Answered step by step

Verified Expert Solution

Question

1 Approved Answer

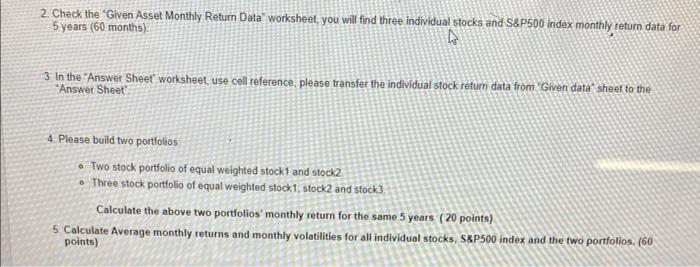

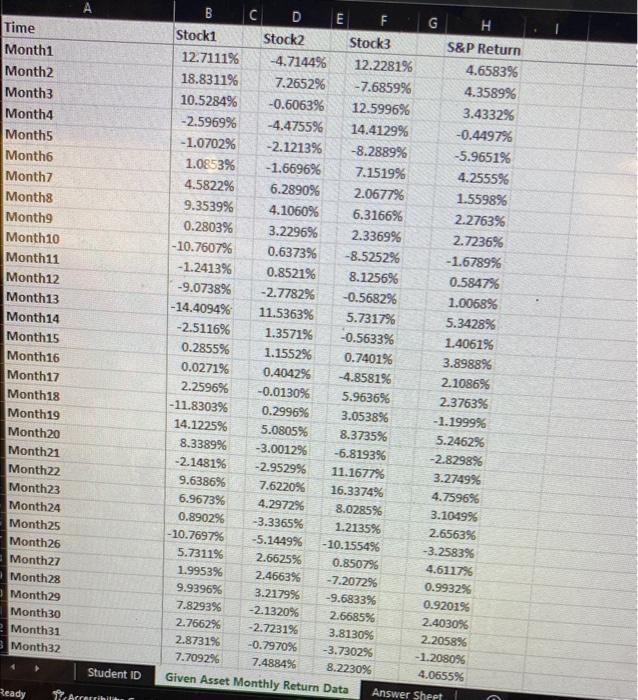

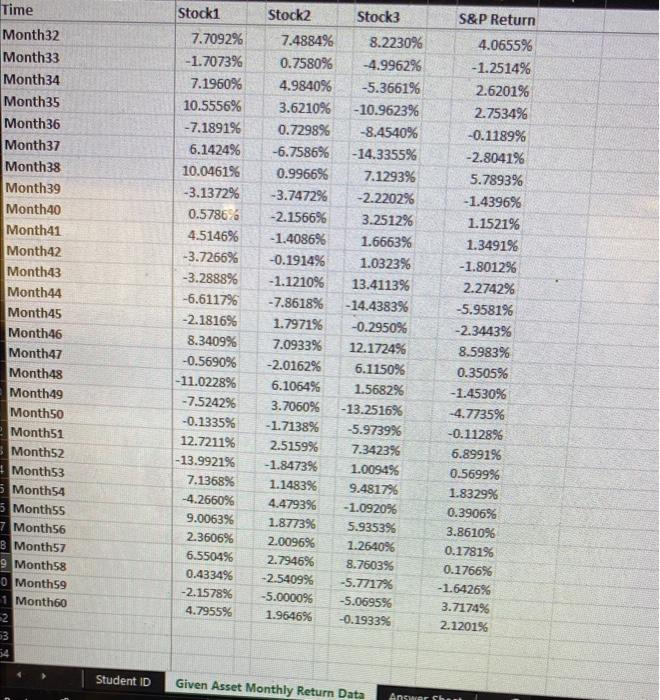

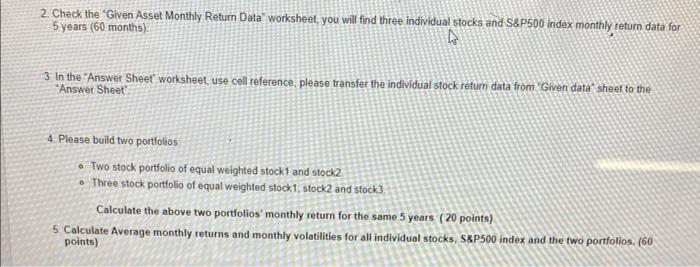

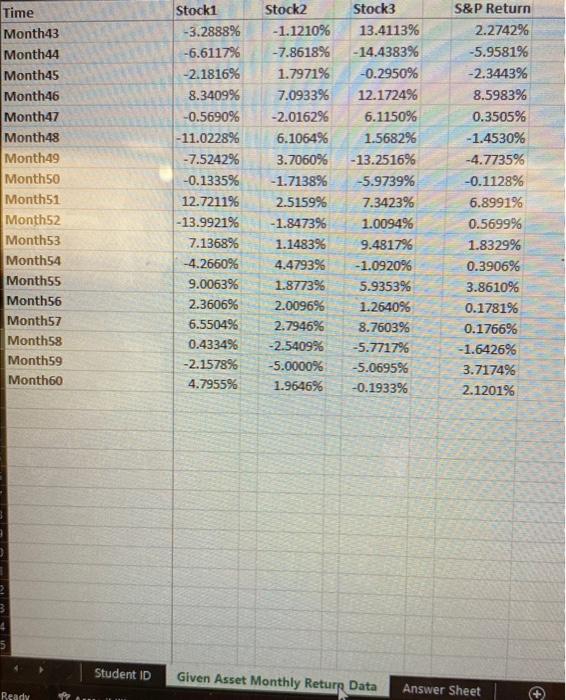

2. Check the 'Glven Assel Monthly Return Data' worksheet, you will find three individual stocks and S&P500 index monthly return data for 5 years (

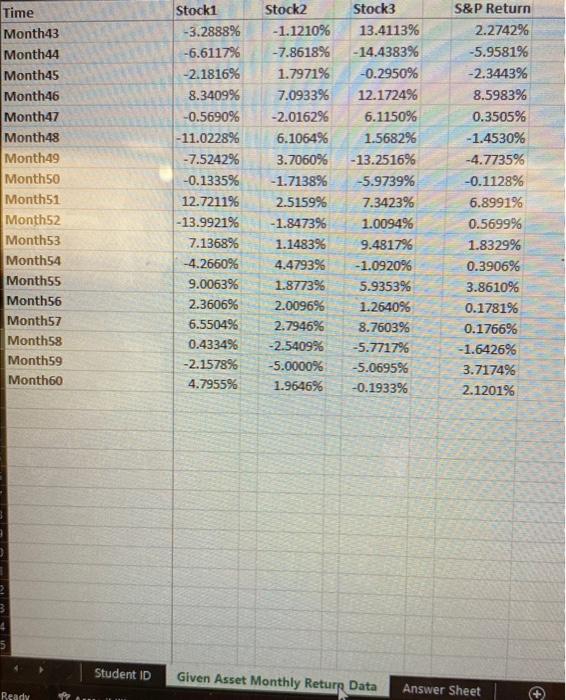

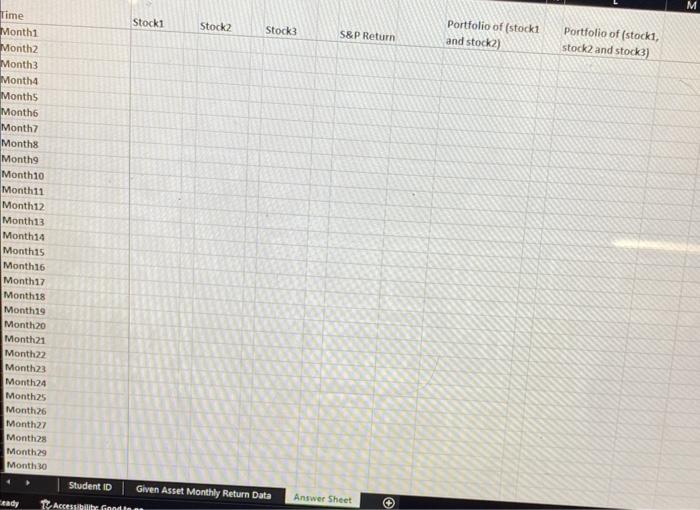

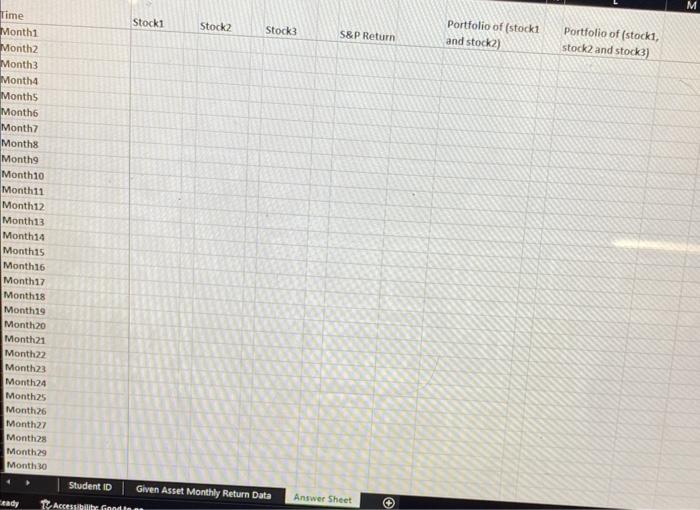

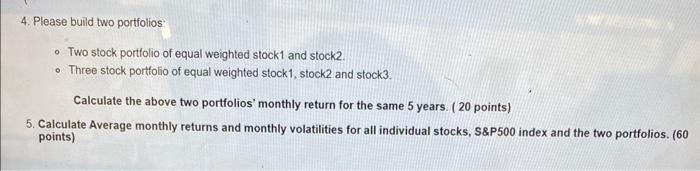

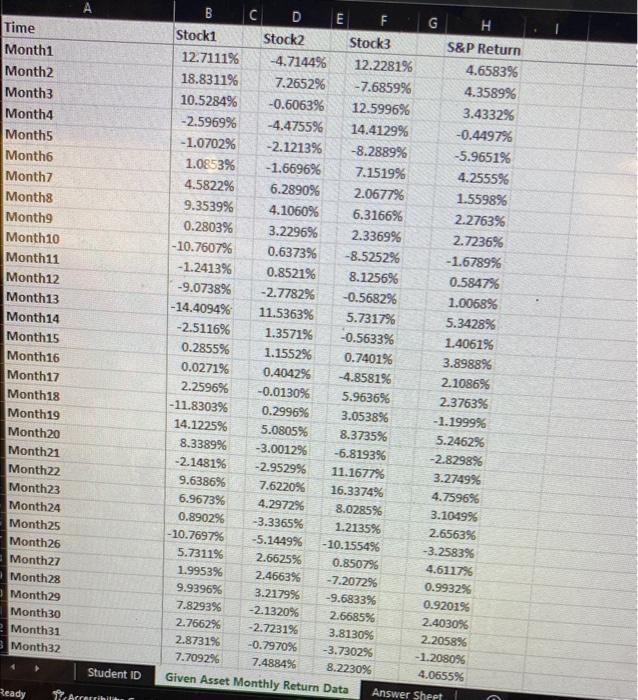

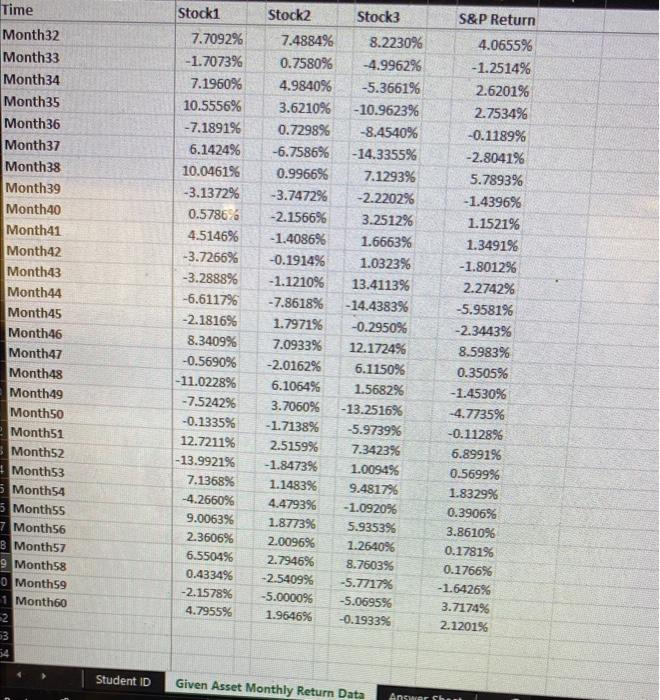

2. Check the 'Glven Assel Monthly Return Data' worksheet, you will find three individual stocks and S\&P500 index monthly return data for 5 years ( 60 months). 3 In the "Answer Sheet" worksheet, use cell reference, please transfer the individual stock refurn data from ' Given data" sheet to the "Answer Sheet". 4. Please build two portiolios - Two stock portfolio of equal weighted stock1 and stock2 - Three stock portiolio of equal weighted stock1, stock2 and stock3 Calculate the above two portfolios' monthly return for the same 5 years (20 points) 5 Calculate Average monthly returns and monthly volatilities for all individual stocks, 58.500 index and the two portfolios, (60 points) 4. Please build two portiolios: - Two stock portfolio of equal weighted stock1 and stock2. - Three stock portfolio of equal weighted stock1, stock2 and stock3. Calculate the above two portfolios' monthly return for the same 5 years. (20 points) 5. Calculate Average monthly returns and monthly volatilities for all individual stocks, S\&P500 index and the two portfolios. (60 points) \begin{tabular}{l|r|r|r|r} \hline Time & Stock1 & \multicolumn{1}{l}{ Stock2 } & \multicolumn{1}{l}{ Stock3 } & S\&P Return \\ \hline Month32 & 7.7092% & 7.4884% & 8.2230% & 4.0655% \\ \hline Month33 & 1.7073% & 0.7580% & 4.9962% & 1.2514% \\ \hline Month34 & 7.1960% & 4.9840% & 5.3661% & 2.6201% \\ \hline Month35 & 10.5556% & 3.6210% & 10.9623% & 2.7534% \\ \hline Month36 & 7.1891% & 0.7298% & 8.4540% & 0.1189% \\ \hline Month37 & 6.1424% & 6.7586% & 14.3355% & 2.8041% \\ \hline Month38 & 10.0461% & 0.9966% & 7.1293% & 5.7893% \\ \hline Month39 & 3.1372% & 3.7472% & 2.2202% & 1.4396% \\ \hline Month40 & 0.5786% & 2.1566% & 3.2512% & 1.1521% \\ \hline Month41 & 4.5146% & 1.4086% & 1.6663% & 1.3491% \\ \hline Month42 & 3.7266% & 0.1914% & 1.0323% & 1.8012% \\ \hline Month43 & 3.2888% & 1.1210% & 13.4113% & 2.2742% \\ \hline Month44 & 6.6117% & 7.8618% & 14.4383% & 5.9581% \\ \hline Month45 & 2.1816% & 1.7971% & 0.2950% & 2.3443% \\ \hline Month46 & 8.3409% & 7.0933% & 12.1724% & 8.5983% \\ \hline Month555 & 0.5690% & 2.0162% & 6.1150% & 0.3505% \\ \hline Month59 & 11.0228% & 6.1064% & 1.5682% & 1.4530% \\ \hline Month60 & 7.5242% & 3.7060% & 13.2516% & 4.7735% \\ \hline Month48 & 0.1335% & 1.7138% & 5.9739% & 0.1128% \\ \hline Month49 & 12.7211% & 2.5159% & 7.3423% & 6.8991% \\ \hline Month50 & 13.9921% & 1.8473% & 1.0094% & 0.5699% \\ \hline Month51 & 7.1368% & 1.1483% & 9.4817% & 1.8329% \\ \hline Month52 & 4.2660% & 4.4793% & 1.0920% & 0.3906% \\ \hline Month53 & 9.0063% & 1.8773% & 5.9353% & 3.8610% \\ \hline Month54 & 2.3606% & 2.0096% & 1.2640% & 0.1781% \\ \hline \end{tabular} 2. Check the 'Glven Assel Monthly Return Data' worksheet, you will find three individual stocks and S\&P500 index monthly return data for 5 years ( 60 months). 3 In the "Answer Sheet" worksheet, use cell reference, please transfer the individual stock refurn data from ' Given data" sheet to the "Answer Sheet". 4. Please build two portiolios - Two stock portfolio of equal weighted stock1 and stock2 - Three stock portiolio of equal weighted stock1, stock2 and stock3 Calculate the above two portfolios' monthly return for the same 5 years (20 points) 5 Calculate Average monthly returns and monthly volatilities for all individual stocks, 58.500 index and the two portfolios, (60 points) 4. Please build two portiolios: - Two stock portfolio of equal weighted stock1 and stock2. - Three stock portfolio of equal weighted stock1, stock2 and stock3. Calculate the above two portfolios' monthly return for the same 5 years. (20 points) 5. Calculate Average monthly returns and monthly volatilities for all individual stocks, S\&P500 index and the two portfolios. (60 points) \begin{tabular}{l|r|r|r|r} \hline Time & Stock1 & \multicolumn{1}{l}{ Stock2 } & \multicolumn{1}{l}{ Stock3 } & S\&P Return \\ \hline Month32 & 7.7092% & 7.4884% & 8.2230% & 4.0655% \\ \hline Month33 & 1.7073% & 0.7580% & 4.9962% & 1.2514% \\ \hline Month34 & 7.1960% & 4.9840% & 5.3661% & 2.6201% \\ \hline Month35 & 10.5556% & 3.6210% & 10.9623% & 2.7534% \\ \hline Month36 & 7.1891% & 0.7298% & 8.4540% & 0.1189% \\ \hline Month37 & 6.1424% & 6.7586% & 14.3355% & 2.8041% \\ \hline Month38 & 10.0461% & 0.9966% & 7.1293% & 5.7893% \\ \hline Month39 & 3.1372% & 3.7472% & 2.2202% & 1.4396% \\ \hline Month40 & 0.5786% & 2.1566% & 3.2512% & 1.1521% \\ \hline Month41 & 4.5146% & 1.4086% & 1.6663% & 1.3491% \\ \hline Month42 & 3.7266% & 0.1914% & 1.0323% & 1.8012% \\ \hline Month43 & 3.2888% & 1.1210% & 13.4113% & 2.2742% \\ \hline Month44 & 6.6117% & 7.8618% & 14.4383% & 5.9581% \\ \hline Month45 & 2.1816% & 1.7971% & 0.2950% & 2.3443% \\ \hline Month46 & 8.3409% & 7.0933% & 12.1724% & 8.5983% \\ \hline Month555 & 0.5690% & 2.0162% & 6.1150% & 0.3505% \\ \hline Month59 & 11.0228% & 6.1064% & 1.5682% & 1.4530% \\ \hline Month60 & 7.5242% & 3.7060% & 13.2516% & 4.7735% \\ \hline Month48 & 0.1335% & 1.7138% & 5.9739% & 0.1128% \\ \hline Month49 & 12.7211% & 2.5159% & 7.3423% & 6.8991% \\ \hline Month50 & 13.9921% & 1.8473% & 1.0094% & 0.5699% \\ \hline Month51 & 7.1368% & 1.1483% & 9.4817% & 1.8329% \\ \hline Month52 & 4.2660% & 4.4793% & 1.0920% & 0.3906% \\ \hline Month53 & 9.0063% & 1.8773% & 5.9353% & 3.8610% \\ \hline Month54 & 2.3606% & 2.0096% & 1.2640% & 0.1781% \\ \hline \end{tabular}

2. Check the 'Glven Assel Monthly Return Data' worksheet, you will find three individual stocks and S\&P500 index monthly return data for 5 years ( 60 months). 3 In the "Answer Sheet" worksheet, use cell reference, please transfer the individual stock refurn data from ' Given data" sheet to the "Answer Sheet". 4. Please build two portiolios - Two stock portfolio of equal weighted stock1 and stock2 - Three stock portiolio of equal weighted stock1, stock2 and stock3 Calculate the above two portfolios' monthly return for the same 5 years (20 points) 5 Calculate Average monthly returns and monthly volatilities for all individual stocks, 58.500 index and the two portfolios, (60 points) 4. Please build two portiolios: - Two stock portfolio of equal weighted stock1 and stock2. - Three stock portfolio of equal weighted stock1, stock2 and stock3. Calculate the above two portfolios' monthly return for the same 5 years. (20 points) 5. Calculate Average monthly returns and monthly volatilities for all individual stocks, S\&P500 index and the two portfolios. (60 points) \begin{tabular}{l|r|r|r|r} \hline Time & Stock1 & \multicolumn{1}{l}{ Stock2 } & \multicolumn{1}{l}{ Stock3 } & S\&P Return \\ \hline Month32 & 7.7092% & 7.4884% & 8.2230% & 4.0655% \\ \hline Month33 & 1.7073% & 0.7580% & 4.9962% & 1.2514% \\ \hline Month34 & 7.1960% & 4.9840% & 5.3661% & 2.6201% \\ \hline Month35 & 10.5556% & 3.6210% & 10.9623% & 2.7534% \\ \hline Month36 & 7.1891% & 0.7298% & 8.4540% & 0.1189% \\ \hline Month37 & 6.1424% & 6.7586% & 14.3355% & 2.8041% \\ \hline Month38 & 10.0461% & 0.9966% & 7.1293% & 5.7893% \\ \hline Month39 & 3.1372% & 3.7472% & 2.2202% & 1.4396% \\ \hline Month40 & 0.5786% & 2.1566% & 3.2512% & 1.1521% \\ \hline Month41 & 4.5146% & 1.4086% & 1.6663% & 1.3491% \\ \hline Month42 & 3.7266% & 0.1914% & 1.0323% & 1.8012% \\ \hline Month43 & 3.2888% & 1.1210% & 13.4113% & 2.2742% \\ \hline Month44 & 6.6117% & 7.8618% & 14.4383% & 5.9581% \\ \hline Month45 & 2.1816% & 1.7971% & 0.2950% & 2.3443% \\ \hline Month46 & 8.3409% & 7.0933% & 12.1724% & 8.5983% \\ \hline Month555 & 0.5690% & 2.0162% & 6.1150% & 0.3505% \\ \hline Month59 & 11.0228% & 6.1064% & 1.5682% & 1.4530% \\ \hline Month60 & 7.5242% & 3.7060% & 13.2516% & 4.7735% \\ \hline Month48 & 0.1335% & 1.7138% & 5.9739% & 0.1128% \\ \hline Month49 & 12.7211% & 2.5159% & 7.3423% & 6.8991% \\ \hline Month50 & 13.9921% & 1.8473% & 1.0094% & 0.5699% \\ \hline Month51 & 7.1368% & 1.1483% & 9.4817% & 1.8329% \\ \hline Month52 & 4.2660% & 4.4793% & 1.0920% & 0.3906% \\ \hline Month53 & 9.0063% & 1.8773% & 5.9353% & 3.8610% \\ \hline Month54 & 2.3606% & 2.0096% & 1.2640% & 0.1781% \\ \hline \end{tabular} 2. Check the 'Glven Assel Monthly Return Data' worksheet, you will find three individual stocks and S\&P500 index monthly return data for 5 years ( 60 months). 3 In the "Answer Sheet" worksheet, use cell reference, please transfer the individual stock refurn data from ' Given data" sheet to the "Answer Sheet". 4. Please build two portiolios - Two stock portfolio of equal weighted stock1 and stock2 - Three stock portiolio of equal weighted stock1, stock2 and stock3 Calculate the above two portfolios' monthly return for the same 5 years (20 points) 5 Calculate Average monthly returns and monthly volatilities for all individual stocks, 58.500 index and the two portfolios, (60 points) 4. Please build two portiolios: - Two stock portfolio of equal weighted stock1 and stock2. - Three stock portfolio of equal weighted stock1, stock2 and stock3. Calculate the above two portfolios' monthly return for the same 5 years. (20 points) 5. Calculate Average monthly returns and monthly volatilities for all individual stocks, S\&P500 index and the two portfolios. (60 points) \begin{tabular}{l|r|r|r|r} \hline Time & Stock1 & \multicolumn{1}{l}{ Stock2 } & \multicolumn{1}{l}{ Stock3 } & S\&P Return \\ \hline Month32 & 7.7092% & 7.4884% & 8.2230% & 4.0655% \\ \hline Month33 & 1.7073% & 0.7580% & 4.9962% & 1.2514% \\ \hline Month34 & 7.1960% & 4.9840% & 5.3661% & 2.6201% \\ \hline Month35 & 10.5556% & 3.6210% & 10.9623% & 2.7534% \\ \hline Month36 & 7.1891% & 0.7298% & 8.4540% & 0.1189% \\ \hline Month37 & 6.1424% & 6.7586% & 14.3355% & 2.8041% \\ \hline Month38 & 10.0461% & 0.9966% & 7.1293% & 5.7893% \\ \hline Month39 & 3.1372% & 3.7472% & 2.2202% & 1.4396% \\ \hline Month40 & 0.5786% & 2.1566% & 3.2512% & 1.1521% \\ \hline Month41 & 4.5146% & 1.4086% & 1.6663% & 1.3491% \\ \hline Month42 & 3.7266% & 0.1914% & 1.0323% & 1.8012% \\ \hline Month43 & 3.2888% & 1.1210% & 13.4113% & 2.2742% \\ \hline Month44 & 6.6117% & 7.8618% & 14.4383% & 5.9581% \\ \hline Month45 & 2.1816% & 1.7971% & 0.2950% & 2.3443% \\ \hline Month46 & 8.3409% & 7.0933% & 12.1724% & 8.5983% \\ \hline Month555 & 0.5690% & 2.0162% & 6.1150% & 0.3505% \\ \hline Month59 & 11.0228% & 6.1064% & 1.5682% & 1.4530% \\ \hline Month60 & 7.5242% & 3.7060% & 13.2516% & 4.7735% \\ \hline Month48 & 0.1335% & 1.7138% & 5.9739% & 0.1128% \\ \hline Month49 & 12.7211% & 2.5159% & 7.3423% & 6.8991% \\ \hline Month50 & 13.9921% & 1.8473% & 1.0094% & 0.5699% \\ \hline Month51 & 7.1368% & 1.1483% & 9.4817% & 1.8329% \\ \hline Month52 & 4.2660% & 4.4793% & 1.0920% & 0.3906% \\ \hline Month53 & 9.0063% & 1.8773% & 5.9353% & 3.8610% \\ \hline Month54 & 2.3606% & 2.0096% & 1.2640% & 0.1781% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started