Answered step by step

Verified Expert Solution

Question

1 Approved Answer

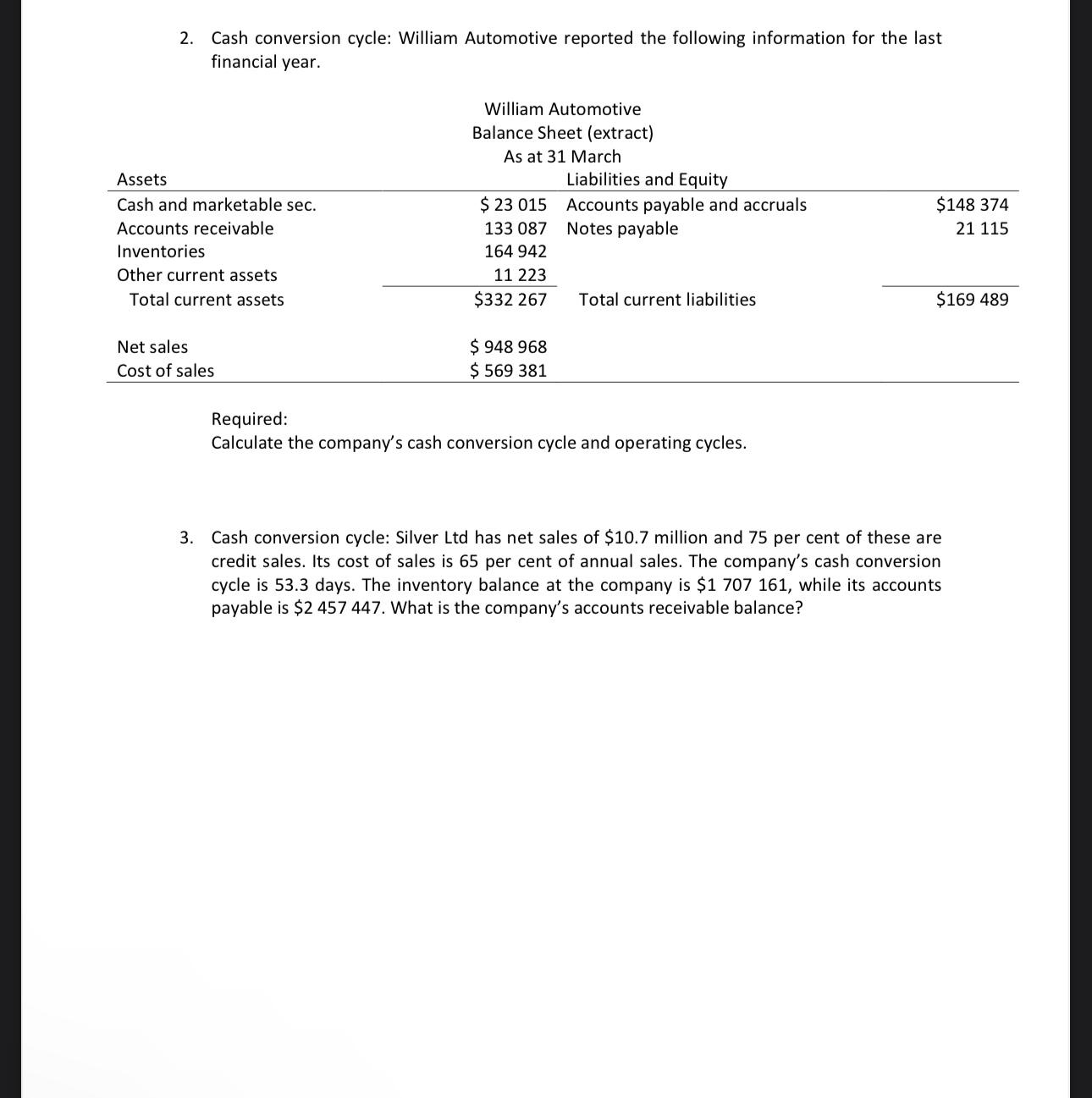

2. Cash conversion cycle: William Automotive reported the following information for the last financial year. Assets Cash and marketable sec. Accounts receivable Inventories Other

2. Cash conversion cycle: William Automotive reported the following information for the last financial year. Assets Cash and marketable sec. Accounts receivable Inventories Other current assets Total current assets Net sales Cost of sales William Automotive Balance Sheet (extract) As at 31 March $ 23 015 133 087 164 942 11 223 $332 267 $ 948 968 $ 569 381 Liabilities and Equity Accounts payable and accruals Notes payable Total current liabilities Required: Calculate the company's cash conversion cycle and operating cycles. $148 374 21 115 $169 489 3. Cash conversion cycle: Silver Ltd has net sales of $10.7 million and 75 per cent of these are credit sales. Its cost of sales is 65 per cent of annual sales. The company's cash conversion cycle is 53.3 days. The inventory balance at the company is $1 707 161, while its accounts payable is $2 457 447. What is the company's accounts receivable balance?

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started