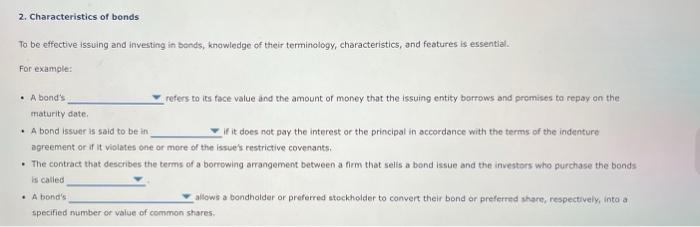

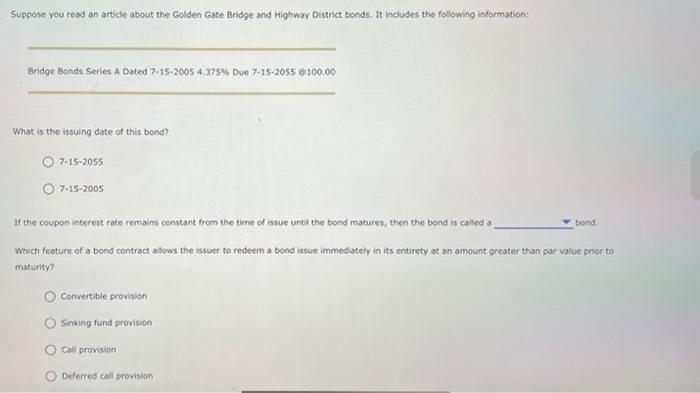

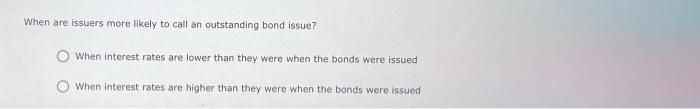

2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the maturity date. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375 % Due 7-15-2055 @100.00 What is the issuing date of this bond? 7-15-2055 7-15-2005 If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision O Sinking fund provision Call provision Deferred call provision When are issuers more likely to call an outstanding bond issue? When interest rates are lower than they were when the bonds were issued When interest rates are higher than they were when the bonds were issued 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the maturity date. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375 % Due 7-15-2055 @100.00 What is the issuing date of this bond? 7-15-2055 7-15-2005 If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision O Sinking fund provision Call provision Deferred call provision When are issuers more likely to call an outstanding bond issue? When interest rates are lower than they were when the bonds were issued When interest rates are higher than they were when the bonds were issued