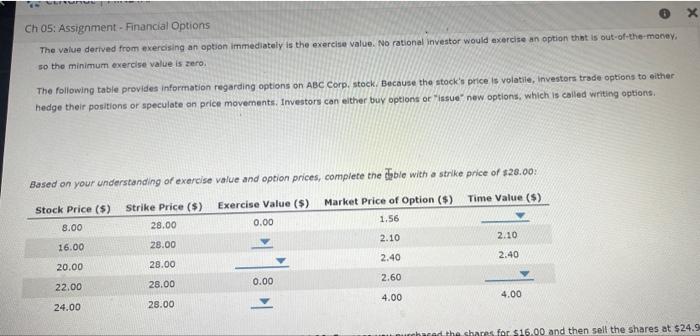

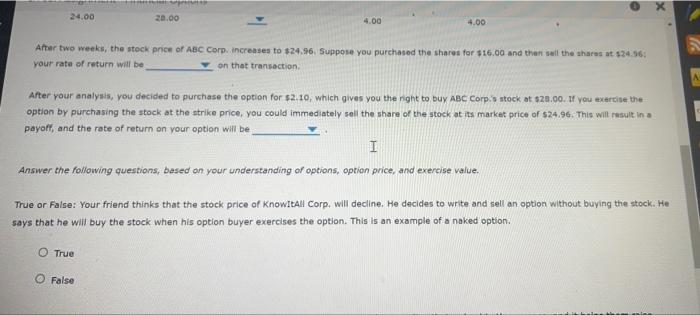

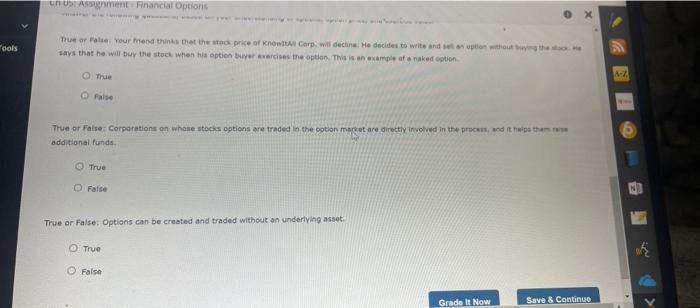

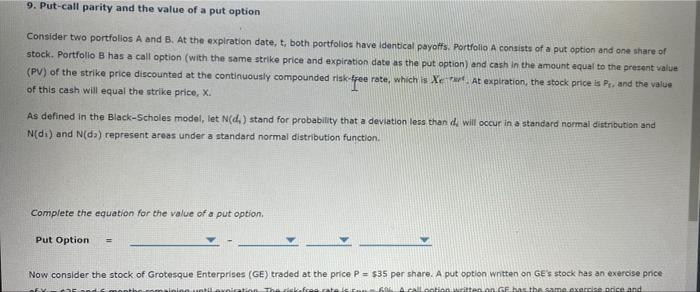

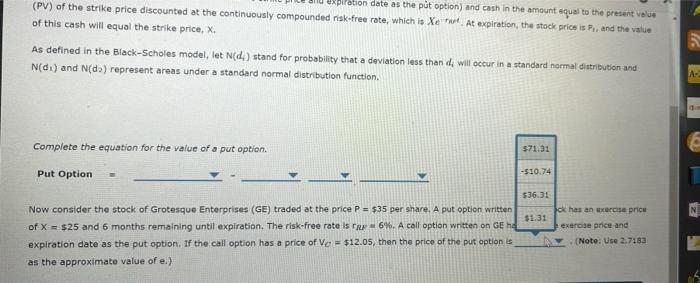

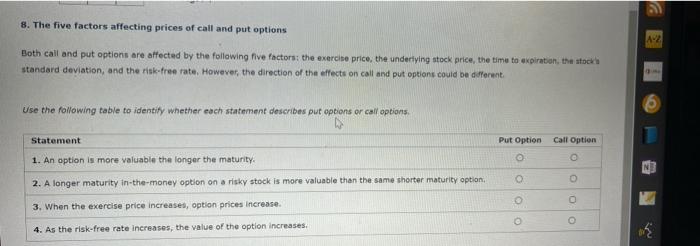

Ch 05: Assignment - Financial Options The value derived from exercising an option immediately is the exercise value. No rational investor would exercise an option that is out-of-the-money, so the minimum exercise value is zero The following table provides information regarding options on ABC Corp, stock. Because the stock's price is volatile, investors trade options to either hedge their positions or speculate on price movements. Investors can either buy options or issue new options, which is called writing options. Based on your understanding of exercise value and option prices, complete the cable with a strike price of $28.00: Time Value ($) Stock Price ($) 8.00 Strike Price (5) 28.00 Exercise Value ($) 0.00 Market Price of Option ($) 1.56 2.10 2.10 16.00 28.00 2.40 2.40 20.00 28.00 0.00 2.60 22.00 28.00 4.00 4.00 24.00 28.00 med the shares for $16.00 and then sell the shares at $24.9 24.00 20.00 4.00 4.00 After two weeks, the stock price of ABC Corp. Increases to $24.96. Suppose you purchased the shares for $16.00 and then sell the shares at $24.56 your rate of return will be on that transaction After your analysis, you decided to purchase the option for $2.10, which gives you the right to buy ABC Corps stock at $20.00. If you exercise the option by purchasing the stock at the strike price, you could immediately sell the share of the stock at its market price of $24.96. This will result in a payoff, and the rate of return on your option will be I Answer the following questions, based on your understanding of options, option price, and exercise value. True or False: Your friend thinks that the stock price of Knowital Corp, will decline. He decides to write and sell an option without buying the stock. He says that he will buy the stock when his option buyer exercises the option. This is an example of a naked option O True O False US Arment Financial Options 0 x Tools The False your enthinks that the price of Knoll Carp wil declina He decides to write and option that the says that he will buy the stock when his option buyer avercises the option. This is an example of a naked option True AZ Faite True or False Corporations on whose stocks options are traded in the option mare are directly involved in the procedit with additional funds True O False True or False: Options can be created and traded without an underlying asset True False Grade It Now Save & Continue 9. Put-call parity and the value of a put option Consider two portfolios A and B. At the expiration date, t, both portfolios have identical payoffs. Portfolio A consists of a put option and one share of stock. Portfolio B has a call option (with the same strike price and expiration date as the put option) and cash in the amount equal to the present value (PV) of the strike price discounted at the continuously compounded risk-free rate, which is Xe. At expiration, the stock price is Ps, and the value of this cash will equal the strike price, X. As defined in the Black-Scholes model, let (d) stand for probability that a deviation less than di will occur in a standard normal distribution and Ndi) and N(d) represent areas under a standard normal distribution function. Complete the equation for the value of a put option Put Option Now consider the stock of Grotesque Enterprises (GE) traded at the price P = $35 per share. A put option written on GE s stock has an exercise price The anther CALCA stien tentang bata sam se price and stion date as the put option) and cash in the amount equal to the presenta (PV) of the strike price discounted at the continuously compounded risk-free rate, which is Xe tut At expiration, the stock price is Ps, and the value of this cash will equal the strike price, X. As defined in the Black-Scholes model, let Nd.) stand for probability that a deviation less than di will occur in a standard normal distribution and Ndi) and N(d) represent areas under a standard normal distribution function A- Complete the equation for the value of a put option. $71.31 Put Option -510.74 N 536.31 Now consider the stock of Grotesque Enterprises (GE) traded at the price P = $35 per share. A put option written ok has an exercise price of X = $25 and 6 months remaining until expiration. The risk-free rate is Rp = 6%. A call option written on GE na $1.31 exercise price and expiration date as the put option. If the call option has a price of Ve = $12.05, then the price of the put option is (Note: Use 2.7183 as the approximate value of e.) A-2 8. The five factors affecting prices of call and put options Both call and put options are affected by the following five factors: the exercise price, the undertying stock price, the time to expiration, the stocks standard deviation, and the risk-free rate. However, the direction of the effects on call and put options could be different Use the following table to identify whether each statement describes put options or call options Statement Put Option Call Option 1. An option is more valuable the longer the maturity. O 0 0 2. A longer maturity in-the-money option on a risky stock is more valuable than the same shorter maturity option O 3. When the exercise price increases, option prices increase Oo e 4. As the risk-free rate increases, the value of the option increases