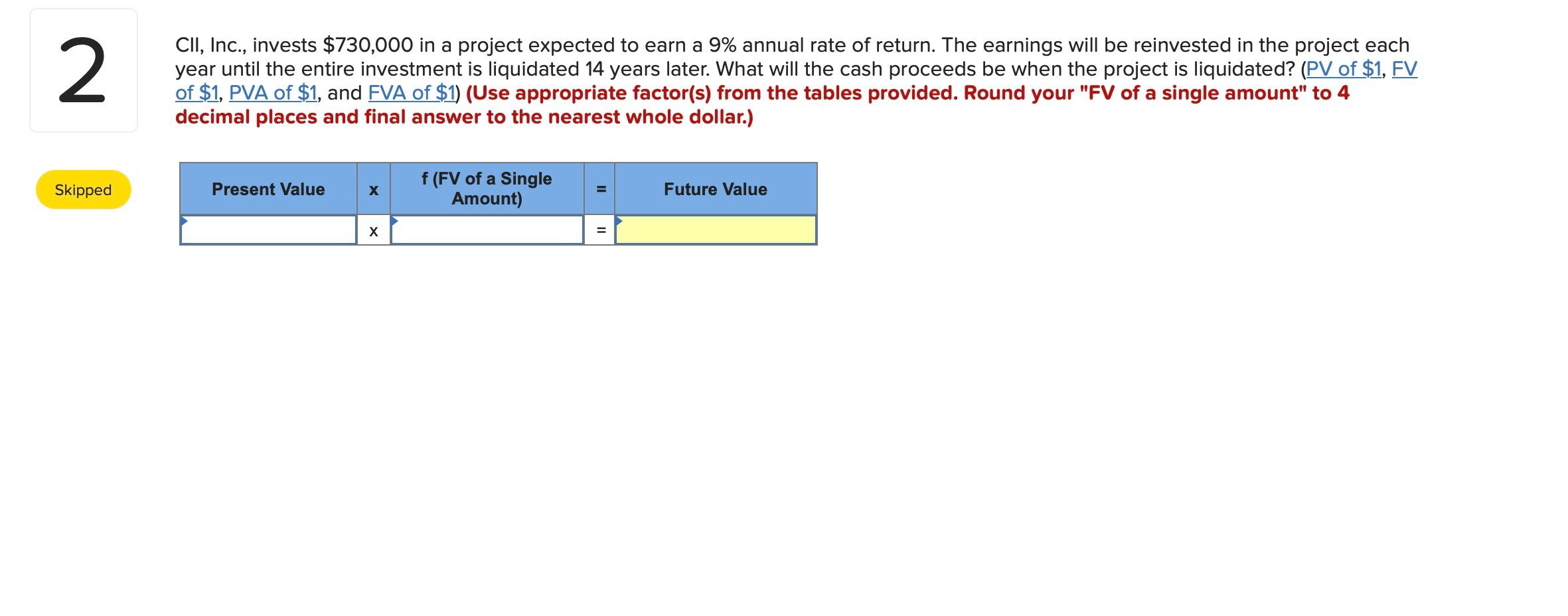

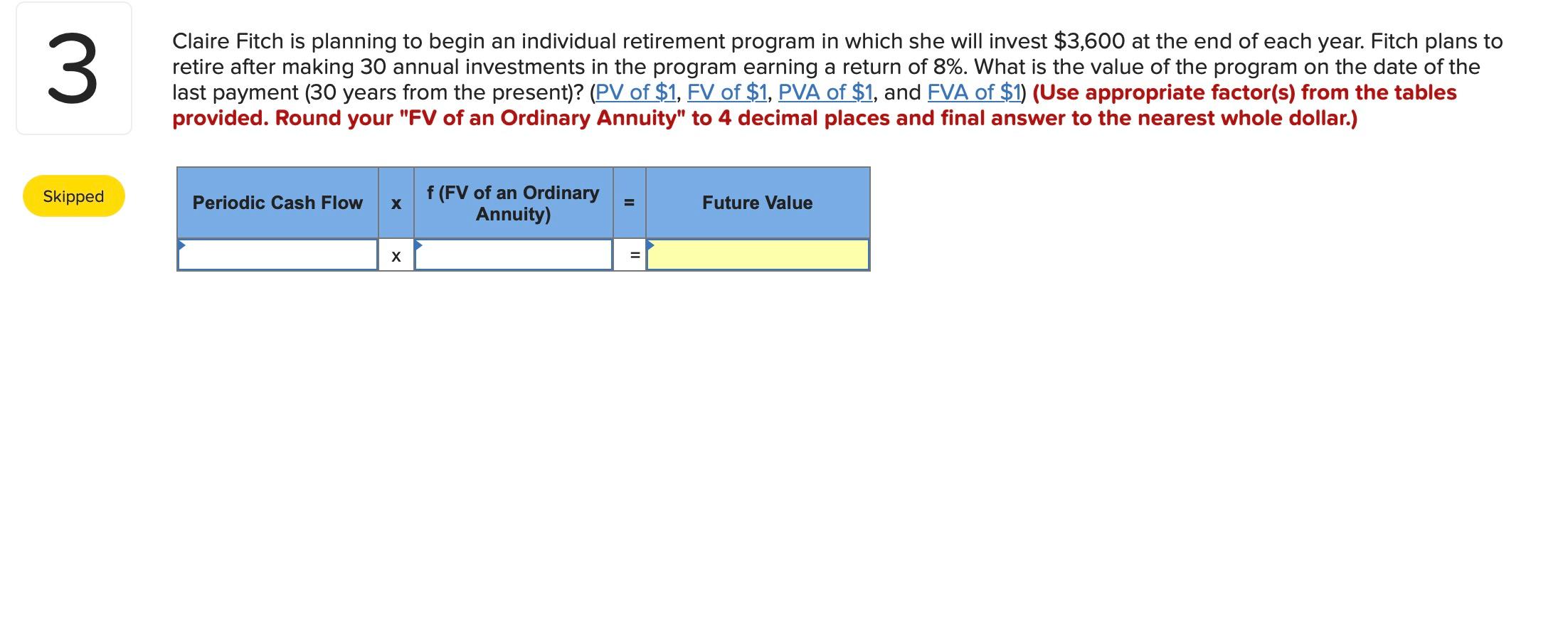

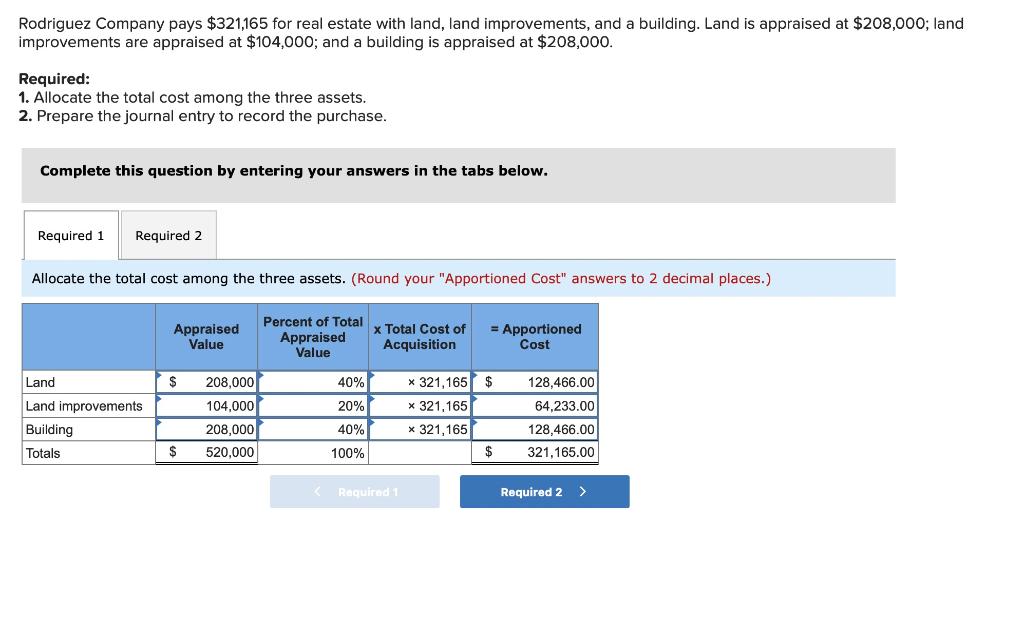

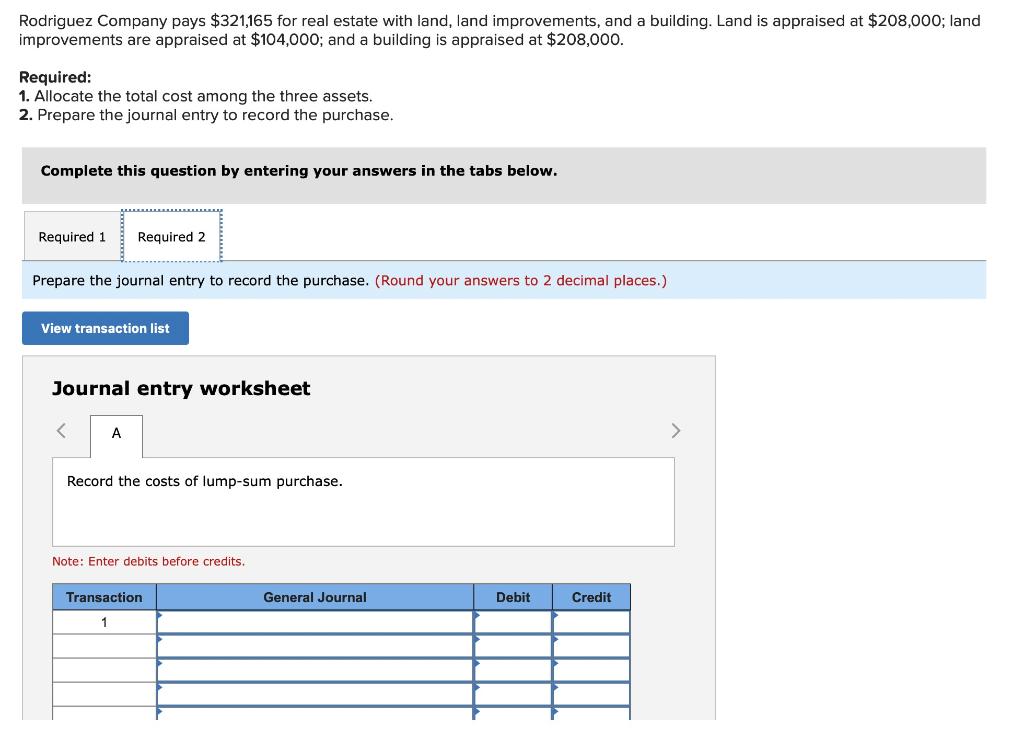

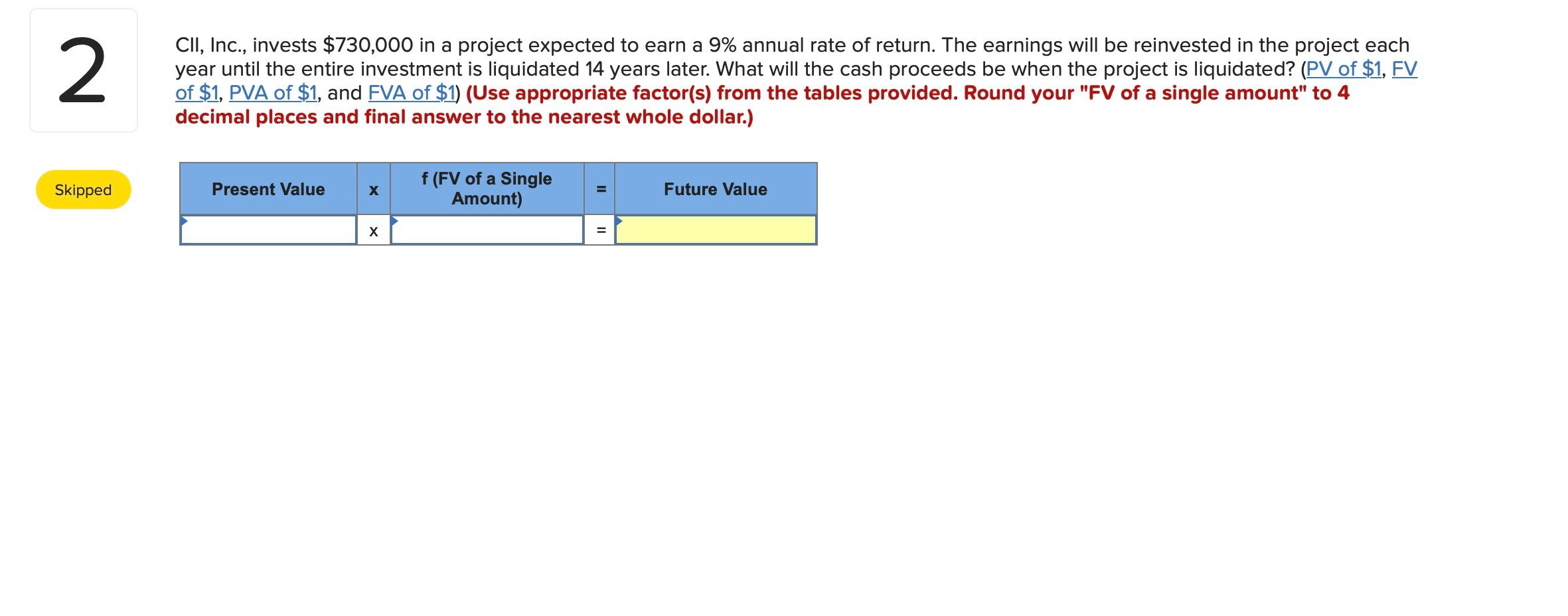

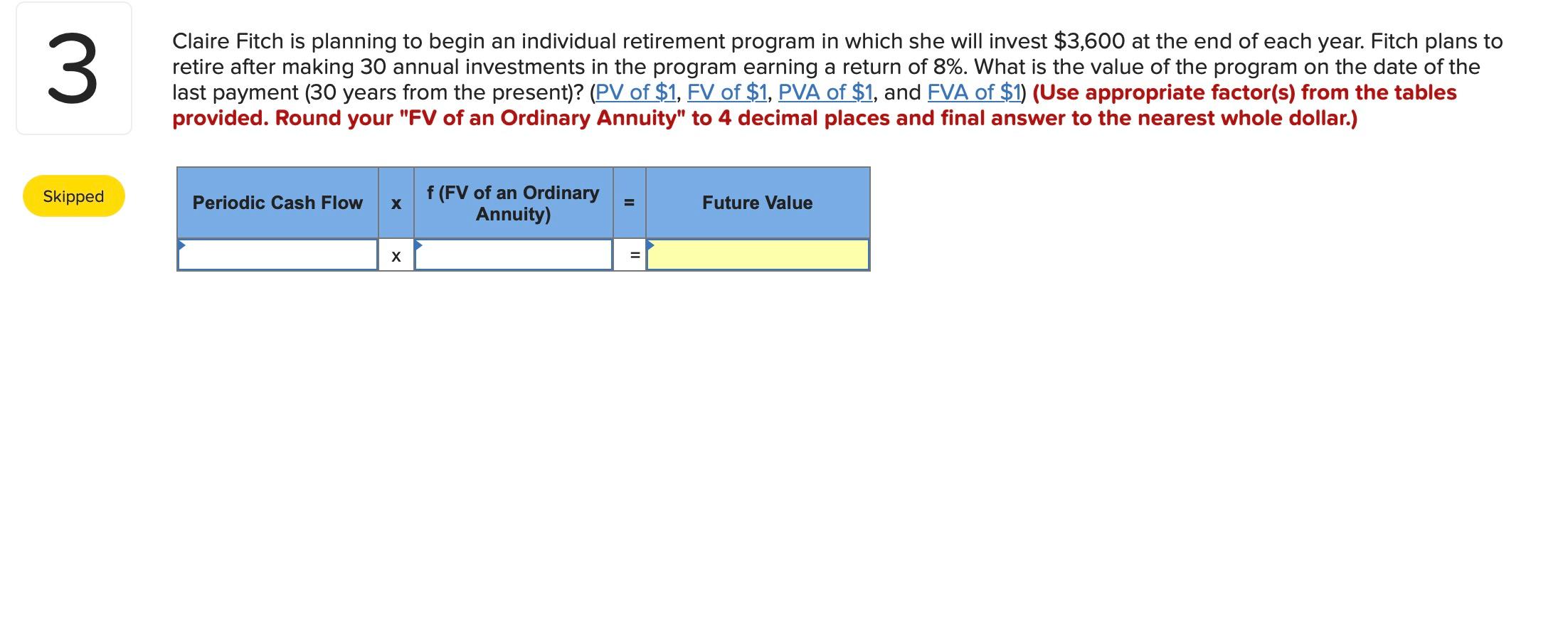

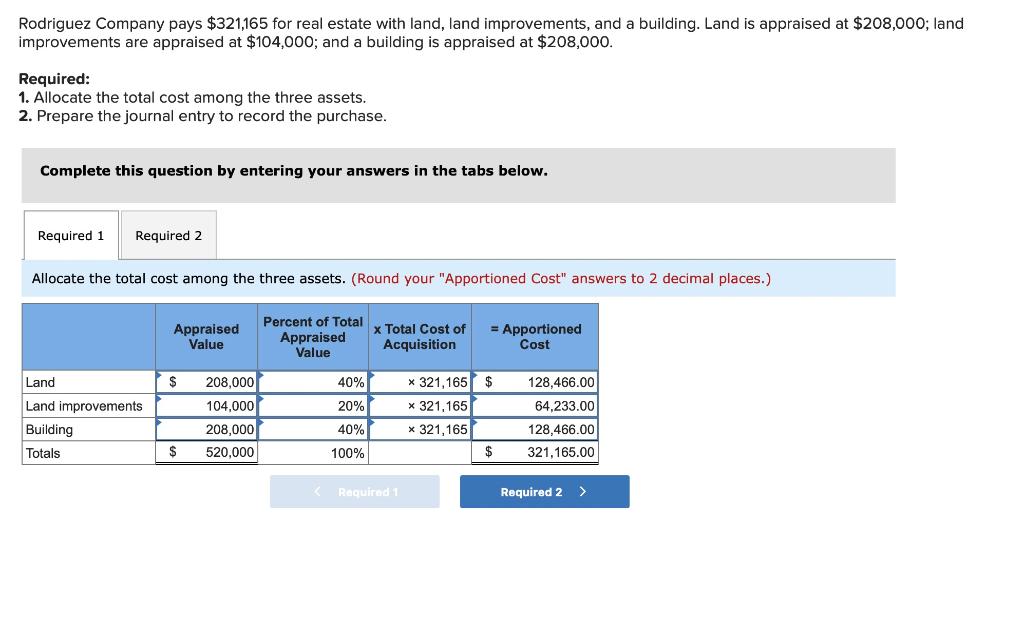

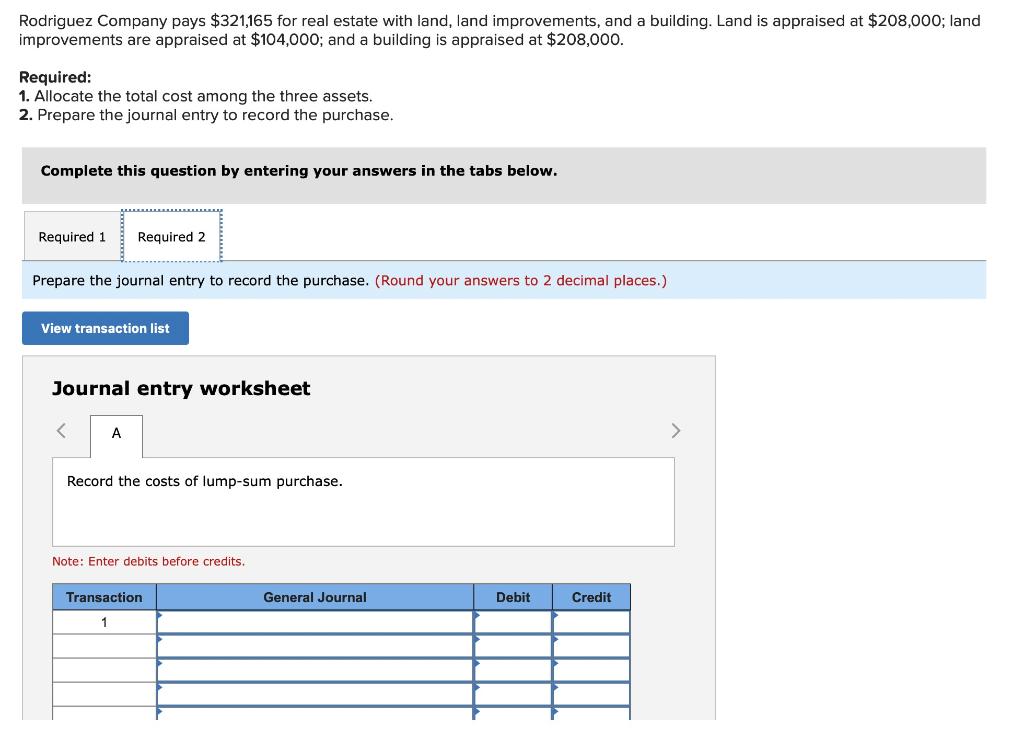

2 CII, Inc., invests $730,000 in a project expected to earn a 9% annual rate of return. The earnings will be reinvested in the project each year until the entire investment is liquidated 14 years later. What will the cash proceeds be when the project is liquidated? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of a single amount" to 4 decimal places and final answer to the nearest whole dollar.) Skipped Present Value f(FV of a Single Amount) Future Value 3 Claire Fitch is planning to begin an individual retirement program in which she will invest $3,600 at the end of each year. Fitch plans to retire after making 30 annual investments in the program earning a return of 8%. What is the value of the program on the date of the last payment (30 years from the present)? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Skipped Periodic Cash Flow f (FV of an Ordinary Annuity) Future Value Rodriguez Company pays $321,165 for real estate with land, land improvements, and a building. Land is appraised at $208,000; land improvements are appraised at $104,000; and a building is appraised at $208,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised Value x Total Cost of Acquisition = Apportioned Cost Land $ 208,000 40% 20% Land improvements Building Totals 104,000 208,000 520,000 x 321,165 $ * 321,165 * 321,165 $ 128,466.00 64,233.00 128,466.00 321,165.00 40% $ 100% Required Required 2 > Rodriguez Company pays $321,165 for real estate with land, land improvements, and a building. Land is appraised at $208,000; land improvements are appraised at $104,000; and a building is appraised at $208,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet Record the costs of lump-sum purchase. Note: Enter debits before credits. Transaction General Journal Debit Credit