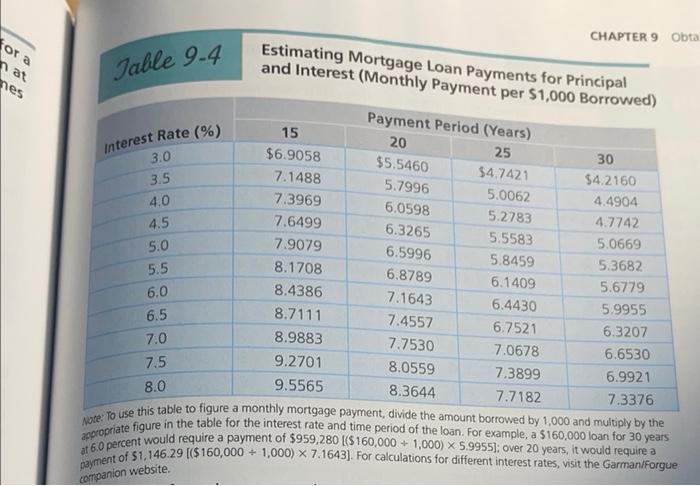

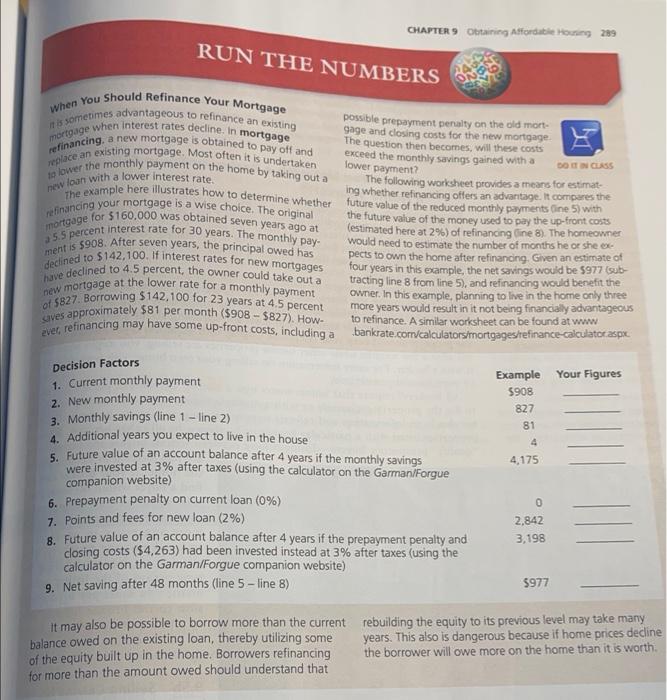

2) Cliff has owned his home for 15 years and expects to live in it for 5 more years. He originally borrowed $150,000 at 5% for 30 years to buy the home. He still owes $110,000 on the loan. Interest rates have fallen to 4% and Cliff wants to know if he should refinance the loan for 15 years. He would pay 2 points on the new loan with no prepayment penalty on the existing loan. A) What is Cliff's current monthly payment? Using Table 9-4 B) Calculate the monthly payment on the new loan. Using Table 9-4 C) Should Cliff refinance or not? Use the Run the Numbers worksheet on page 289. Any numbers existing on the worksheet but not in the scenario just leave blank. for a CHAPTER 9 Obta nar nes Table 9.4 Estimating Mortgage Loan Payments for Principal and Interest (Monthly Payment per $1,000 Borrowed) 25 Interest Rate (%) 3.0 3.5 4.0 4.5 5.0 Payment Period (Years) 15 20 30 $6.9058 $5.5460 $4.7421 7.1488 $4.2160 5.7996 5.0062 4.4904 7.3969 6.0598 5.2783 4.7742 7.6499 6.3265 5.5583 5.0669 7.9079 6.5996 5.8459 5.3682 8.1708 6.8789 6.1409 5.6779 8.4386 7.1643 6.4430 5.9955 8.7111 7.4557 6.7521 6.3207 8.9883 7.7530 7.0678 6.6530 7.5 9.2701 8.0559 7.3899 6.9921 8.0 9.5565 8.3644 7.7182 7.3376 appropriate figure in the table for the interest rate and time period of the loan. For example, a $160,000 loan for 30 years More To use this table to figure a monthly mortgage payment, divide the amount borrowed by 1,000 and multiply by the at 60 percent would require a payment of $959,280 ($160,000 + 1,000) X 5.9955]: over 20 years, it would require a payment of $1,146.29 [($160,000 + 1,000) X 7.1643). For calculations for different interest rates, visit the Garman/Forgue 5.5 6.0 6.5 7.0 companion website. CHAPTER 9 Obtaining Affordable Housing 289 RUN THE NUMBERS refinancing When You Should Refinance Your Mortgage possible prepayment penalty on the old mort- mortgage when interest rates decline. In mortgage It is sometimes advantageous to refinance an existing gage and closing costs for the new mortgage a new mortgage is obtained to pay off and The question then becomes, will these costs place an existing mortgage. Most often it is undertaken exceed the monthly savings gained with a lower payment? DON CLASS to lower the monthly payment on the home by taking out a The following worksheet provides a means for estimat- new loan with a lower interest rate The example here illustrates how to determine whether ing whether refinancing offers an advantage. It compares the refinancing your mortgage is a wise choice. The original future value of the reduced monthly payments line 5) with the future value of the money used to pay the up-front costs mortgage for $160.000 was obtained seven years ago at (estimated here at 2%) of refinancing line 8). The homeowner 35.5 percent interest rate for 30 years. The monthly pay would need to estimate the number of months he or she ment is $908. After seven years, the principal owed has declined to $142,100. If interest rates for new mortgages pects to own the home after refinancing. Given an estimate of four have declined to 4.5 percent, the owner could take out a years in this example, the net savings would be 5977 (sub- tracting line 8 from line 5), and refinancing would benefit the new mortgage at the lower rate for a monthly payment owner. In this example, planning to live in the home only three of 5827. Borrowing $142,100 for 23 years at 4.5 percent more years would result in it not being financially advantageous saves approximately $81 per month ($908 - 5827), How- to refinance. A similar worksheet can be found at www ever, refinancing may have some up-front costs, including a bankrate.com/calculatorsimortgagestefinance calculator aspe Example Your Figures 5908 827 81 4 4,175 Decision Factors 1. Current monthly payment 2. New monthly payment 3. Monthly savings (line 1 - line 2) 4. Additional years you expect to live the house 5. Future value of an account balance after 4 years if the monthly savings were invested at 3% after taxes (using the calculator on the Garman/Forgue companion website) 6. Prepayment penalty on current loan (0%) 7. Points and fees for new loan (2%) 8. Future value of an account balance after 4 years if the prepayment penalty and closing costs ($4,263) had been invested instead at 3% after taxes (using the calculator on the Garman/Forgue companion website) 9. Net saving after 48 months (line 5 - line 8) 0 2.842 3,198 5977 it may also be possible to borrow more than the current balance owed on the existing loan, thereby utilizing some of the equity built up in the home. Borrowers refinancing for more than the amount owed should understand that rebuilding the equity to its previous level may take many years. This also is dangerous because if home prices decline the borrower will owe more on the home than it is worth