Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Charlottetown Manufacturing Inc. borrowed money from Truro Corporation in exchange for a note on January 1, 2021. Charlottetown has a December 31 year

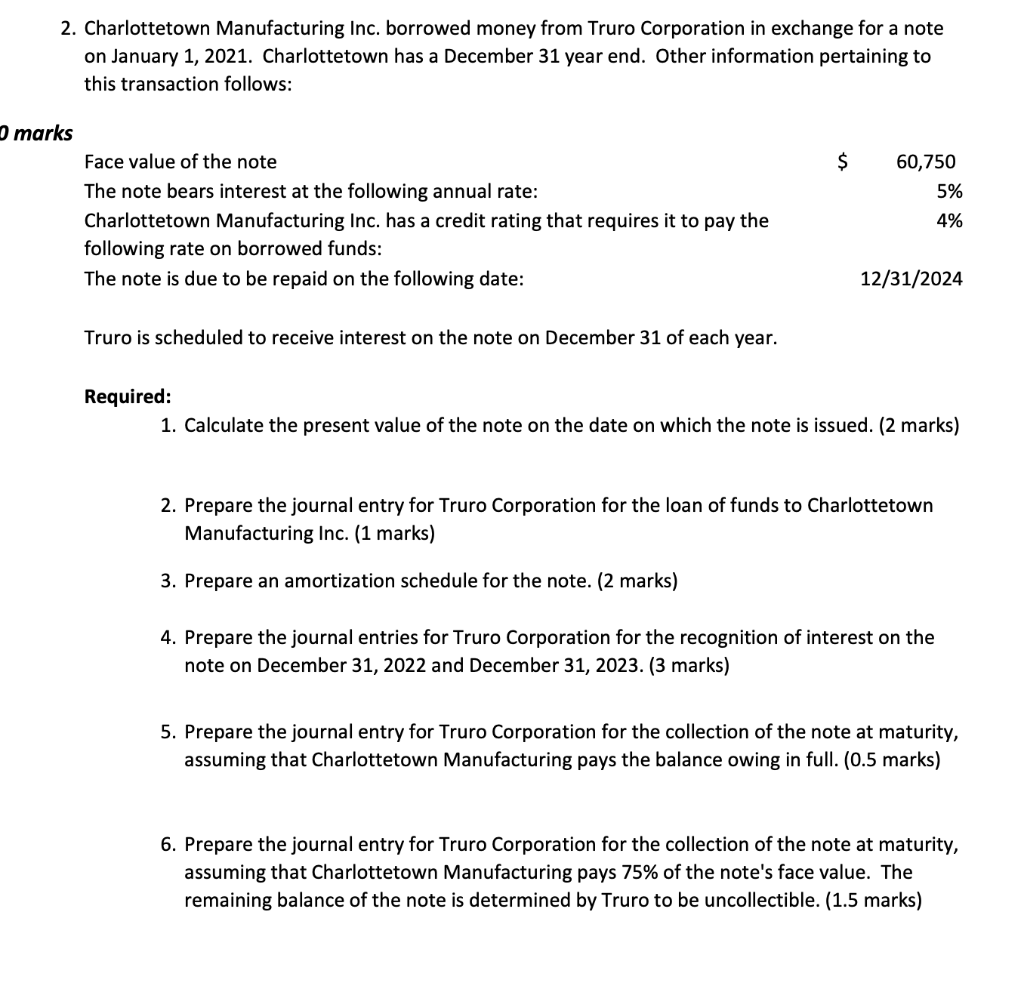

2. Charlottetown Manufacturing Inc. borrowed money from Truro Corporation in exchange for a note on January 1, 2021. Charlottetown has a December 31 year end. Other information pertaining to this transaction follows: O marks Face value of the note The note bears interest at the following annual rate: Charlottetown Manufacturing Inc. has a credit rating that requires it to pay the following rate on borrowed funds: The note is due to be repaid on the following date: Truro is scheduled to receive interest on the note on December 31 of each year. $ 60,750 5% 4% 12/31/2024 Required: 1. Calculate the present value of the note on the date on which the note is issued. (2 marks) 2. Prepare the journal entry for Truro Corporation for the loan of funds to Charlottetown Manufacturing Inc. (1 marks) 3. Prepare an amortization schedule for the note. (2 marks) 4. Prepare the journal entries for Truro Corporation for the recognition of interest on the note on December 31, 2022 and December 31, 2023. (3 marks) 5. Prepare the journal entry for Truro Corporation for the collection of the note at maturity, assuming that Charlottetown Manufacturing pays the balance owing in full. (0.5 marks) 6. Prepare the journal entry for Truro Corporation for the collection of the note at maturity, assuming that Charlottetown Manufacturing pays 75% of the note's face value. The remaining balance of the note is determined by Truro to be uncollectible. (1.5 marks)

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started