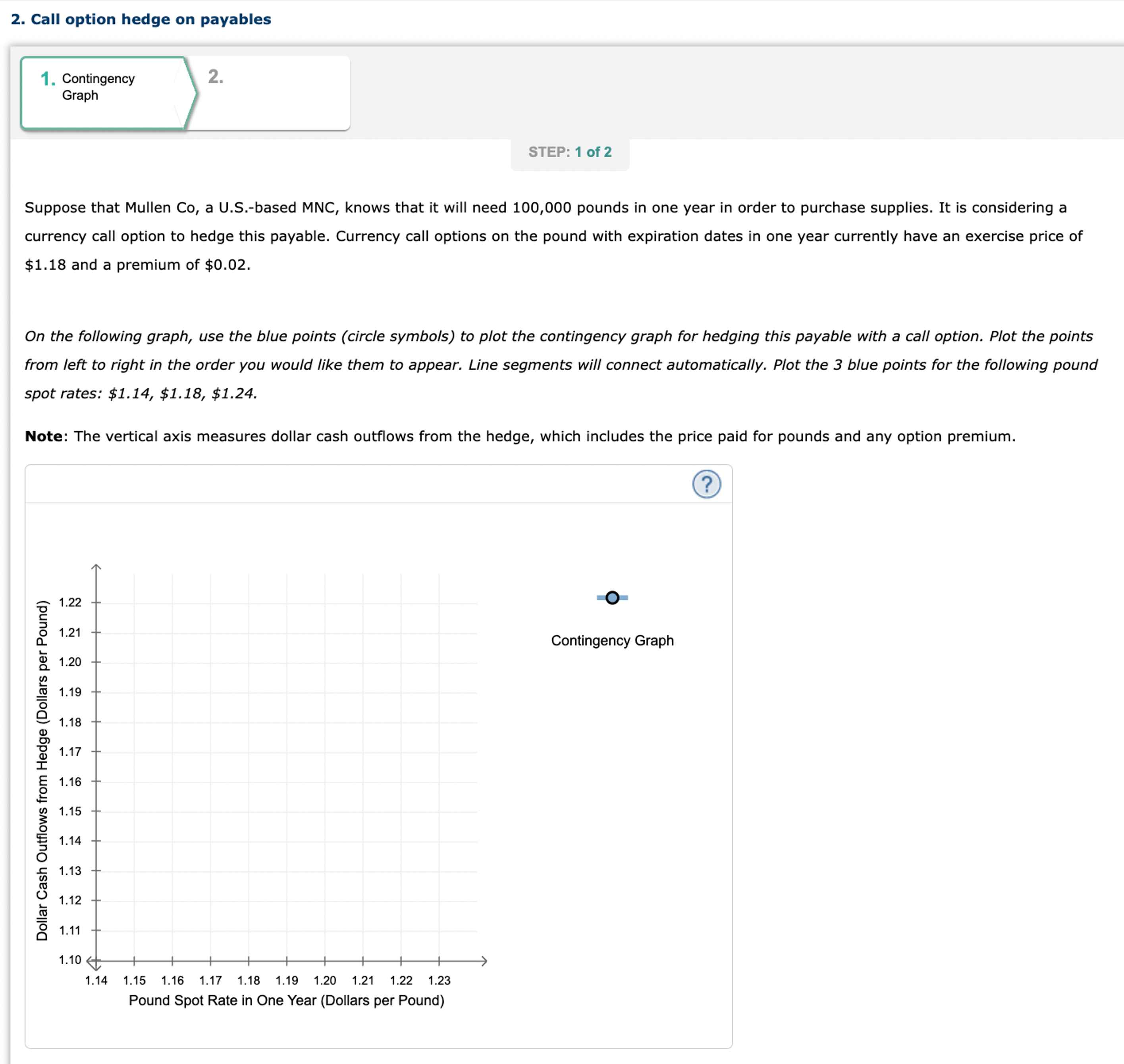

2. Call option hedge on payables B 1. Contingency Graph 2. STEP: 1 of 2 Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 100,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.02. On the following graph, use the blue points (circle symbols) to plot the contingency graph for hedging this payable with a call option. Plot the points from left to right in the order you would like them to appear. Line segments will connect automatically. Plot the 3 blue points for the following pound spot rates: $1.14, $1.18, $1.24. Note: The vertical axis measures dollar cash outflows from the hedge, which includes the price paid for pounds and any option premium. Dollar Cash Outflows from Hedge (Dollars per Pound) 1.16 1.15 1.14 1.13 1.12 1.11 8 1.22 1.21 1.20 1.19 1.18 1.17 1.10 1.14 1.15 1.16 1.17 1.18 1.19 1.20 1.21 1.22 1.23 Pound Spot Rate in One Year (Dollars per Pound) Contingency Graph ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started