Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Carter & Hill (C&H), a publicly traded company, is planning to raise new capital to fund an expansion into the Western part of

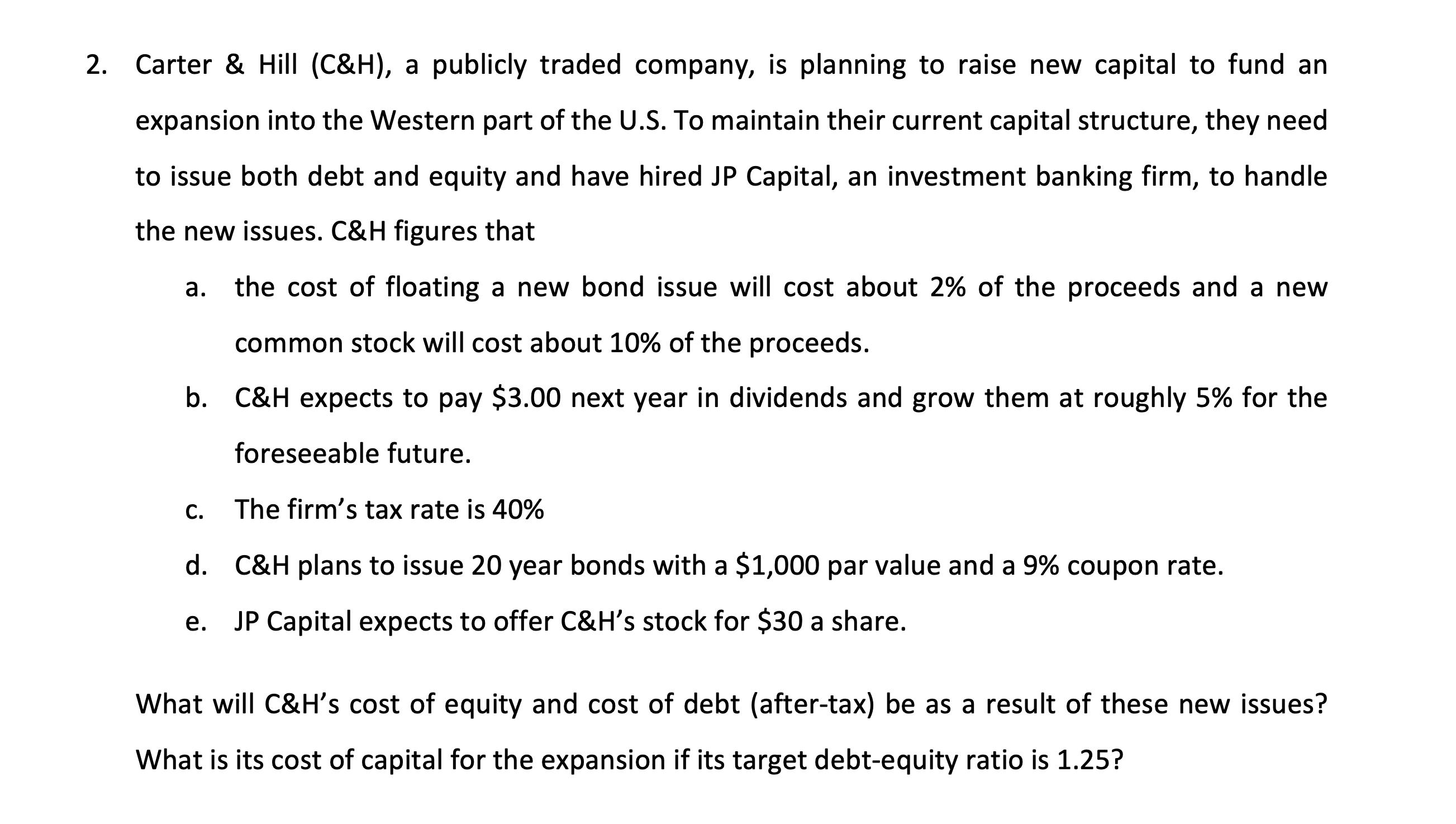

2. Carter & Hill (C&H), a publicly traded company, is planning to raise new capital to fund an expansion into the Western part of the U.S. To maintain their current capital structure, they need to issue both debt and equity and have hired JP Capital, an investment banking firm, to handle the new issues. C&H figures that the cost of floating a new bond issue will cost about 2% of the proceeds and a new common stock will cost about 10% of the proceeds. b. C&H expects to pay $3.00 next year in dividends and grow them at roughly 5% for the foreseeable future. a. C. The firm's tax rate is 40% d. C&H plans to issue 20 year bonds with a $1,000 par value and a 9% coupon rate. e. JP Capital expects to offer C&H's stock for $30 a share. What will C&H's cost of equity and cost of debt (after-tax) be as a result of these new issues? What is its cost of capital for the expansion if its target debt-equity ratio is 1.25?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate CHs cost of equity and cost of debt aftertax resulting from the new issues we need to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started