Answered step by step

Verified Expert Solution

Question

1 Approved Answer

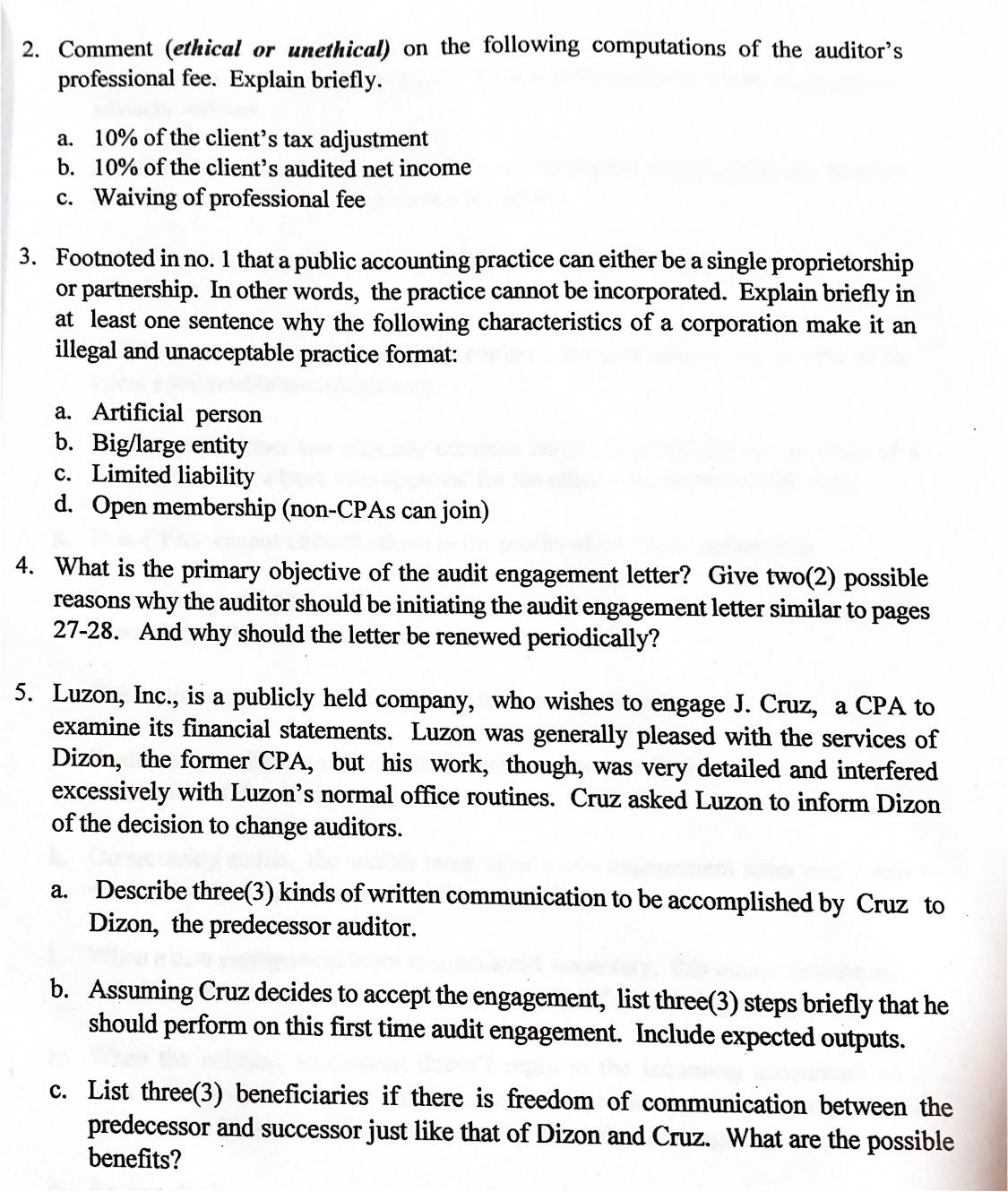

2. Comment (ethical or unethical) on the following computations of the auditor's professional fee. Explain briefly. a. 10% of the client's tax adjustment b.

2. Comment (ethical or unethical) on the following computations of the auditor's professional fee. Explain briefly. a. 10% of the client's tax adjustment b. 10% of the client's audited net income c. Waiving of professional fee 3. Footnoted in no. 1 that a public accounting practice can either be a single proprietorship or partnership. In other words, the practice cannot be incorporated. Explain briefly in at least one sentence why the following characteristics of a corporation make it an illegal and unacceptable practice format: a. Artificial person b. Big/large entity c. Limited liability d. Open membership (non-CPAs can join) 4. What is the primary objective of the audit engagement letter? Give two(2) possible reasons why the auditor should be initiating the audit engagement letter similar to pages 27-28. And why should the letter be renewed periodically? 5. Luzon, Inc., is a publicly held company, who wishes to engage J. Cruz, a CPA to examine its financial statements. Luzon was generally pleased with the services of Dizon, the former CPA, but his work, though, was very detailed and interfered excessively with Luzon's normal office routines. Cruz asked Luzon to inform Dizon of the decision to change auditors. a. Describe three(3) kinds of written communication to be accomplished by Cruz to Dizon, the predecessor auditor. b. Assuming Cruz decides to accept the engagement, list three(3) steps briefly that he should perform on this first time audit engagement. Include expected outputs. c. List three(3) beneficiaries if there is freedom of communication between the predecessor and successor just like that of Dizon and Cruz. What are the possible benefits?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

2 Ethical or Unethical Computations of the auditors Professional Fee as follows a 10 of the clients tax adjustment This computation method could be unethical Charging a percentage of tax adjustment as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started