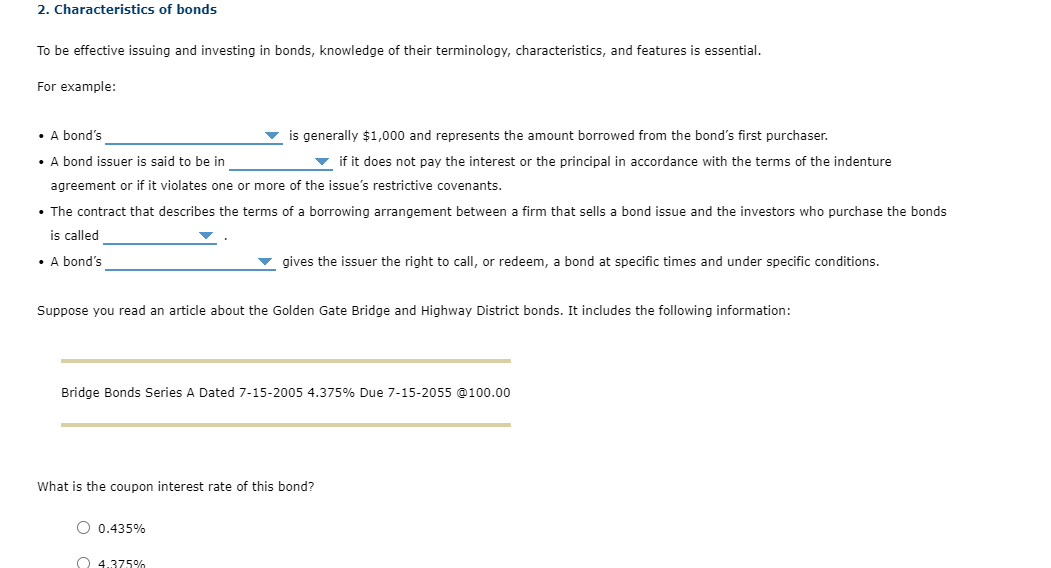

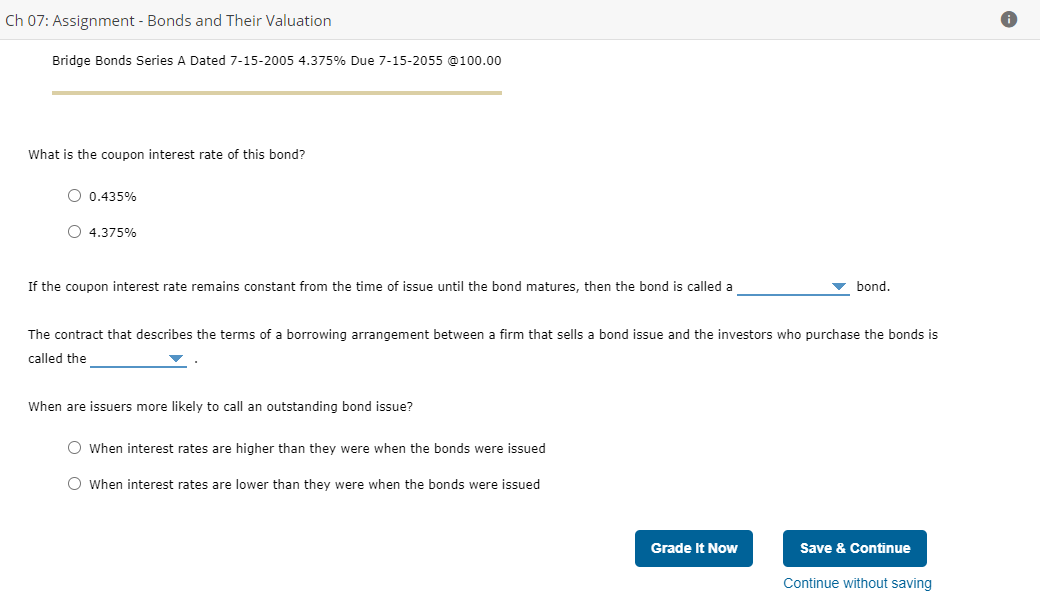

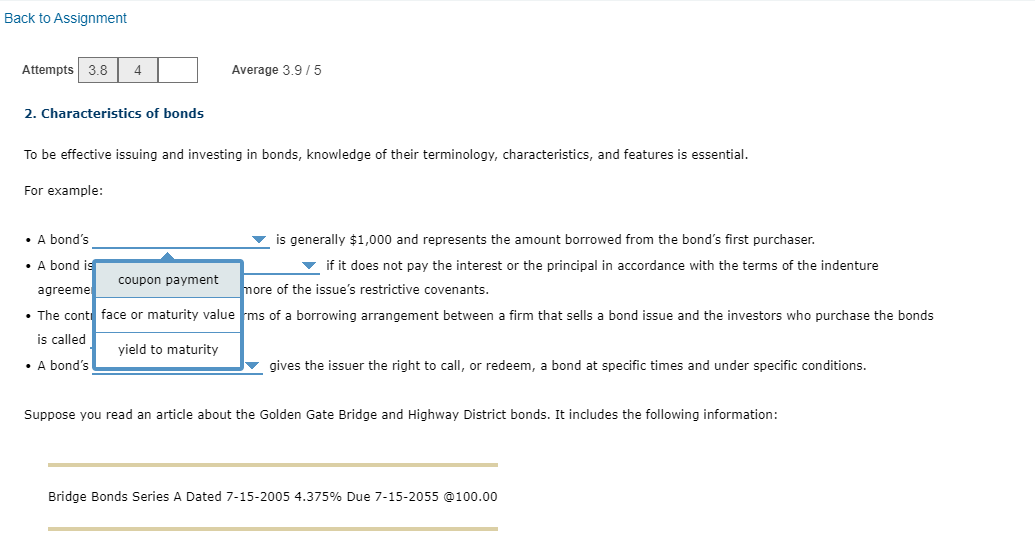

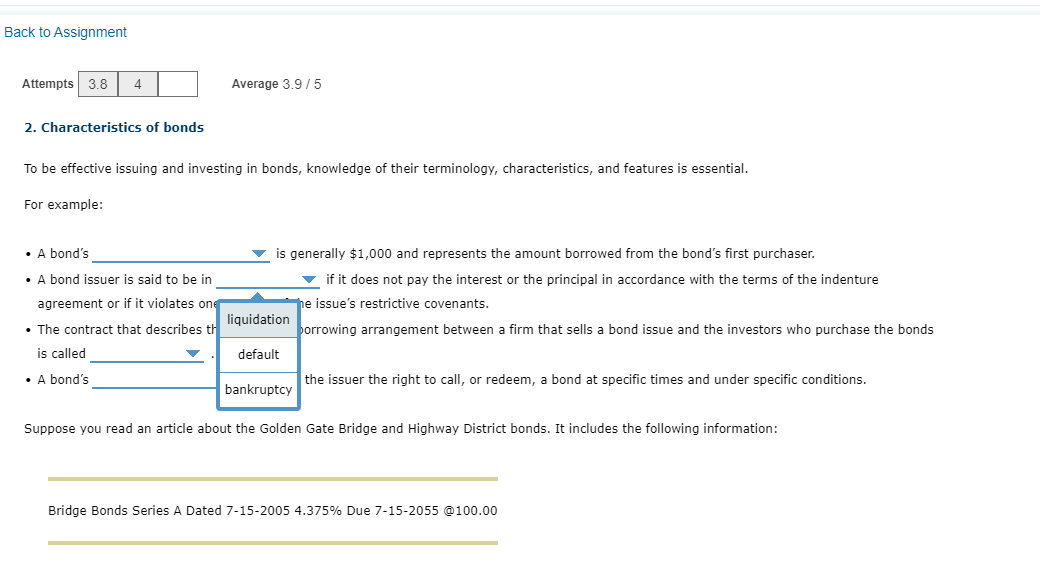

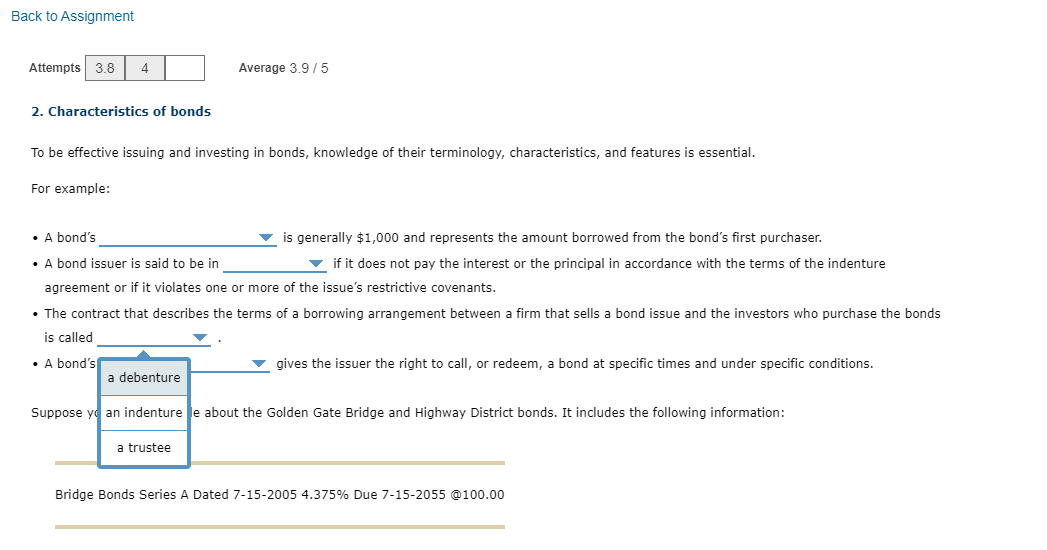

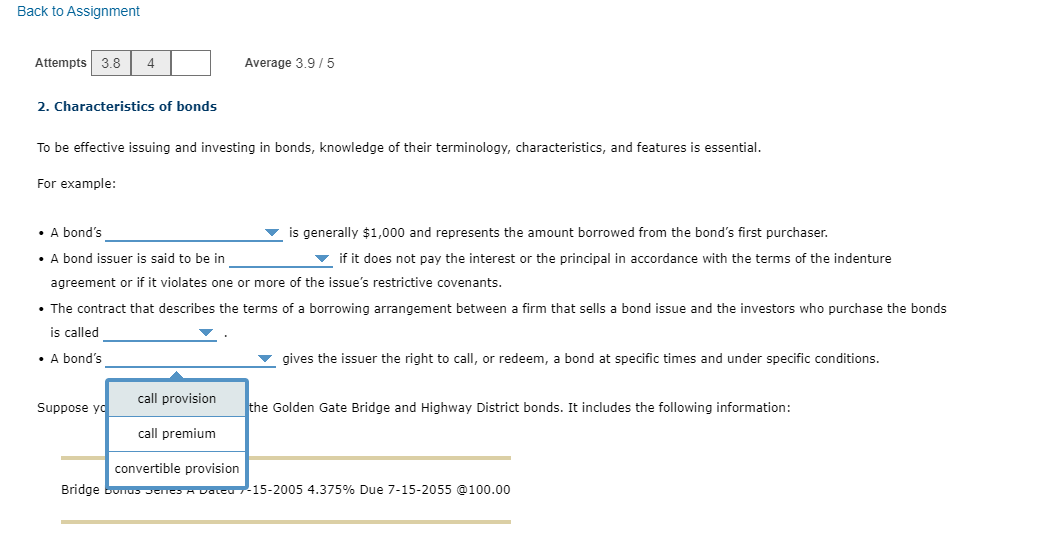

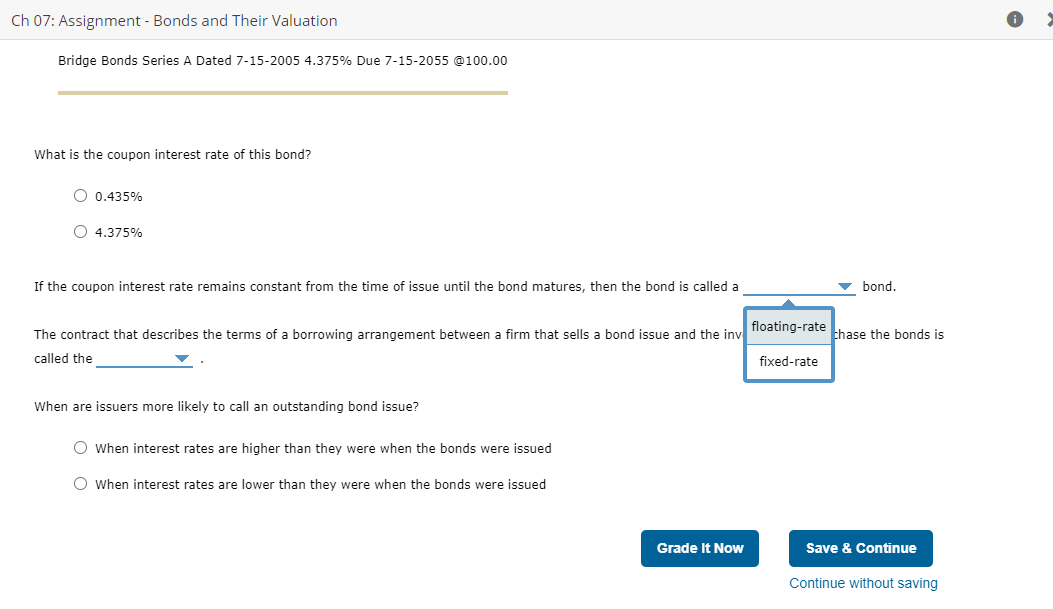

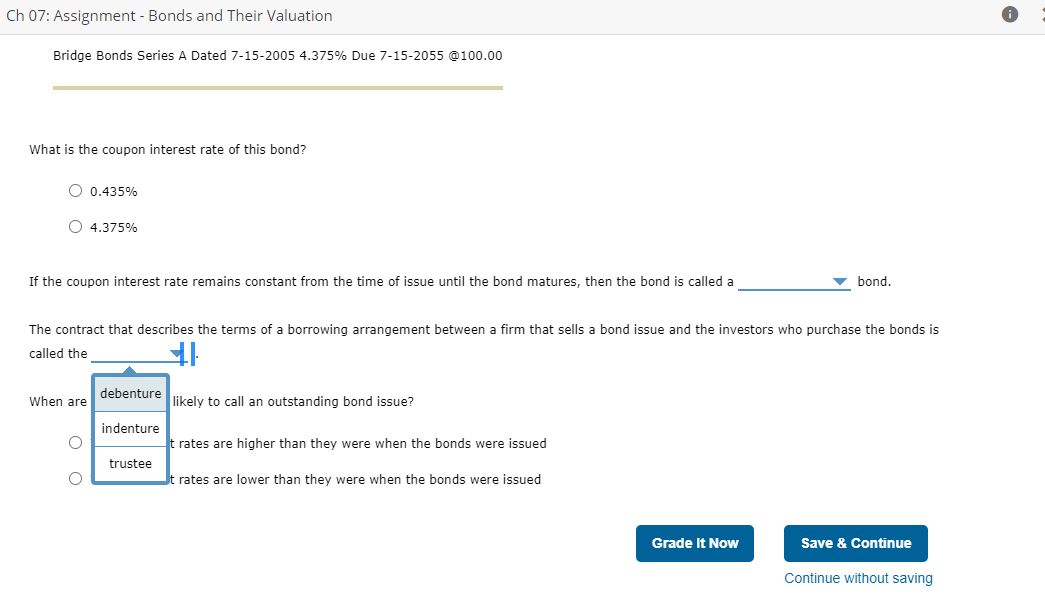

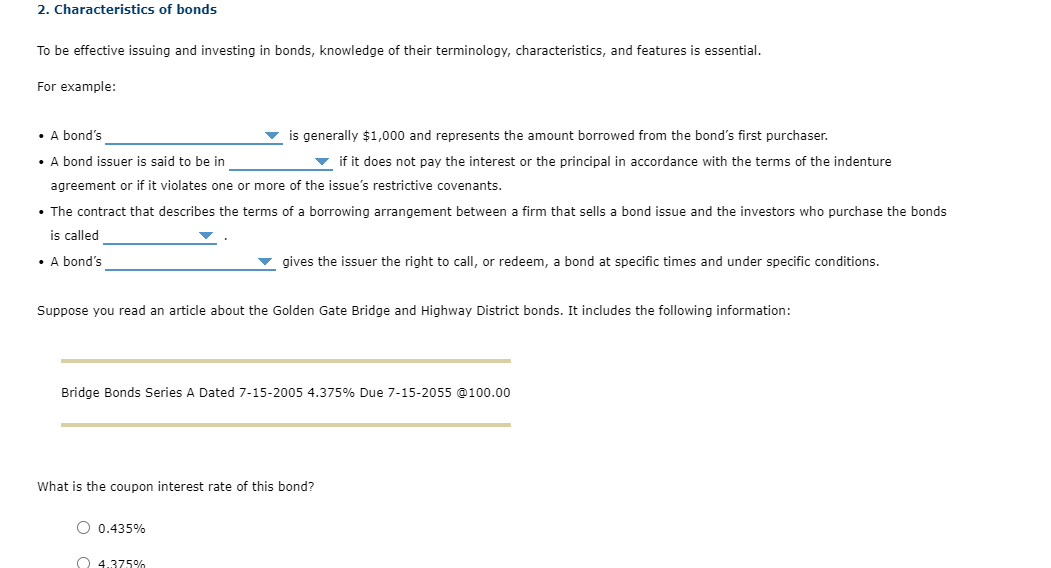

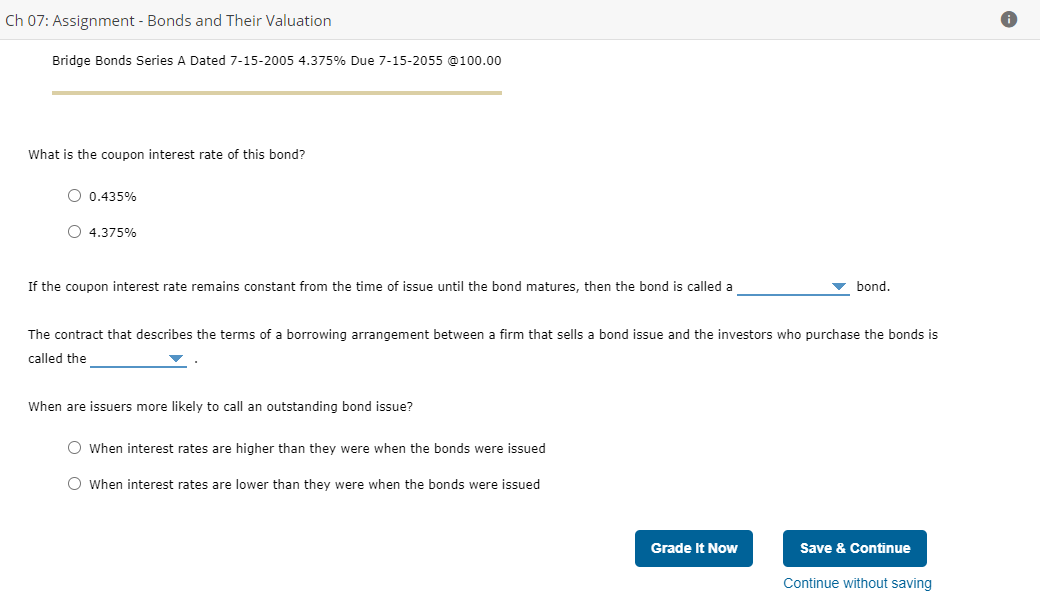

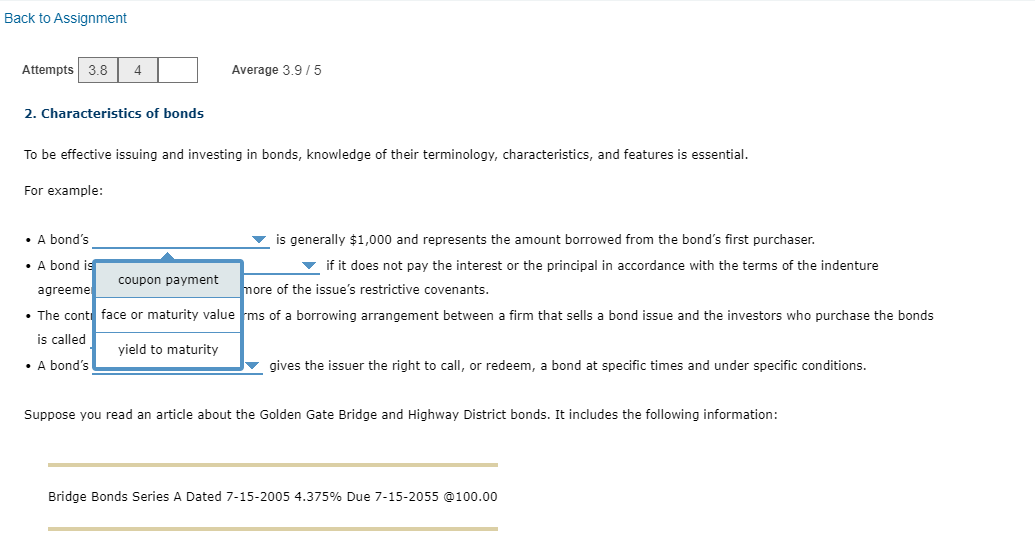

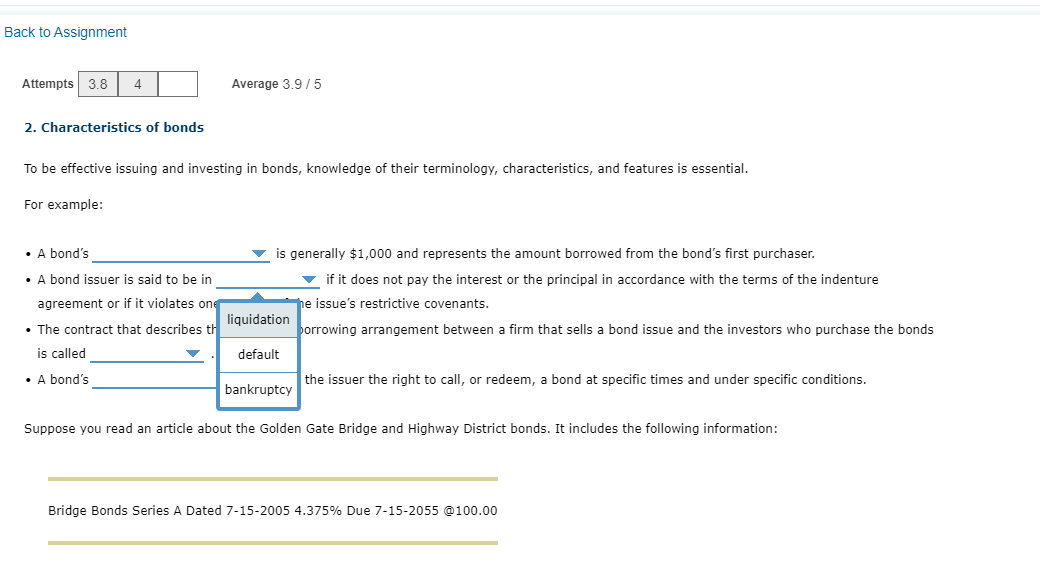

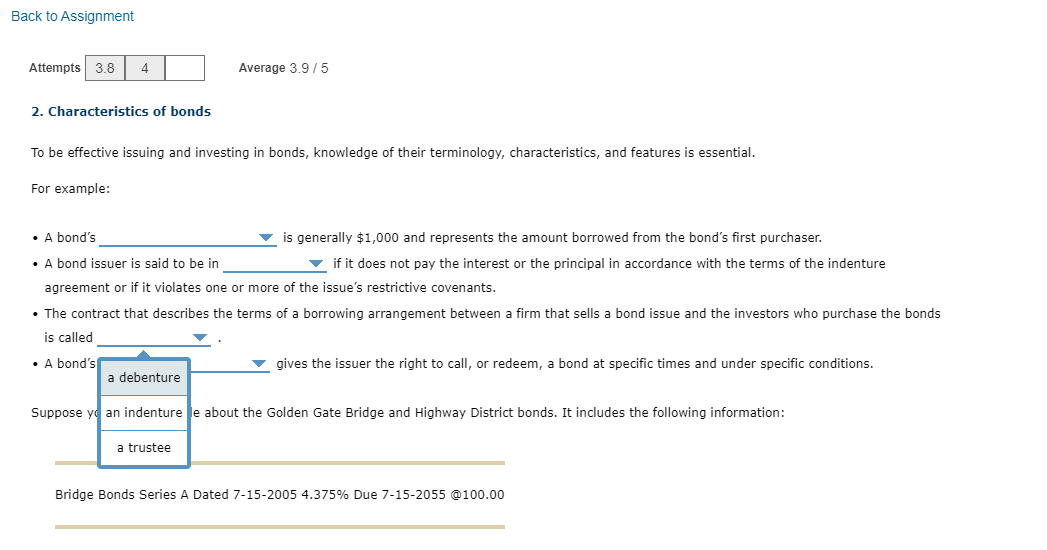

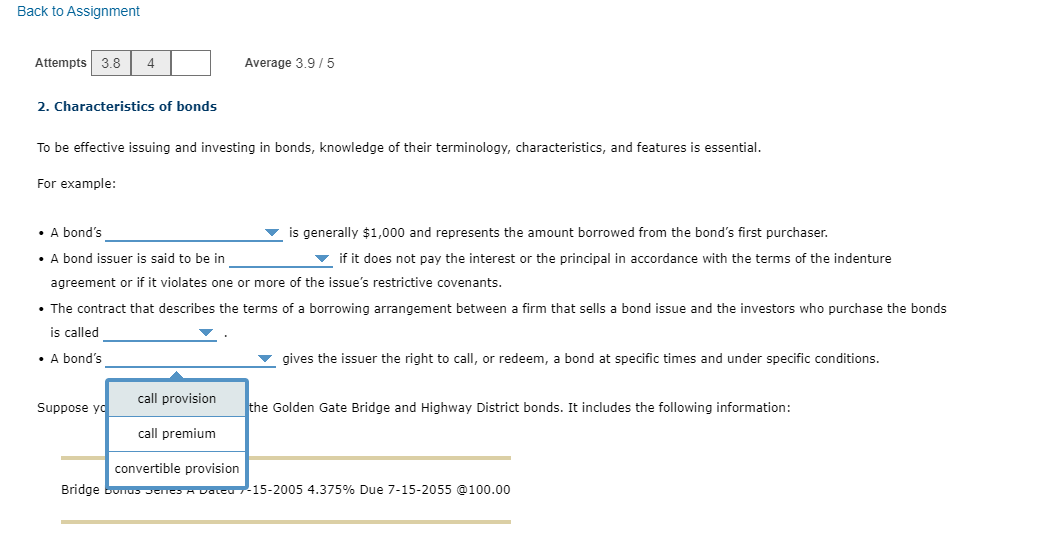

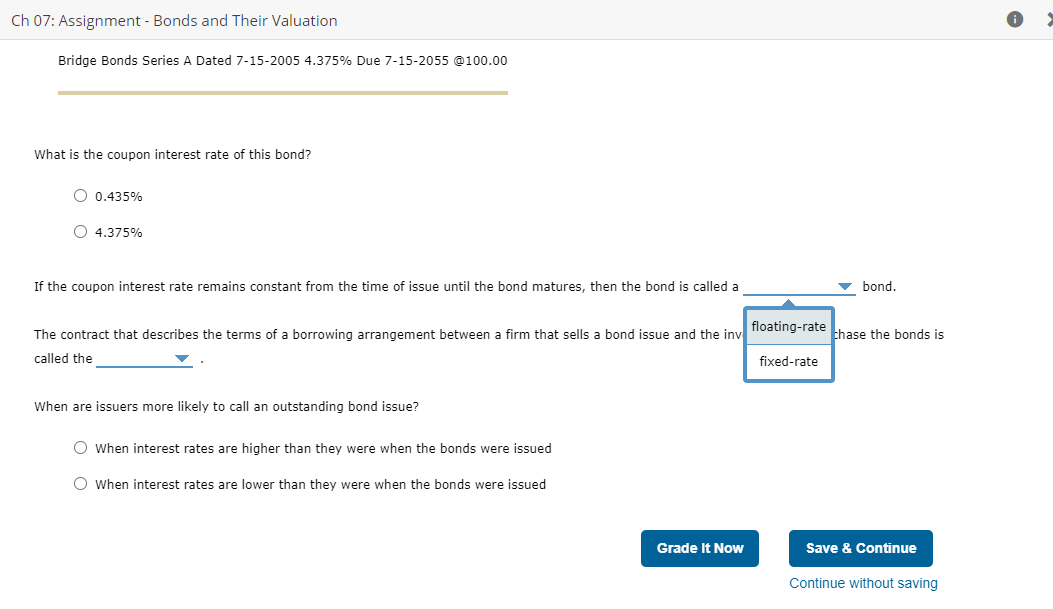

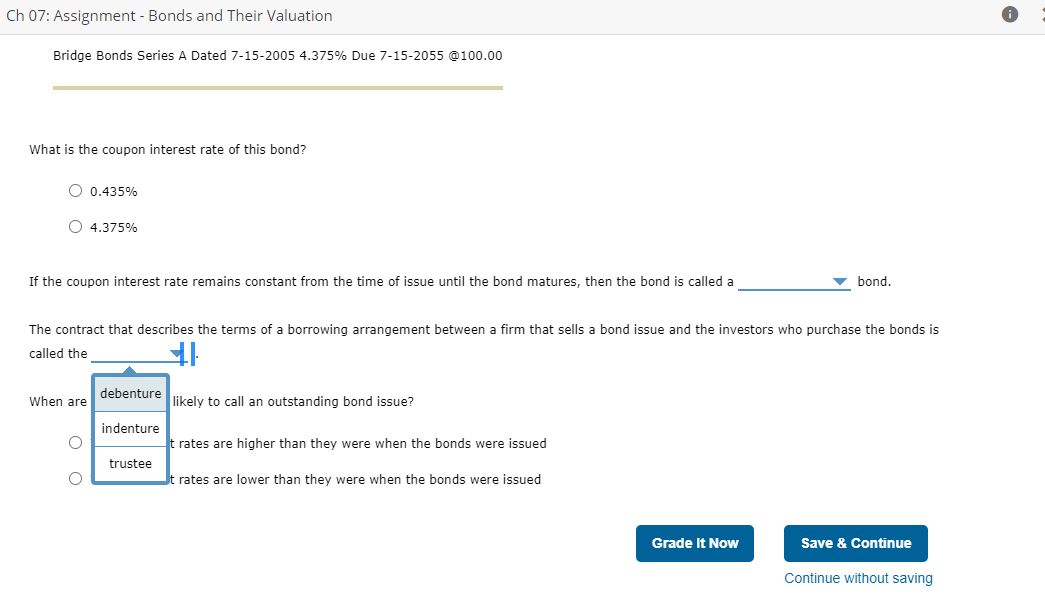

2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's is generally $1,000 and represents the amount borrowed from the bond's first purchaser. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? O 0.435% 04.375% Ch 07: Assignment - Bonds and Their Valuation Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? O 0.435% O 4.375% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. firm that sells a bond issue and the investors who purchase the bonds is The contract that describes the terms of a borrowing arrangement between called the When are issuers more likely to call an outstanding bond issue? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Grade It Now Save & Continue Continue without saving Back to Assignment Attempts 3.8 4 Average 3.9/5 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's is generally $1,000 and represents the amount borrowed from the bond's first purchaser. A bond is if it does not pay the interest or the principal in accordance with the terms of the indenture coupon payment agreeme more of the issue's restrictive covenants. The cont face or maturity value is of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called yield to maturity A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 Back to Assignment Attempts 3.8 4 Average 3.9 / 5 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's is generally $1,000 and represents the amount borrowed from the bond's first purchaser. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates on he issue's restrictive covenants. liquidation The contract that describes th borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called default A bond's the issuer the right to call, or redeem, a bond at specific times and under specific conditions. bankruptcy Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 Back to Assignment Attempts 3.8 4 Average 3.9/5 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's is generally $1,000 and represents the amount borrowed from the bond's first purchaser. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called . A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. a debenture Suppose yo an indenture le about the Golden Gate Bridge and Highway District bonds. It includes the following information: a trustee Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 Back to Assignment Attempts 3.8 4 Average 3.9/5 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's is generally $1,000 and represents the amount borrowed from the bond's first purchaser. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. call provision Suppose ya the Golden Gate Bridge and Highway District bonds. It includes the following information: call premium convertible provision Bridge bonus Deres A DA 7-15-2005 4.375% Due 7-15-2055 @100.00 Ch 07: Assignment - Bonds and Their Valuation Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? O 0.435% O 4.375% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. floating-rate chase the bonds is The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the inv called the fixed-rate When are issuers more likely to call an outstanding bond issue? When interest rates are higher than they were when the bonds were issued O When interest rates are lower than they were when the bonds were issued Grade It Now Save & Continue Continue without saving Ch 07: Assignment - Bonds and Their Valuation Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? O 0.435% O 4.375% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called the + When are debenture likely to call an outstanding bond issue? indenture O t rates are higher than they were when the bonds were issued trustee O rates are lower than they were when the bonds were issued Grade It Now Save & Continue Continue without saving